Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a) Discuss the challenges that the accounting assistant, who is trained in human resources, may face while recording the transactions and preparing the financial

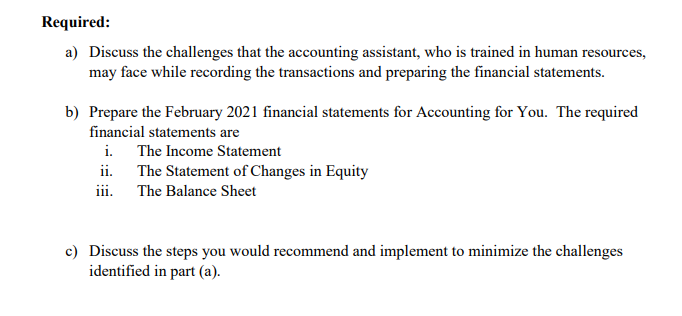

Required: a) Discuss the challenges that the accounting assistant, who is trained in human resources, may face while recording the transactions and preparing the financial statements. b) Prepare the February 2021 financial statements for Accounting for You. The required financial statements are i. The Income Statement ii. The Statement of Changes in Equity iii. The Balance Sheet c) Discuss the steps you would recommend and implement to minimize the challenges identified in part (a).

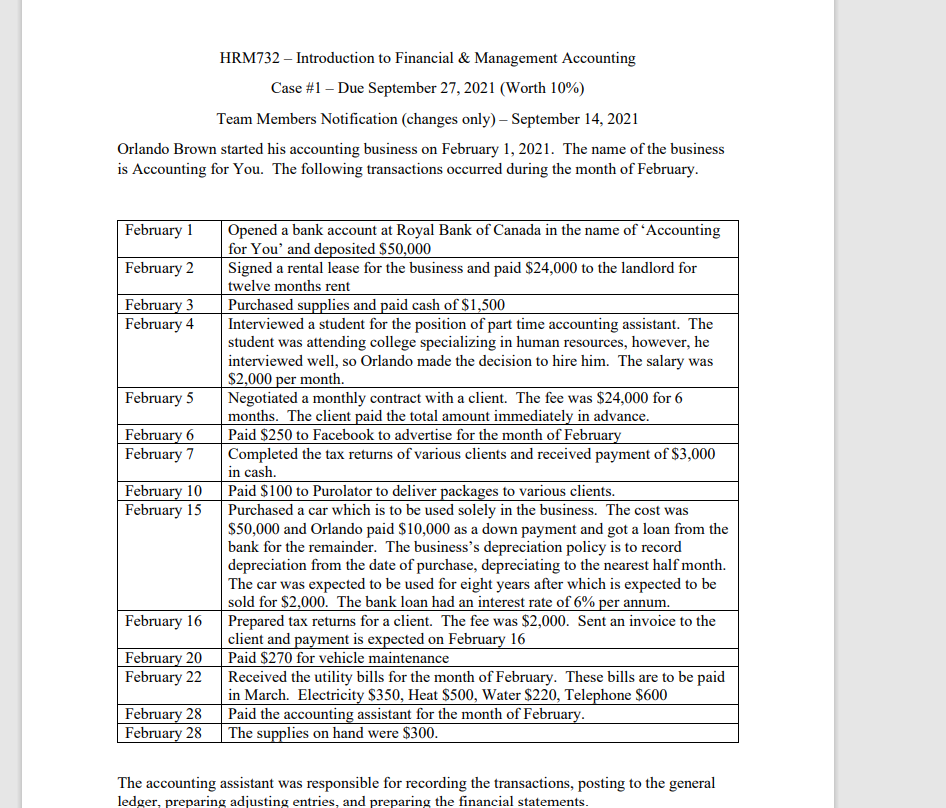

Required: a) Discuss the challenges that the accounting assistant, who is trained in human resources, may face while recording the transactions and preparing the financial statements. b) Prepare the February 2021 financial statements for Accounting for You. The required financial statements are i. The Income Statement ii. The Statement of Changes in Equity The Balance Sheet iii. c) Discuss the steps you would recommend and implement to minimize the challenges identified in part (a). HRM732 - Introduction to Financial & Management Accounting Case #1 - Due September 27, 2021 (Worth 10%) Team Members Notification (changes only) - September 14, 2021 Orlando Brown started his accounting business on February 1, 2021. The name of the business is Accounting for You. The following transactions occurred during the month of February. February 1 Opened a bank account at Royal Bank of Canada in the name of Accounting for You' and deposited $50,000 February 2 Signed a rental lease for the business and paid $24,000 to the landlord for twelve months rent February 3 Purchased supplies and paid cash of $1,500 February 4 Interviewed a student for the position of part time accounting assistant. The student was attending college specializing in human resources, however, he interviewed well, so Orlando made the decision to hire him. The salary was $2,000 per month. February 5 Negotiated a monthly contract with a client. The fee was $24,000 for 6 months. The client paid the total amount immediately in advance. Paid $250 to Facebook to advertise for the month of February February 6 February 7 Completed the tax returns of various clients and received payment of $3,000 in cash. Paid $100 to Purolator to deliver packages to various clients. February 10 February 15 Purchased a car which is to be used solely in the business. The cost was $50,000 and Orlando paid $10,000 as a down payment and got a loan from the bank for the remainder. The business's depreciation policy is to record depreciation from the date of purchase, depreciating to the nearest half month. The car was expected to be used for eight years after which is expected to be sold for $2,000. The bank loan had an interest rate of 6% per annum. Prepared tax returns for a client. The fee was $2,000. Sent an invoice to the client and payment is expected on February 16 February 16 February 20 Paid $270 for vehicle maintenance February 22 Received the utility bills for the month of February. These bills are to be paid in March. Electricity $350, Heat $500, Water $220, Telephone $600 Paid the accounting assistant for the month of February. February 28 February 28 The supplies on hand were $300. The accounting assistant was responsible for recording the transactions, posting to the general ledger, preparing adjusting entries, and preparing the financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started