Question

Required 2.1 Calculate the gross profit margin, operating profit margin and net profit margin for 20.10 and 20.9. (18 marks) 2.2 Comment on your answers

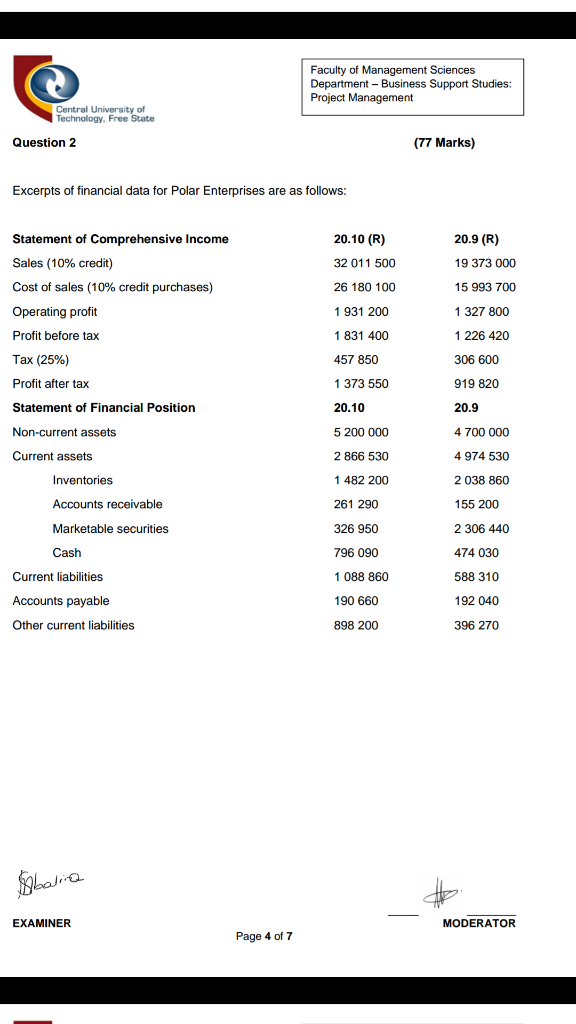

Required 2.1 Calculate the gross profit margin, operating profit margin and net profit margin for 20.10 and 20.9. (18 marks) 2.2 Comment on your answers calculated in question 2.1. (8 marks) 2.3 Calculate the current ratio and acid test ratio at the end of each year. How has the enterprises liquidity changed over this period? (18 marks) 2.4 Compute the following for 20.10 (ratios for 20.9 are given in brackets): (23 marks) 2.4.1 Inventory turnover (20.9: 9.04 times) (6 marks) 2.4.2 Debtors collection period (20.9: 29.24 days) (3 marks) 2.4.3 Creditors payment period (20.9: 42.40 days) (9 marks) 2.4.4 Turnover to net assets (20.9 2.13) (5 marks) 2.5 What is your interpretation of the enterprises performance with respect to your answers in question 2.4.4? (10 marks)

Faculty of Management Sciences Department - Business Support Studies: Project Management Central University of Technology. Free State Question 2 (77 Marks) Excerpts of financial data for Polar Enterprises are as follows: 20.10 (R) 20.9 (R) 32 011 500 19 373 000 Statement of Comprehensive Income Sales (10% credit) Cost of sales (10% credit purchases) Operating profit Profit before tax 26 180 100 15 993 700 1 931 200 1 327 800 1 831 400 1 226 420 Tax (25%) 457 850 306 600 Profit after tax 1 373 550 919 820 Statement of Financial Position 20.10 20.9 Non-current assets 5 200 000 4 700 000 Current assets Inventories Accounts receivable 2 866 530 1 482 200 261 290 4 974 530 2 038 860 2 155 200 Marketable securities 326 950 2 306 440 Cash 796 090 474 030 Current liabilities 1 088 860 588 310 Accounts payable 190 660 192 040 Other current liabilities 898 200 396 270 Sebalina EXAMINER MODERATOR Page 4 of 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started