Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: ( a ) Assume you are the tax adviser, explain to the management of FUK regarding the proposed share acquisition of FOOD in respect

Required:

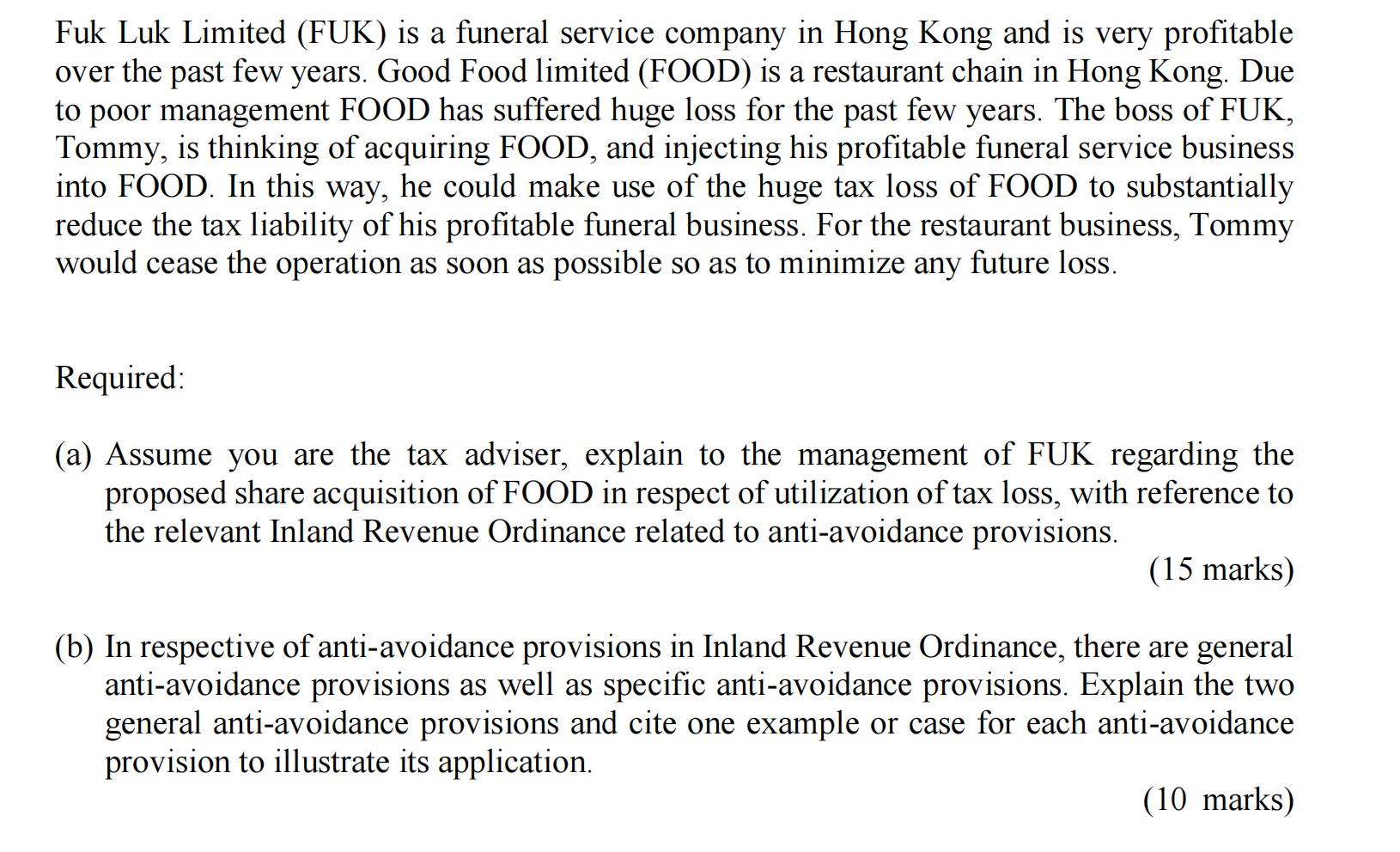

a Assume you are the tax adviser, explain to the management of FUK regarding the

proposed share acquisition of FOOD in respect of utilization of tax loss, with reference to

the relevant Inland Revenue Ordinance related to antiavoidance provisions.

marks

b In respective of antiavoidance provisions in Inland Revenue Ordinance, there are general

antiavoidance provisions as well as specific antiavoidance provisions. Explain the two

general antiavoidance provisions and cite one example or case for each antiavoidance

provision to illustrate its application.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started