Question

Required: a) Calculate the overhead cost per unit for each of the companys two products under the traditional costing system if the overhead are absorbed

Required:

a) Calculate the overhead cost per unit for each of the companys two products under the traditional costing system if the overhead are absorbed based on machine hours (6 marks)

b) Calculate the product cost per unit for each of the companys two products based on traditional costing system. (6 marks)

c) If the manufacturer decides to use activity based costing in computing overhead compute the activity rate for each cost pool. (6 marks)

d) Calculate the total overhead and overhead cost per unit for each of the companys two products based on activity based costing (8 marks)

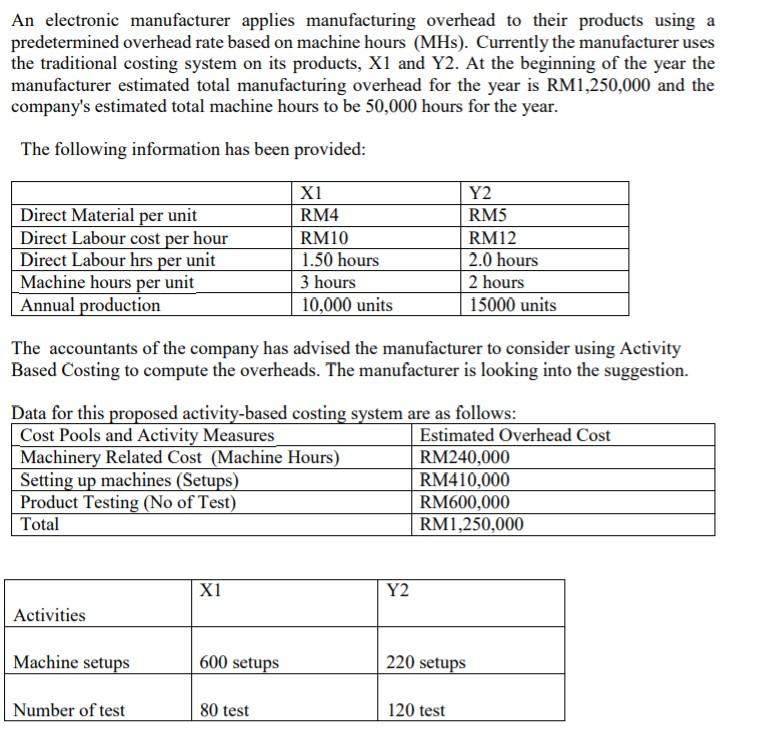

An electronic manufacturer applies manufacturing overhead to their products using a predetermined overhead rate based on machine hours (MHs). Currently the manufacturer uses the traditional costing system on its products, X1 and Y2. At the beginning of the year the manufacturer estimated total manufacturing overhead for the year is RM1,250,000 and the company's estimated total machine hours to be 50,000 hours for the year. The following information has been provided: Direct Material per unit Direct Labour cost per hour Direct Labour hrs per unit Machine hours per unit Annual production X1 RM4 RM10 1.50 hours 3 hours 10,000 units Y2 RM5 RM12 2.0 hours 2 hours 15000 units The accountants of the company has advised the manufacturer to consider using Activity Based Costing to compute the overheads. The manufacturer is looking into the suggestion. Data for this proposed activity-based costing system are as follows: Cost Pools and Activity Measures Estimated Overhead Cost Machinery Related Cost (Machine Hours) RM240,000 Setting up machines (Setups) RM410,000 Product Testing (No of Test) RM600,000 Total RM1,250,000 X1 Y2 Activities Machine setups 600 setups 220 setups Number of test 80 test 120 test

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started