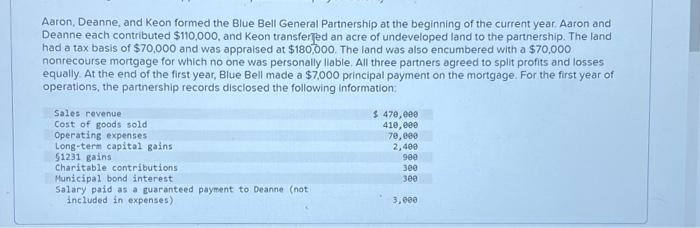

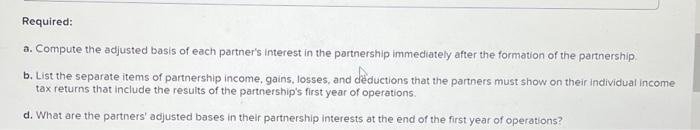

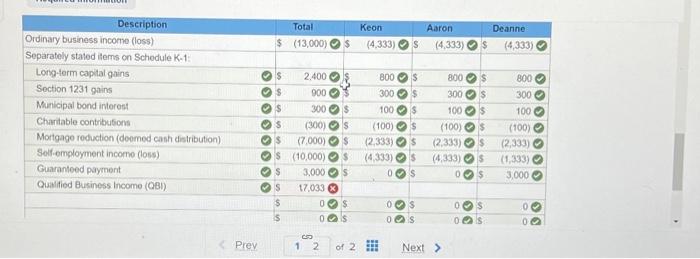

Required: a. Compute the adjusted basis of each partner's interest in the portnership immediately after the formation of the partnership. b. List the separate items of partnership income, gains, losses, and deductions that the partners must show on their individual income tax returns that include the results of the partnership's first year of operations. d. What are the partners' adjusted bases in their partnership interests at the end of the first year of operations? Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $110,000, and Keon transferfed an acre of undeveloped land to the partnership. The land had a tax basis of $70,000 and was appraised at $180,000. The land was also encumbered with a $70,000 nonrecourse mortgage for which no one was personally llable. All three partners agreed to split profits and losses equally. At the end of the first year, Blue Bell made a $7,000 principal payment on the mortgage. For the first year of operations, the partnership records disclosed the following information: \begin{tabular}{|c|c|c|c|c|c|c|} \hline Description & & & Total & Keon & Aaron & Deanne \\ \hline Ordinary business income (loss) & $ & 5 & (13,000)s & (4,333)s & $(4,333)$ & (4,333) \\ \hline \multicolumn{7}{|l|}{ Separately statod ilems on Schodule K-1: } \\ \hline Long-form capital gains & 0 s & & 2.4000$ & 8000$ & 8000s & 8000 \\ \hline Soction 1231 gains & Os & & 900054 & 30005 & 3000$ & 3000 \\ \hline Municipal bond interost & 0 s & & 3000/5 & 10003 & 10005 & 1000 \\ \hline Charitable contribusions & Os & & (300)0s & (100)s & (100)0s & (100)0 \\ \hline Mortgage reduction (deomed cash distribution) & 0 s & $ & (7,000)s & (2,333)0s & (2,333)0s & (2,333) \\ \hline Solf-omployment income (loss) & 0 s & s & (10,000)s & (4,333)05 & (4,333)5 & (1,333) \\ \hline Guaranteed payment & 0 s & $ & 3.00005 & .005 & 005 & 3,0000 \\ \hline \multirow[t]{3}{*}{ Qualified Business Income (OBI) } & 0 s & & 17,0338 & & & \\ \hline & $ & $ & 00s & 00s & 00s & 00 \\ \hline & 5 & & 00 is & 00s & 00 s & 00 \\ \hline \end{tabular} Prev 12 or 2 Next