Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I could really use some help with this hedging transaction, I would really appreciate help!! 8. (20 points) Des Moines Metals Inc. (DMM) in the

I could really use some help with this hedging transaction, I would really appreciate help!!

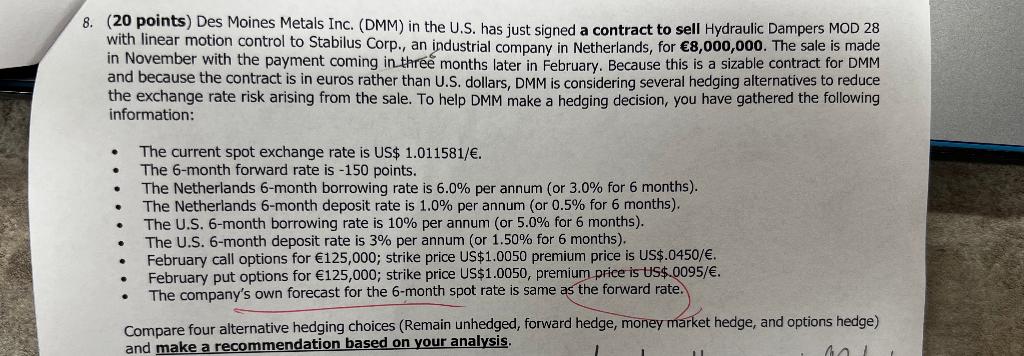

8. (20 points) Des Moines Metals Inc. (DMM) in the U.S. has just signed a contract to sell Hydraulic Dampers MOD 28 with linear motion control to Stabilus Corp., an industrial company in Netherlands, for 8,000,000. The sale is made in November with the payment coming in three months later in February. Because this is a sizable contract for DMM and because the contract is in euros rather than U.S. dollars, DMM is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help DMM make a hedging decision, you have gathered the following information: - The current spot exchange rate is US\$1.011581/. - The 6-month forward rate is 150 points. - The Netherlands 6-month borrowing rate is 6.0% per annum (or 3.0% for 6 months). - The Netherlands 6-month deposit rate is 1.0% per annum (or 0.5% for 6 months). - The U.S. 6-month borrowing rate is 10% per annum (or 5.0% for 6 months). - The U.S. 6-month deposit rate is 3\% per annum (or 1.50% for 6 months). - February call options for 125,000; strike price US\$1.0050 premium price is US\$.0450/. - February put options for 125,000; strike price US\$1.0050, premium price is US\$.0095/. - The company's own forecast for the 6-month spot rate is same as the forward rate. Compare four alternative hedging choices (Remain unhedged, forward hedge, money market hedge, and options hedge) and make a recommendation based on your analysis. 8. (20 points) Des Moines Metals Inc. (DMM) in the U.S. has just signed a contract to sell Hydraulic Dampers MOD 28 with linear motion control to Stabilus Corp., an industrial company in Netherlands, for 8,000,000. The sale is made in November with the payment coming in three months later in February. Because this is a sizable contract for DMM and because the contract is in euros rather than U.S. dollars, DMM is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help DMM make a hedging decision, you have gathered the following information: - The current spot exchange rate is US\$1.011581/. - The 6-month forward rate is 150 points. - The Netherlands 6-month borrowing rate is 6.0% per annum (or 3.0% for 6 months). - The Netherlands 6-month deposit rate is 1.0% per annum (or 0.5% for 6 months). - The U.S. 6-month borrowing rate is 10% per annum (or 5.0% for 6 months). - The U.S. 6-month deposit rate is 3\% per annum (or 1.50% for 6 months). - February call options for 125,000; strike price US\$1.0050 premium price is US\$.0450/. - February put options for 125,000; strike price US\$1.0050, premium price is US\$.0095/. - The company's own forecast for the 6-month spot rate is same as the forward rate. Compare four alternative hedging choices (Remain unhedged, forward hedge, money market hedge, and options hedge) and make a recommendation based on your analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started