Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: (a) Compute the Statutory Income in respect of the partnership business for individual partners Anita and Salwa. (b) Discuss the partnership in accordance with

Required:

(a) Compute the Statutory Income in respect of the partnership business for individual partners Anita and Salwa.

(b) Discuss the partnership in accordance with the Income Tax Act 1967?

(c) Explain how a partnership is assessed for tax and who is responsible for filling up the partnership returns.

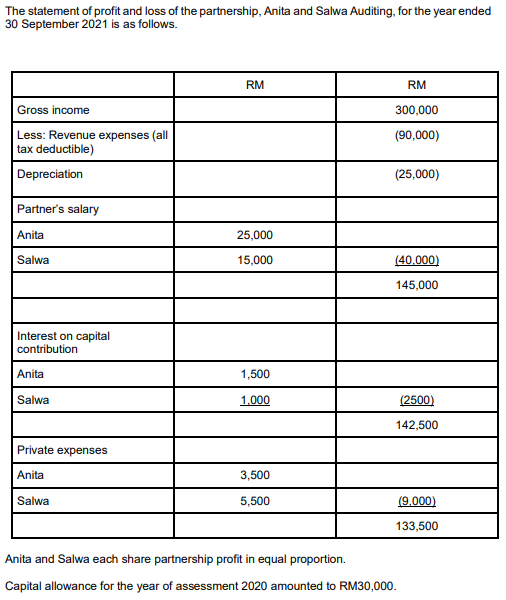

The statement of profit and loss of the partnership, Anita and Salwa Auditing, for the year ended 30 September 2021 is as follows. RM RM Gross income 300,000 (90,000) Less: Revenue expenses (all tax deductible) Depreciation (25,000) Partner's salary Anita 25,000 Salwa 15,000 (40.000) 145,000 Interest on capital contribution Anita Salwa 1,500 1.000 (2500) 142,500 Private expenses Anita 3,500 Salwa 5,500 (9.000) 133,500 Anita and Salwa each share partnership profit in equal proportion. Capital allowance for the year of assessment 2020 amounted to RM30,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started