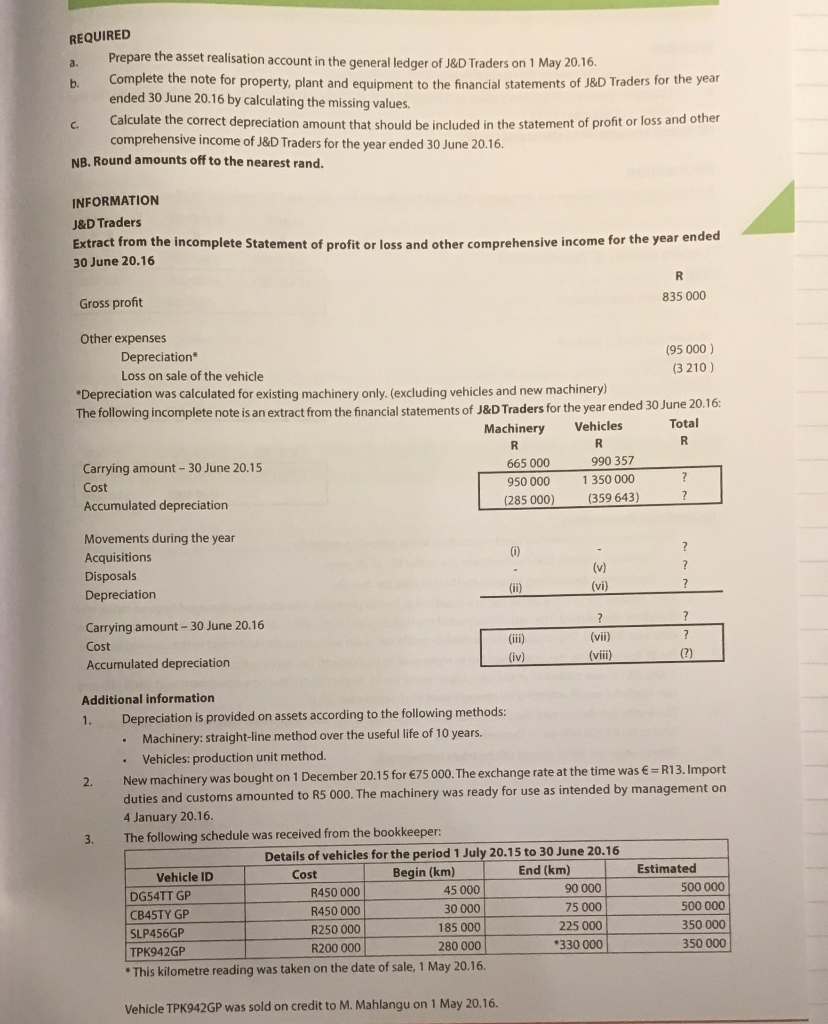

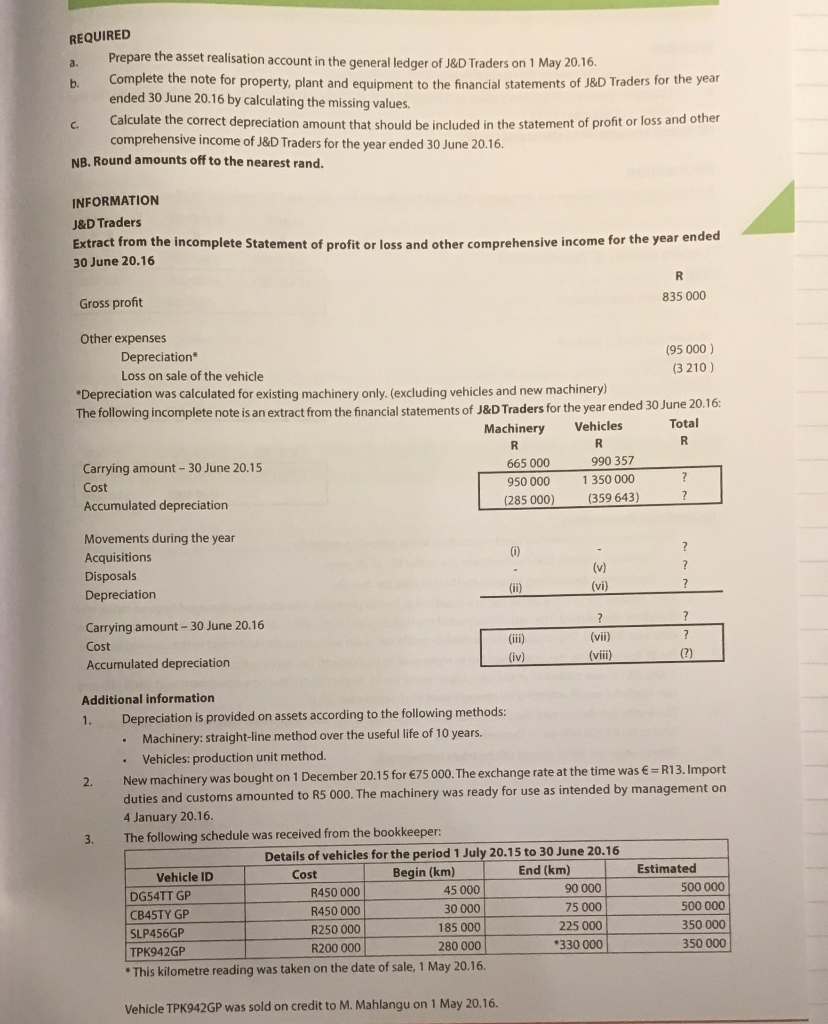

REQUIRED a. b. Prepare the asset realisation account in the general ledger of J&D Traders on 1 May 20.16. Complete the note for property, plant and equipment to the financial statements of J&D Traders for the year ended 30 June 20.16 by calculating the missing values. Calculate the correct depreciation amount that should be included in the statement of profit or loss and other comprehensive income of J&D Traders for the year ended 30 June 20.16. NB. Round amounts off to the nearest rand. c INFORMATION J&D Traders Extract from the incomplete Statement of profit or loss and other comprehensive income for the year ended 30 June 20.16 R 835 000 Gross profit Other expenses Depreciation* (95 000) Loss on sale of the vehicle (3210) *Depreciation was calculated for existing machinery only. (excluding vehicles and new machinery) The following incomplete note is an extract from the financial statements of J&D Traders for the year ended 30 June 2016: Machinery Vehicles Total R R R Carrying amount - 30 June 20.15 665 oC 990 357 Cost 950 000 1 350 000 Accumulated depreciation (285 000) (359 643) ? (0) Movements during the year Acquisitions Disposals Depreciation (v) (vi) (ii) 7 ? Carrying amount - 30 June 20.16 Cost Accumulated depreciation (iii) (iv) ? (vii) (viii) ? (?) Additional information 1. Depreciation is provided on assets according to the following methods: Machinery: straight-line method over the useful life of 10 years. Vehicles: production unit method. 2 New machinery was bought on 1 December 20.15 for 75 000. The exchange rate at the time was = R13. Import duties and customs amounted to R5 000. The machinery was ready for use as intended by management on 4 January 20.16. 3. The following schedule was received from the bookkeeper: Details of vehicles for the period 1 July 20.15 to 30 June 20.16 Vehicle ID Cost Begin (km) End (km) Estimated DG54TT GP R450 000 45 000 90 000 500 000 CB45TY GP R450 000 30 000 75 000 500 000 SLP456GP R250 000 185 000 225 000 350 000 TPK942GP R200 000 280 000 *330 000 350 000 * This kilometre reading was taken on the date of sale, 1 May 20.16. Vehicle TPK942GP was sold on credit to M. Mahlangu on 1 May 20.16. REQUIRED a. b. Prepare the asset realisation account in the general ledger of J&D Traders on 1 May 20.16. Complete the note for property, plant and equipment to the financial statements of J&D Traders for the year ended 30 June 20.16 by calculating the missing values. Calculate the correct depreciation amount that should be included in the statement of profit or loss and other comprehensive income of J&D Traders for the year ended 30 June 20.16. NB. Round amounts off to the nearest rand. c INFORMATION J&D Traders Extract from the incomplete Statement of profit or loss and other comprehensive income for the year ended 30 June 20.16 R 835 000 Gross profit Other expenses Depreciation* (95 000) Loss on sale of the vehicle (3210) *Depreciation was calculated for existing machinery only. (excluding vehicles and new machinery) The following incomplete note is an extract from the financial statements of J&D Traders for the year ended 30 June 2016: Machinery Vehicles Total R R R Carrying amount - 30 June 20.15 665 oC 990 357 Cost 950 000 1 350 000 Accumulated depreciation (285 000) (359 643) ? (0) Movements during the year Acquisitions Disposals Depreciation (v) (vi) (ii) 7 ? Carrying amount - 30 June 20.16 Cost Accumulated depreciation (iii) (iv) ? (vii) (viii) ? (?) Additional information 1. Depreciation is provided on assets according to the following methods: Machinery: straight-line method over the useful life of 10 years. Vehicles: production unit method. 2 New machinery was bought on 1 December 20.15 for 75 000. The exchange rate at the time was = R13. Import duties and customs amounted to R5 000. The machinery was ready for use as intended by management on 4 January 20.16. 3. The following schedule was received from the bookkeeper: Details of vehicles for the period 1 July 20.15 to 30 June 20.16 Vehicle ID Cost Begin (km) End (km) Estimated DG54TT GP R450 000 45 000 90 000 500 000 CB45TY GP R450 000 30 000 75 000 500 000 SLP456GP R250 000 185 000 225 000 350 000 TPK942GP R200 000 280 000 *330 000 350 000 * This kilometre reading was taken on the date of sale, 1 May 20.16. Vehicle TPK942GP was sold on credit to M. Mahlangu on 1 May 20.16