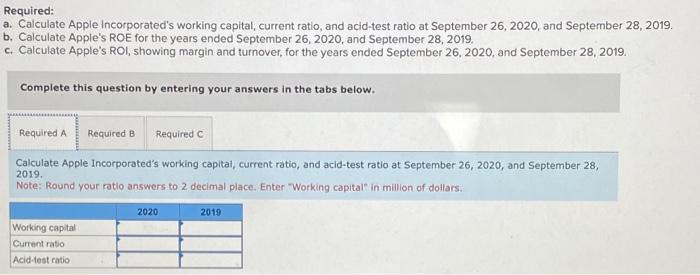

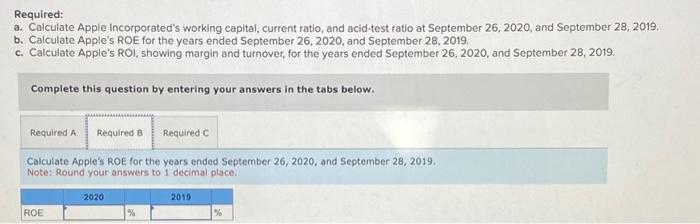

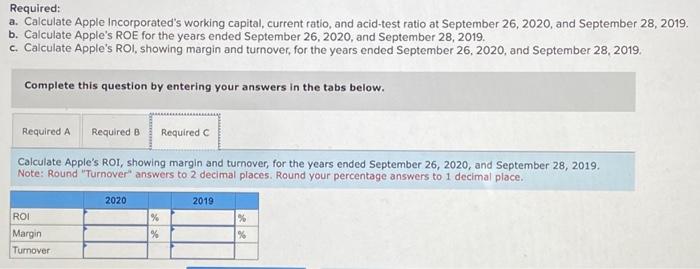

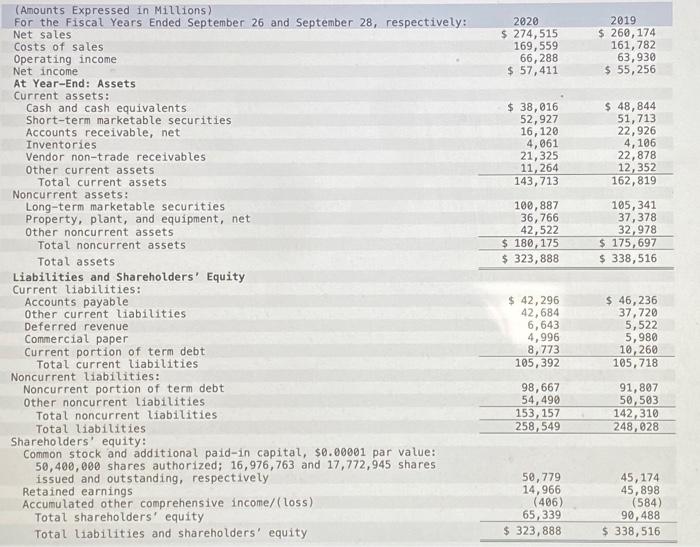

Required: a. Calculate Apple incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 2019. b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 2019. Note: Round your ratio answers to 2 decimal place. Enter "Working capital" in million of dollars. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 2019, b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28,2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28, 2019 . Complete this question by entering your answers in the tabs below. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. Note: Round your answers to 1 decimal place. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28 , 2019 b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. c. Calculate Apple's ROl, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019 . Complete this question by entering your answers in the tabs below. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28, 2019. Note: Round "Turnover" answers to 2 decimal places. Round your percentage answers to 1 decimal place. (Amounts Expressed in Millions) FortheFiscalYearsEndedSeptember26andSeptember28,respectively:NetsalesCostsofsalesOperatingincomeNetincome2020$274,515169,55966,288$57,4112019$260,174161,78263,930$55,256 At Year-End: Assets Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, net Inventories Vendor non-trade receivables other current assets Total current assets Noncurrent assets: Long-term marketable securities Property, plant, and equipment, net other noncurrent assets Total noncurrent assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable other current liabilities Deferred revenue Commercial paper Current portion of term debt Total current liabilities Noncurrent liabilities: Noncurrent portion of term debt other noncurrent liabilities Total noncurrent liabilities Total liabilities Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 16,976,763 and 17,772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity