Answered step by step

Verified Expert Solution

Question

1 Approved Answer

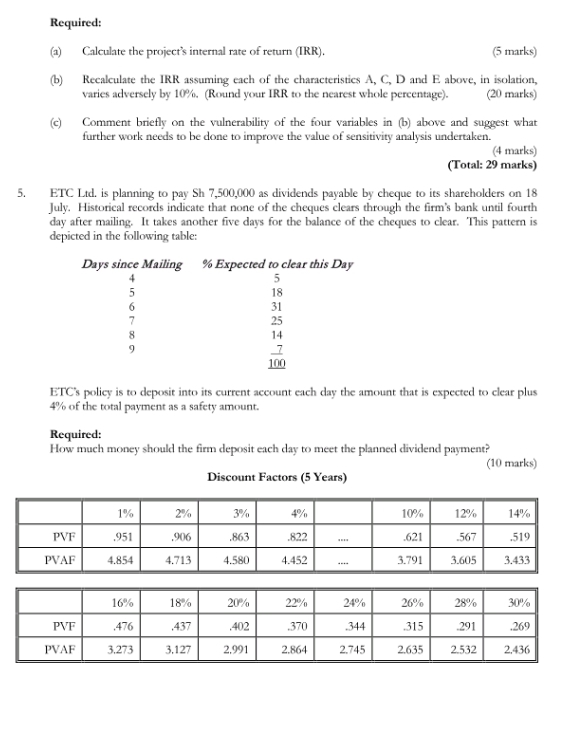

Required: (a) Calculate the project's internal rate of return (IRR). (5 marks) 5. (b) Recalculate the IRR assuming each of the characteristics A, C,

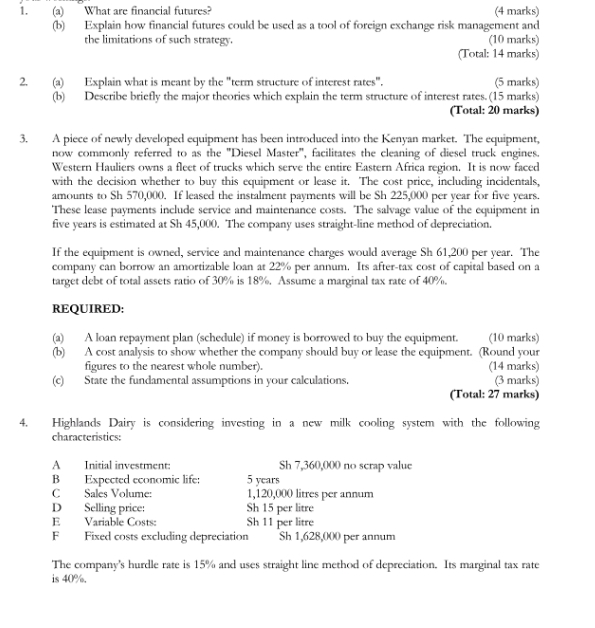

Required: (a) Calculate the project's internal rate of return (IRR). (5 marks) 5. (b) Recalculate the IRR assuming each of the characteristics A, C, D and E above, in isolation, varies adversely by 10%. (Round your IRR to the nearest whole percentage). (20 marks) Comment briefly on the vulnerability of the four variables in (b) above and suggest what further work needs to be done to improve the value of sensitivity analysis undertaken. (4 marks) (Total: 29 marks) ETC Ltd. is planning to pay Sh 7,500,000 as dividends payable by cheque to its shareholders on 18 July. Historical records indicate that none of the cheques clears through the firm's bank until fourth day after mailing. It takes another five days for the balance of the cheques to clear. This pattern is depicted in the following table: Days since Mailing % Expected to clear this Day 5 6 7 8 9 5 18 31 25 14 ETC's policy is to deposit into its current account each day the amount that is expected to clear plus 4% of the total payment as a safety amount. Required: How much money should the firm deposit each day to meet the planned dividend payment? Discount Factors (5 Years) (10 marks) 1% 2% 3% 4% 10% 12% 14% PVF .951 .906 .863 822 .621 .567 .519 PVAF 4.854 4.713 4.580 4.452 3.791 3.605 3.433 16% 18% 20% 22% 24% 26% 28% 30% PVF .476 .437 .402 370 344 315 .291 .269 PVAF 3.273 3.127 2.991 2.864 2.745 2.635 2.532 2.436 1. 2. 3. 4. (b) (E) What are financial futures? (4 marks) Explain how financial futures could be used as a tool of foreign exchange risk management and the limitations of such strategy. (10 marks) (Total: 14 marks) (5 marks) Explain what is meant by the "term structure of interest rates". (b) Describe briefly the major theories which explain the term structure of interest rates. (15 marks) (Total: 20 marks) A piece of newly developed equipment has been introduced into the Kenyan market. The equipment, now commonly referred to as the "Diesel Master", facilitates the cleaning of diesel truck engines. Western Hauliers owns a fleet of trucks which serve the entire Eastern Africa region. It is now faced with the decision whether to buy this equipment or lease it. The cost price, including incidentals, amounts to Sh 570,000. If leased the instalment payments will be Sh 225,000 per year for five years. These lease payments include service and maintenance costs. The salvage value of the equipment in five years is estimated at Sh 45,000. The company uses straight-line method of depreciation. If the equipment is owned, service and maintenance charges would average Sh 61,200 per year. The company can borrow an amortizable loan at 22% per annum. Its after-tax cost of capital based on a target debt of total assets ratio of 30% is 18%. Assume a marginal tax rate of 40%. REQUIRED: (a) (b) A loan repayment plan (schedule) if money is borrowed to buy the equipment. A cost analysis to show whether the company should buy or lease the equipment. figures to the nearest whole number). (c) State the fundamental assumptions in your calculations. (10 marks) (Round your (14 marks) (3 marks) (Total: 27 marks) Highlands Dairy is considering investing in a new milk cooling system with the following characteristics: ABCDEE Initial investment: Sh 7,360,000 no scrap value Expected economic life: 5 years Sales Volume: 1,120,000 litres per annum Selling price: Sh 15 per litre Variable Costs: Sh 11 per litre F Fixed costs excluding depreciation Sh 1,628,000 per annum The company's hurdle rate is 15% and uses straight line method of depreciation. Its marginal tax rate is 40%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started