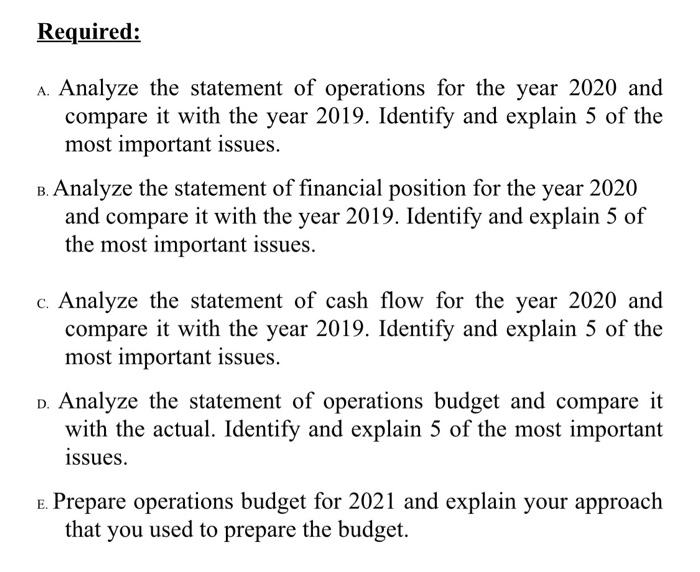

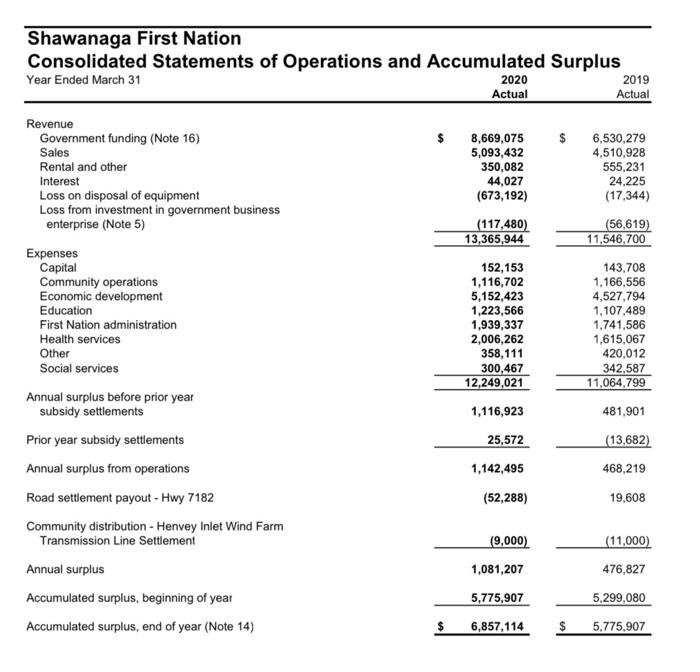

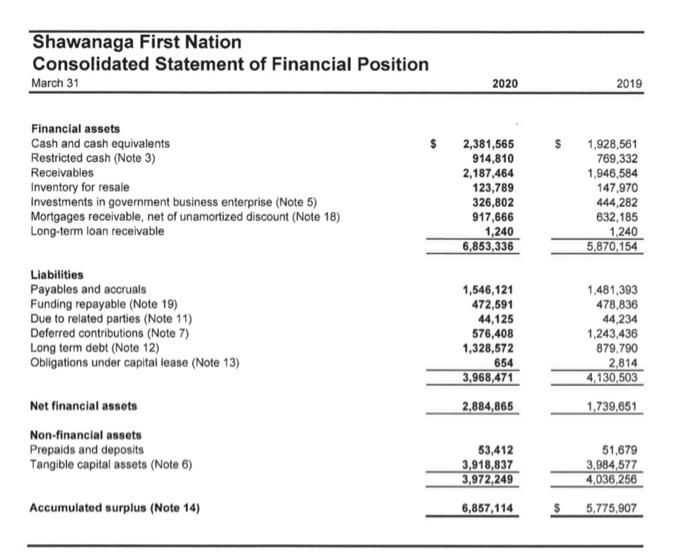

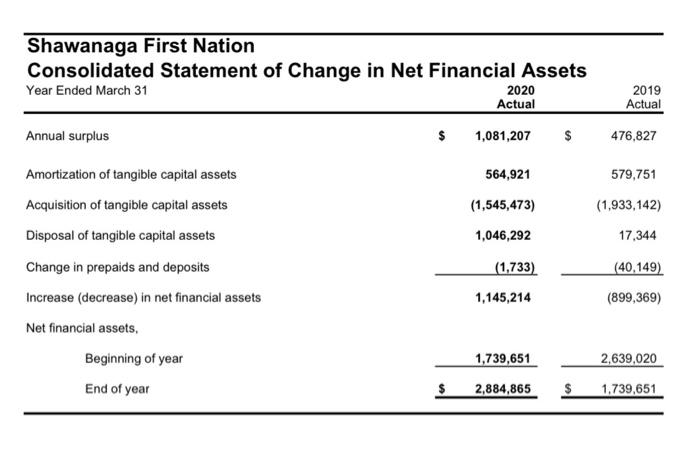

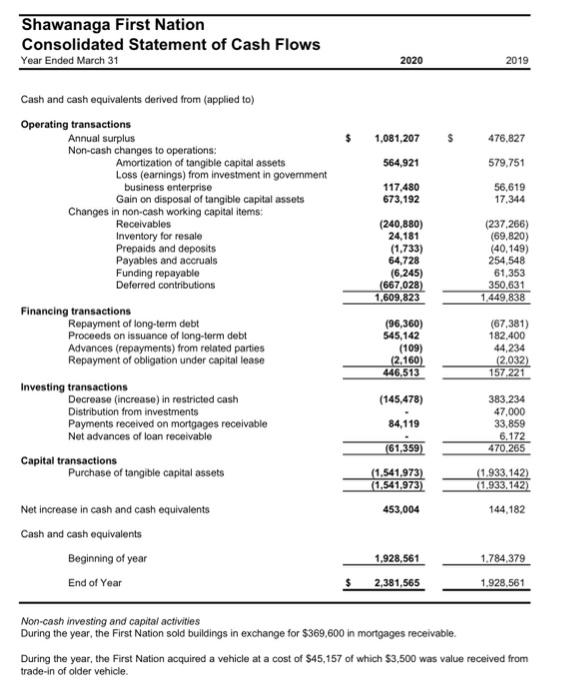

Required: A. Analyze the statement of operations for the year 2020 and compare it with the year 2019. Identify and explain 5 of the most important issues. B. Analyze the statement of financial position for the year 2020 and compare it with the year 2019. Identify and explain 5 of the most important issues. c. Analyze the statement of cash flow for the year 2020 and compare it with the year 2019. Identify and explain 5 of the most important issues. d. Analyze the statement of operations budget and compare it with the actual. Identify and explain 5 of the most important issues. E. Prepare operations budget for 2021 and explain your approach that you used to prepare the budget. Shawanaga First Nation Consolidated Statements of Operations and Accumulated Surplus Year Ended March 31 2020 2019 Actual Actual Revenue Government funding (Note 16) 8,669,075 $ 6,530,279 Sales 5,093,432 4.510,928 Rental and other 350,082 555,231 Interest 44,027 24 225 Loss on disposal of equipment (673,192) (17,344) Loss from investment in government business enterprise (Note 5) (117,480) (56,619) 13,365,944 11,546,700 Expenses Capital 152,153 143,708 Community operations 1,116,702 1,166,556 Economic development 5,152,423 4,527,794 Education 1,223,566 1,107,489 First Nation administration 1,939,337 1.741,586 Health services 2,006,262 1,615,067 Other 358,111 420,012 Social services 300,467 342,587 12,249,021 11,064,799 Annual surplus before prior year subsidy settlements 1,116,923 481,901 Prior year subsidy settlements 25,572 (13,682) Annual surplus from operations 1,142,495 468,219 Road settlement payout - Hwy 7182 (52,288) 19,608 Community distribution - Henvey Inlet Wind Farm Transmission Line Settlement (9,000) (11,000) Annual surplus 1,081,207 476,827 Accumulated surplus, beginning of year 5,775,907 5,299,080 Accumulated surplus, end of year (Note 14) $ 6,857,114 $ 5,775,907 Shawanaga First Nation Consolidated Statement of Financial Position March 31 2020 2019 Financial assets Cash and cash equivalents Restricted cash (Note 3) Receivables Inventory for resale Investments in government business enterprise (Note 5) Mortgages receivable, net of unamortized discount (Note 18) Long-term loan receivable 2,381,565 914,810 2,187,464 123,789 326,802 917,666 1,240 6,863,336 1,928,561 769,332 1,946,584 147,970 444,282 632,185 1,240 5,870,154 Liabilities Payables and accruals Funding repayable (Note 19) Due to related parties (Note 11) Deferred contributions (Note 7) Long term debt (Note 12) Obligations under capital tease (Note 13) 1,546,121 472,591 44,125 576,408 1,328,572 654 3,968,471 2,884,865 1,481,393 478,836 44,234 1.243,436 879,790 2,814 4,130,503 1,739,651 Net financial assets Non-financial assets Prepaids and deposits Tangible capital assets (Note 6) 53,412 3,918,837 3,972,249 6,857,114 51,679 3,984,577 4,036, 256 5.775,907 Accumulated surplus (Note 14) Shawanaga First Nation Consolidated Statement of Change in Net Financial Assets Year Ended March 31 Actual Annual surplus $ 1,081,207 $ 2020 2019 Actual 476,827 564,921 579,751 (1,545,473) (1,933,142) 1,046,292 17,344 (1,733) Amortization of tangible capital assets Acquisition of tangible capital assets Disposal of tangible capital assets Change in prepaids and deposits Increase (decrease) in net financial assets Net financial assets, Beginning of year End of year (40,149) (899,369) 1,145,214 1,739,651 2,639,020 $ 2,884,865 $ 1.739,651 Shawanaga First Nation Consolidated Statement of Cash Flows Year Ended March 31 2020 2019 $ 476,827 1,081,207 564,921 579,751 56,619 17.344 Cash and cash equivalents derived from (applied to) Operating transactions Annual surplus Non-cash changes to operations: Amortization of tangible capital assets Loss (earnings) from Investment in government business enterprise Gain on disposal of tangible capital assets Changes in non-cash working capital items: Receivables Inventory for resale Prepaids and deposits Payables and accruals Funding repayable Deferred contributions Financing transactions Repayment of long-term debt Proceeds on issuance of long-term debt Advances (repayments) from related parties Repayment of obligation under capital tease Investing transactions Decrease (increase) in restricted cash Distribution from investments Payments received on mortgages receivable Net advances of loan receivable Capital transactions Purchase of tangible capital assets 117,480 673,192 (240,880) 24,181 (1.733) 64,728 (6.245) (667,028) 1,609,823 (96,360) 545,142 (109) (2.160) 446,513 (237,266) (69.820) (40,149) 254,548 61,353 350.631 1.449,838 (67.381) 182,400 44,234 (2,032) 157. 221 (145,478) 84,119 383 234 47,000 33,859 6.172 470.265 (61,359) (1,541,973) (1,541,973) 453,004 (1.933.142) (1.933, 142) 144.182 Net increase in cash and cash equivalents Cash and cash equivalents Beginning of year End of Year 1.784,379 1,928,561 $ 2,381,565 1.928,561 Non-cash investing and capital activities During the year, the First Nation sold buildings in exchange for $369,600 in mortgages receivable. During the year, the First Nation acquired a vehicle at a cost of $45,157 of which $3,500 was value received from trade-in of older vehicle