Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a) For the year of assessment 2020, compute the followings: i. The chargeable income of the deceased; and ii. The income tax liability of

Required:

a) For the year of assessment 2020, compute the followings:

i. The chargeable income of the deceased; and

ii. The income tax liability of the executor.

b) Explain the tax treatment on the administrators fee received by the executor.

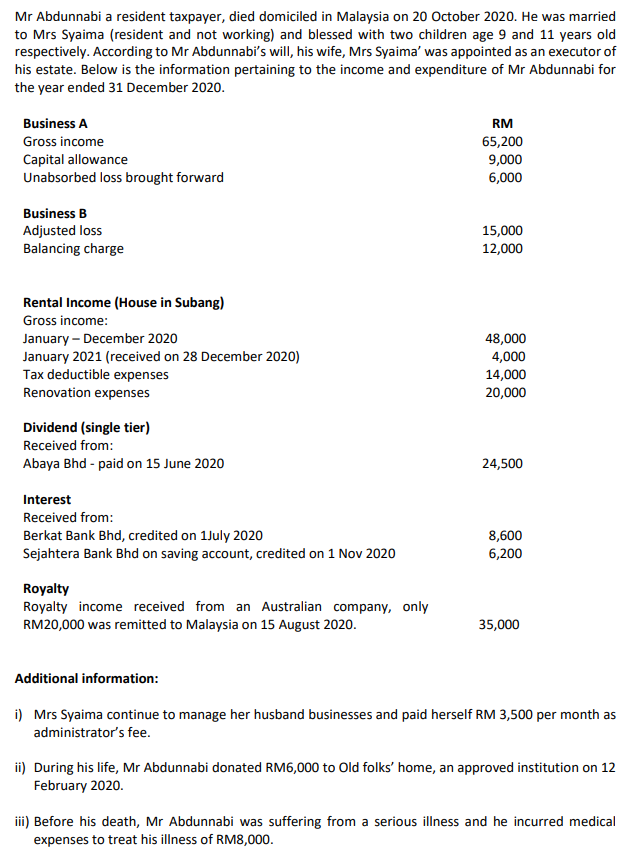

Mr Abdunnabi a resident taxpayer, died domiciled in Malaysia on 20 October 2020. He was married to Mrs Syaima (resident and not working) and blessed with two children age 9 and 11 years old respectively. According to Mr Abdunnabi's will, his wife, Mrs Syaima' was appointed as an executor of his estate. Below is the information pertaining to the income and expenditure of Mr Abdunnabi for the year ended 31 December 2020. Business A Gross income Capital allowance Unabsorbed loss brought forward RM 65,200 9,000 6,000 Business B Adjusted loss Balancing charge 15,000 12,000 Rental Income (House in Subang) Gross income: January - December 2020 January 2021 (received on 28 December 2020) Tax deductible expenses Renovation expenses 48,000 4,000 14,000 20,000 Dividend (single tier) Received from: Abaya Bhd - paid on 15 June 2020 24,500 Interest Received from: Berkat Bank Bhd, credited on 1 July 2020 Sejahtera Bank Bhd on saving account, credited on 1 Nov 2020 8,600 6,200 Royalty Royalty income received from an Australian company, only RM20,000 was remitted to Malaysia on 15 August 2020. 35,000 Additional information: i) Mrs Syaima continue to manage her husband businesses and paid herself RM 3,500 per month as administrator's fee. ii) During his life, Mr Abdunnabi donated RM6,000 to Old folks' home, an approved institution on 12 February 2020. iii) Before his death, Mr Abdunnabi was suffering from a serious illness and he incurred medical expenses to treat his illness of RM8,000. Mr Abdunnabi a resident taxpayer, died domiciled in Malaysia on 20 October 2020. He was married to Mrs Syaima (resident and not working) and blessed with two children age 9 and 11 years old respectively. According to Mr Abdunnabi's will, his wife, Mrs Syaima' was appointed as an executor of his estate. Below is the information pertaining to the income and expenditure of Mr Abdunnabi for the year ended 31 December 2020. Business A Gross income Capital allowance Unabsorbed loss brought forward RM 65,200 9,000 6,000 Business B Adjusted loss Balancing charge 15,000 12,000 Rental Income (House in Subang) Gross income: January - December 2020 January 2021 (received on 28 December 2020) Tax deductible expenses Renovation expenses 48,000 4,000 14,000 20,000 Dividend (single tier) Received from: Abaya Bhd - paid on 15 June 2020 24,500 Interest Received from: Berkat Bank Bhd, credited on 1 July 2020 Sejahtera Bank Bhd on saving account, credited on 1 Nov 2020 8,600 6,200 Royalty Royalty income received from an Australian company, only RM20,000 was remitted to Malaysia on 15 August 2020. 35,000 Additional information: i) Mrs Syaima continue to manage her husband businesses and paid herself RM 3,500 per month as administrator's fee. ii) During his life, Mr Abdunnabi donated RM6,000 to Old folks' home, an approved institution on 12 February 2020. iii) Before his death, Mr Abdunnabi was suffering from a serious illness and he incurred medical expenses to treat his illness of RM8,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started