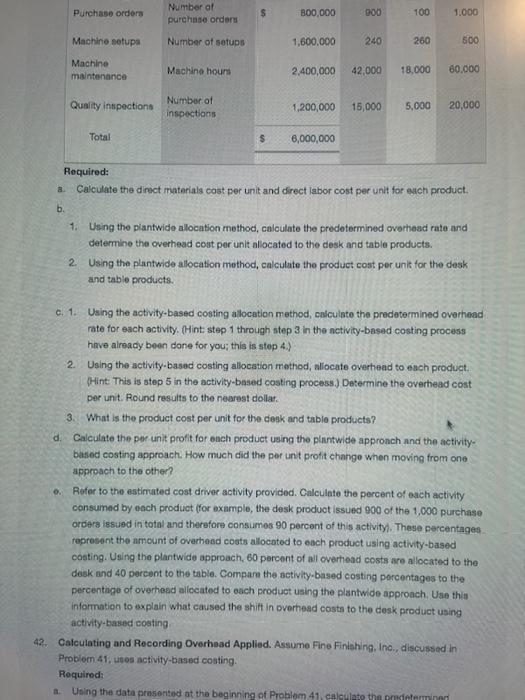

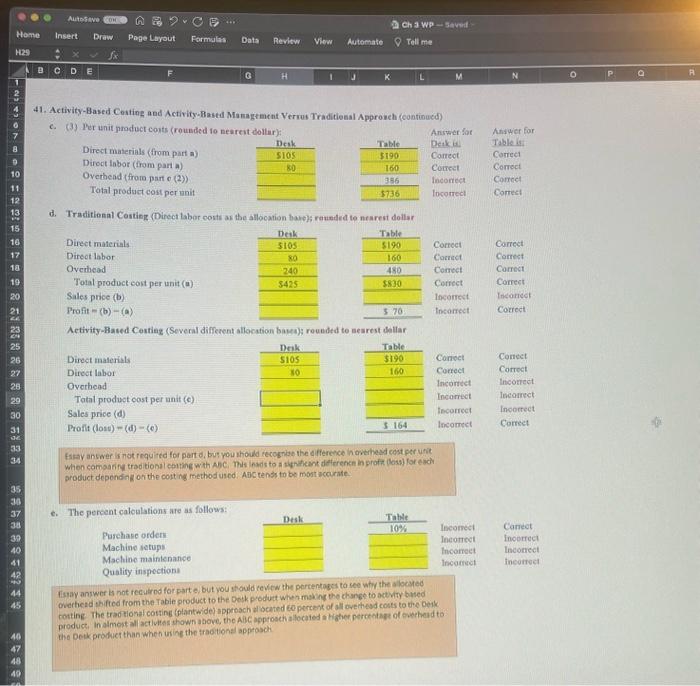

Required: a. Calculate the direct materials cost per unit and direct labor cost per unit for ench product. b. 1. Using the piantwide allocation method, caloulate the predetermined overhead rate and determine the overhead cost per unit allocated to the desk and table products. 2. Using the plantwide allocation method, calcutate the product cost per unit for the desk and table products. c. 1. Using the activity-based costing a location method, casculate the predetermined overhead rate for each activity. (Hint step 1 through step 3 in the nctivity-based costing process have already been done for you; this is step 4.) 2. Using the activify-based costing allocation mothod, aliocate overhead to esch product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest dollar. 3. What is the product cost per unit for the desk and table products? d. Calculate the per unit profit for each product using the plintwide appronch and the activity= batied costing approach. How much did the per unt protit charige when moving from one approach to the other? 6. Refer to the estimated cost driver activity provided. Calculate the percent of each activity consumed by eech product (for example, the desk product issued 900 of the 1,000 purchase orders iesued in total and therefore consumes 90 percent of this activity/. These percentages. represent the amount of overhesd coots allocated to each product using activity-based costing. Using the plantwide approach, 60 percent of all overhead cests are allocated to the desk and 40 percent to the table. Compare the activity-based costing percentages to the percentage of overhesd allocated to each product using the plantwide approach. Uae this information to axplain what caused the shift in overhegd costs to the cesk produot using activity-based costing 42. Calculating and Pecording Overhead Applied. Assume Fine Finishing, Ino, discussed in Problom 41, uses activity-based costing. Required: a. Ueing the data praserited at the beginning of Problom 41, caleulato the ormdetemuined. 41. Activity-Based Conting and Activity-Bastd Managtment Verrus Traditional Approneh (contioued) d. Traditional Costiog (Direct labor costs as the allocation bare); raunded to neareut dollor Aetivity-Based Costing (Several different allocation base); rounded to searest sallar product depending ori the cost ing method usod. Afic tenss to be most sccurate. e. 1 fisa answer is not reculrod for part e, but you should revicw the percentagss to see why the alocied overhead thifted from the Tabie product to the Detk product whermaking the change to actiry bused cotting. The tradtional costing (plantwide) appenach al oented ee persert of all ove hed couts to the oenk produch, in almort all actlutes thown above, the ABC approseh alocated a Higher perceetage of evehead to the Deek prodict than when usine the traetionel approsch Required: a. Calculate the direct materials cost per unit and direct labor cost per unit for ench product. b. 1. Using the piantwide allocation method, caloulate the predetermined overhead rate and determine the overhead cost per unit allocated to the desk and table products. 2. Using the plantwide allocation method, calcutate the product cost per unit for the desk and table products. c. 1. Using the activity-based costing a location method, casculate the predetermined overhead rate for each activity. (Hint step 1 through step 3 in the nctivity-based costing process have already been done for you; this is step 4.) 2. Using the activify-based costing allocation mothod, aliocate overhead to esch product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest dollar. 3. What is the product cost per unit for the desk and table products? d. Calculate the per unit profit for each product using the plintwide appronch and the activity= batied costing approach. How much did the per unt protit charige when moving from one approach to the other? 6. Refer to the estimated cost driver activity provided. Calculate the percent of each activity consumed by eech product (for example, the desk product issued 900 of the 1,000 purchase orders iesued in total and therefore consumes 90 percent of this activity/. These percentages. represent the amount of overhesd coots allocated to each product using activity-based costing. Using the plantwide approach, 60 percent of all overhead cests are allocated to the desk and 40 percent to the table. Compare the activity-based costing percentages to the percentage of overhesd allocated to each product using the plantwide approach. Uae this information to axplain what caused the shift in overhegd costs to the cesk produot using activity-based costing 42. Calculating and Pecording Overhead Applied. Assume Fine Finishing, Ino, discussed in Problom 41, uses activity-based costing. Required: a. Ueing the data praserited at the beginning of Problom 41, caleulato the ormdetemuined. 41. Activity-Based Conting and Activity-Bastd Managtment Verrus Traditional Approneh (contioued) d. Traditional Costiog (Direct labor costs as the allocation bare); raunded to neareut dollor Aetivity-Based Costing (Several different allocation base); rounded to searest sallar product depending ori the cost ing method usod. Afic tenss to be most sccurate. e. 1 fisa answer is not reculrod for part e, but you should revicw the percentagss to see why the alocied overhead thifted from the Tabie product to the Detk product whermaking the change to actiry bused cotting. The tradtional costing (plantwide) appenach al oented ee persert of all ove hed couts to the oenk produch, in almort all actlutes thown above, the ABC approseh alocated a Higher perceetage of evehead to the Deek prodict than when usine the traetionel approsch