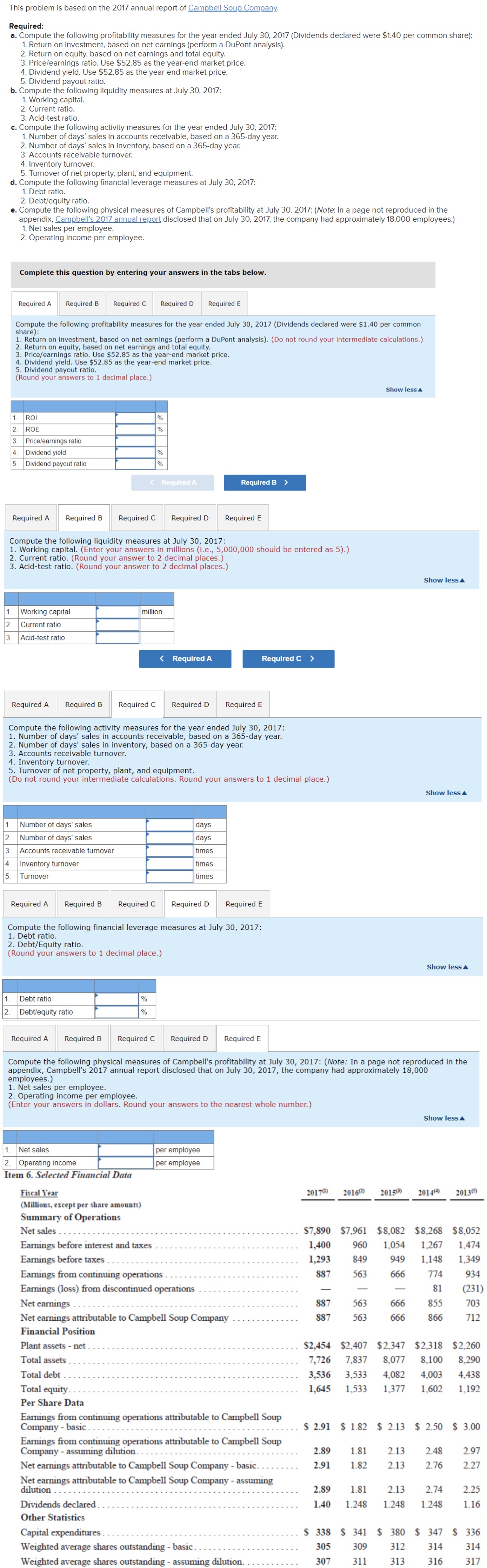

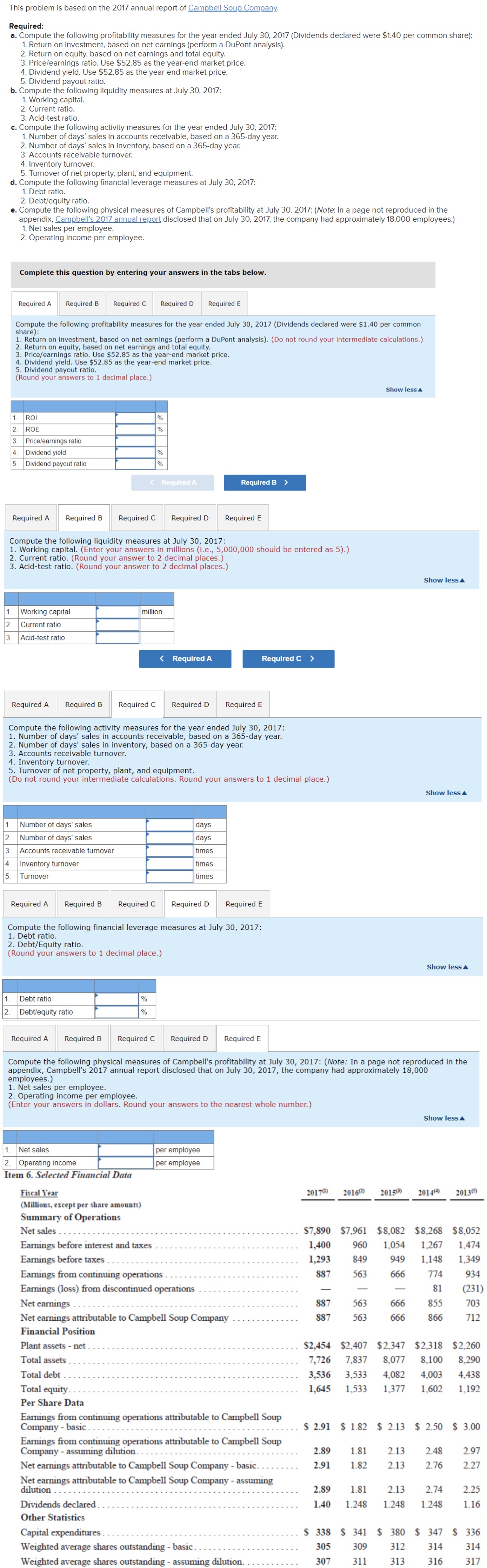

Required: a. Compute the following profitability measures for the year ended July 30,2017 (Dividends declared were $1.40 per common share): 1. Return on investment, based on net earnings (perform a DuPont analysis). 2. Return on equity, based on net earnings and total equity. market price. 4. Dividend yield. Use $52.85 as the year-end market price. 5. Dividend payout ratio. 1. Working capital. 2. Current ratio. c. Compute the following activity measures for the year ended July 30, 2017: 1. Number of days' sales in accounts receivable, based on a 365 -day year 2. Number of days' sales in inventory, based on a 365-day year. 3. Accounts receivable turnover. 4. Anventory turnover. of the following financial leverage measures at July 30, 2017: 1. Debt ratio. e. Compute the following physical measures of Campbell's profitability at July 30, 2017: (Note: In a page not reproduced in the appendix, Campbell's 2017 annual report disclosed that on July 30, 2017, the company had approximately 18,000 employees.) 1. Net sales per employee. 2. Operating income per employee. n by entering your answers in the tabs below. Compute the following profitability measures for the year ended July 30, 2017 (Dividends declared were $1.40 per common share): 1. Return on investment, based on net earnings (perform a DuPont analysis). (Do not round your intermediate calculations.) 2. Return on equity, based on net earnings and total equity. 3. . Price/earnings ratio. Use $52.85 as the year-end market price. 4. Dividend yield. Use $52.85 as the year-end market price. 5. Dividend payout ratio. (Round your answers to 1 decimal place.) Show less Compute the following liquidity measures at July 30, 2017: 1. Working capital. (Enter your answers in millions (i.e., 5,000,000 should be entered as 5).) 2. Current ratio. (Round your answer to 2 decimal places.) 3 . Acid-test ratio. (Round your answer to 2 decimal places.) Show less A Compute the following activity measures for the year ended July 30, 2017: 1. Number of days' sales in accounts receivable, based on a 365-day year. 2. Number of days' sales in inventory, based on a 365 -day year. 3. Accounts receivable turnover. 4. Inventory turnover. 5. Turnover of net property, plant, and equipment. (Do not round your intermediate calculations. Round your answers to 1 decimal place.) Compute the following financial leverage measures at July 30, 2017: 1. Debt ratio. 2. Debt/Equity ratio. (Round your answers to 1 decimal place.) Compute the following physical measures of Campbell's profitability at July 30, 2017: (Note: In a page not reproduced in the appendix, Campbell's 2017 annual report disclosed that on July 30, 2017, the company had approximately 18,000 employees.) 1. Net sales per employee. 2. Operating income per employee, (Enter your answers in dollars. Round your answers to the nearest whole number.)