Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a . A taxpayer completes $ 7 0 0 of accounting services in December 2 0 2 3 for a client who pays for

Required:

a A taxpayer completes $ of accounting services in December for a client who pays for the accounting work in January

b A taxpayer is in the business of renting computers on a shortterm basis. On December she rents a computer for a $ rental fee and receives a $ deposit. The customer returns the computer and is refunded the deposit on December

c Same facts as b except that the computer is returned on January

d On December a landlord rents an apartment for $ per month and collects the first and last months' rent up front. It is customary that tenants apply the security deposit to their last month's rent upon moving out.

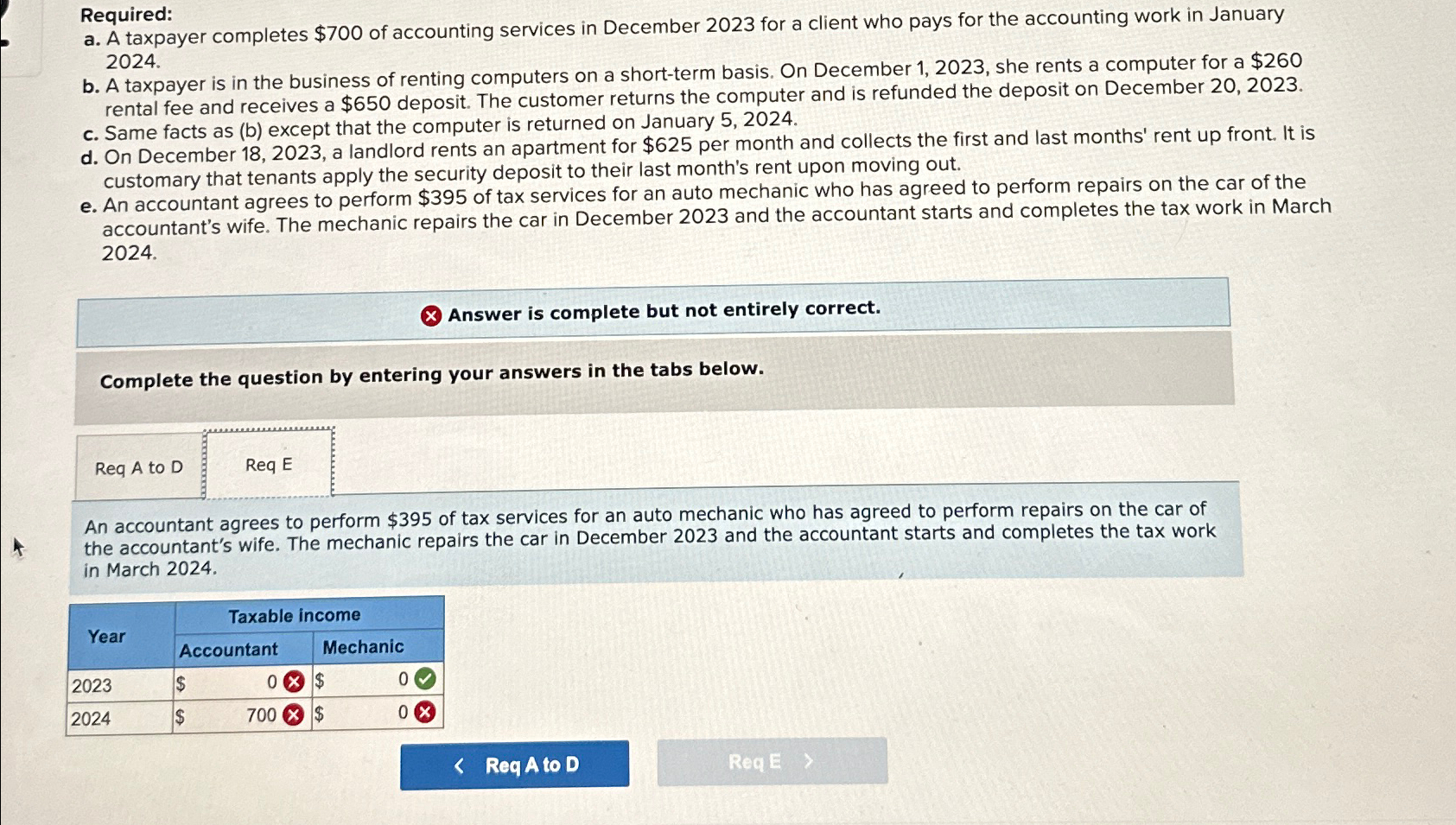

e An accountant agrees to perform $ of tax services for an auto mechanic who has agreed to perform repairs on the car of the accountant's wife. The mechanic repairs the car in December and the accountant starts and completes the tax work in March

Answer is complete but not entirely correct.

Complete the question by entering your answers in the tabs below.

Req to

Req

An accountant agrees to perform $ of tax services for an auto mechanic who has agreed to perform repairs on the car of the accountant's wife. The mechanic repairs the car in December and the accountant starts and completes the tax work in March

tableYearTaxable income,AccountantMechanic,,$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started