Answered step by step

Verified Expert Solution

Question

1 Approved Answer

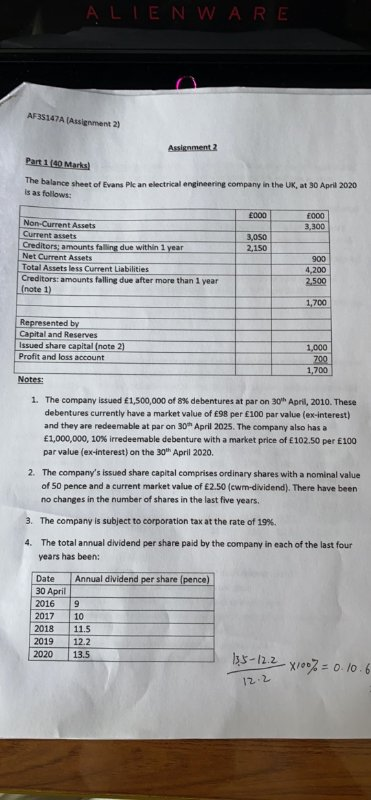

Required: a) Calculate the weighted average cost of capital for Evans Plc as at the 30th April 2020 (in order to calculate the cost of

Required:

a) Calculate the weighted average cost of capital for Evans Plc as at the 30th April 2020 (in order to calculate the cost of redeemable debt use 5% and 10% as your discount rates)

b) In no more than 250 words, critically discuss the limitations of Evans Plc weighted average cost of capital for the evaluation of future projects in investment appraisal.

c) In no more than 250 words, critically discuss the importance of your calculated weighted average cost of capital for Evans Plc as at 30th April 2020

ALLEN WARE AF 35147A (Assignment 2) Assignment2 Part 1 [Marks) The balance sheet of Evans Plc an electrical engineering company in the UK, at 30 April 2020 is as follows: 000 E000 3,300 3,050 2,150 Non-Current Assets Current assets Creditors; amounts falling due within 1 year Net Current Assets Total Assets less Current Liabilities Creditors: amounts falling due after more than 1 year (note 1 900 4,200 2.500 1,700 Represented by Capital and Reserves Issued share capital (note 2) Profit and loss account 1,000 700 1,700 Notes: 1. The company issued 1,500,000 of 8% debentures at par on 30 April, 2010. These debentures currently have a market value of 98 per 100 par value (ex-interest) and they are redeemable at par on 30th April 2025. The company also has a 1,000,000, 10% irredeemable debenture with a market price of 102.50 per 100 par value (ex-interest) on the 30th April 2020. 2. The company's issued share capital comprises ordinary shares with a nominal value of 50 pence and a current market value of 2.50 (cwm-dividend). There have been no changes in the number of shares in the last five years. 3. The company is subject to corporation tax at the rate of 19%. 4. The total annual dividend per share paid by the company in each of the last four years has been: Date 30 April Annual dividend per share (pence) 2016 2017 2018 9 10 11.5 12.2. 13.5 2019 2020 135-12.2 X100% = 0.106 12-2 ALLEN WARE AF 35147A (Assignment 2) Assignment2 Part 1 [Marks) The balance sheet of Evans Plc an electrical engineering company in the UK, at 30 April 2020 is as follows: 000 E000 3,300 3,050 2,150 Non-Current Assets Current assets Creditors; amounts falling due within 1 year Net Current Assets Total Assets less Current Liabilities Creditors: amounts falling due after more than 1 year (note 1 900 4,200 2.500 1,700 Represented by Capital and Reserves Issued share capital (note 2) Profit and loss account 1,000 700 1,700 Notes: 1. The company issued 1,500,000 of 8% debentures at par on 30 April, 2010. These debentures currently have a market value of 98 per 100 par value (ex-interest) and they are redeemable at par on 30th April 2025. The company also has a 1,000,000, 10% irredeemable debenture with a market price of 102.50 per 100 par value (ex-interest) on the 30th April 2020. 2. The company's issued share capital comprises ordinary shares with a nominal value of 50 pence and a current market value of 2.50 (cwm-dividend). There have been no changes in the number of shares in the last five years. 3. The company is subject to corporation tax at the rate of 19%. 4. The total annual dividend per share paid by the company in each of the last four years has been: Date 30 April Annual dividend per share (pence) 2016 2017 2018 9 10 11.5 12.2. 13.5 2019 2020 135-12.2 X100% = 0.106 12-2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started