required A need expenses.

required B stockholders equity

required C

required C2 liabilities

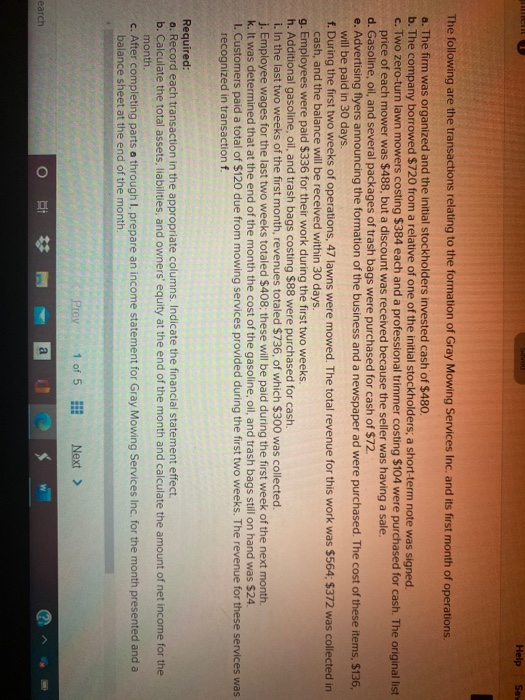

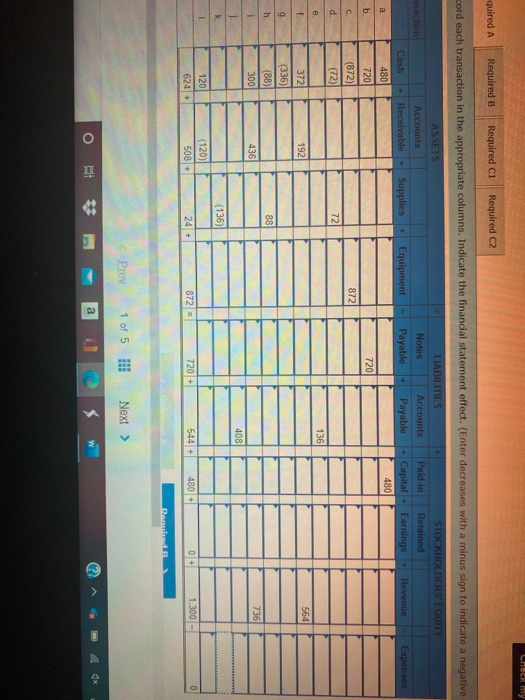

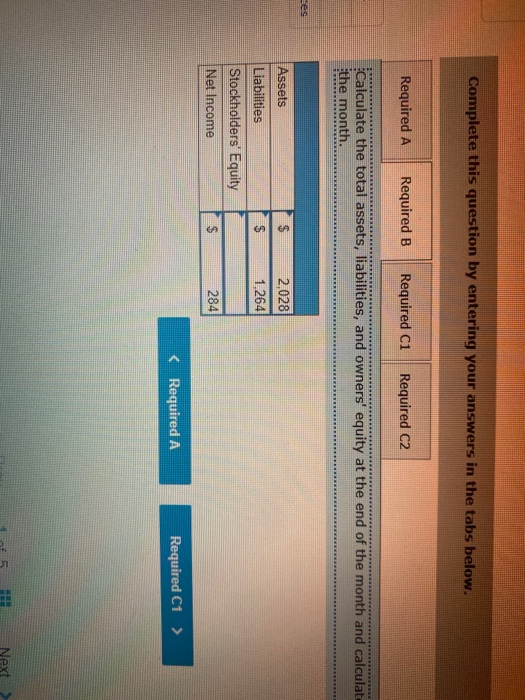

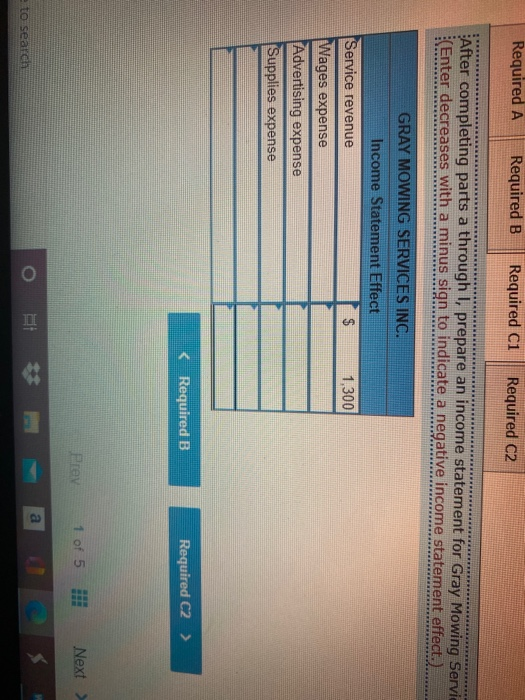

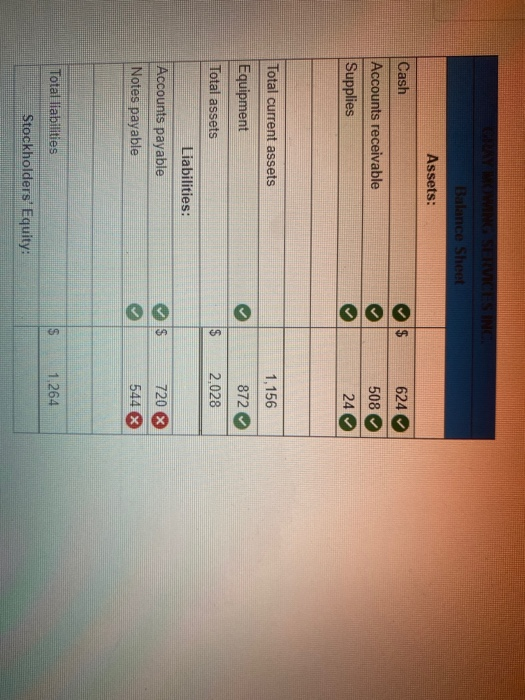

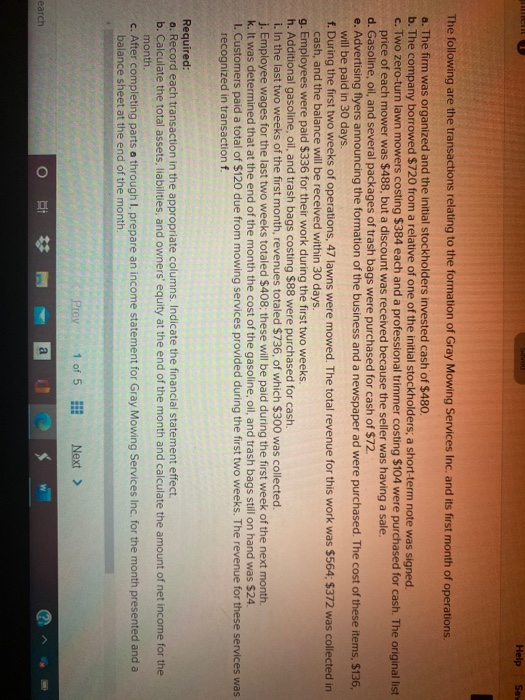

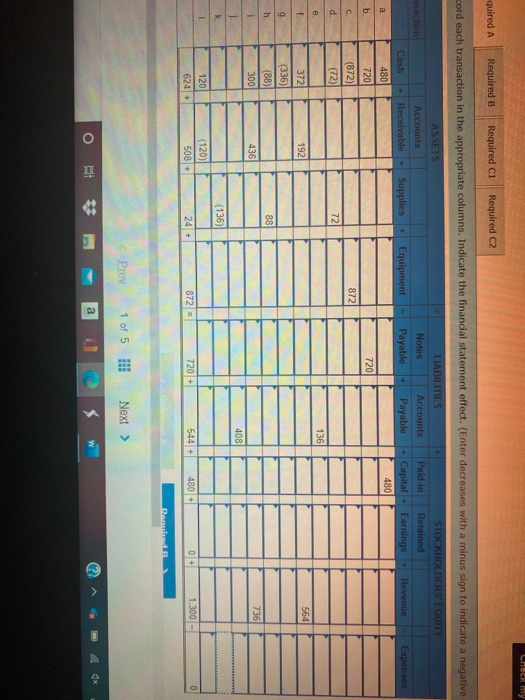

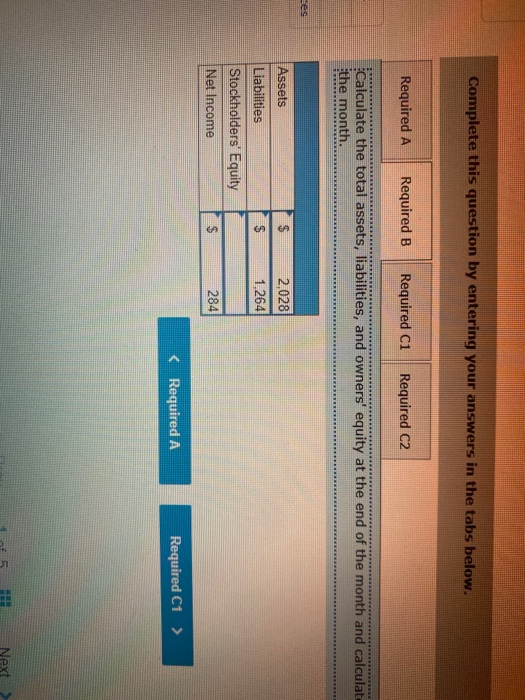

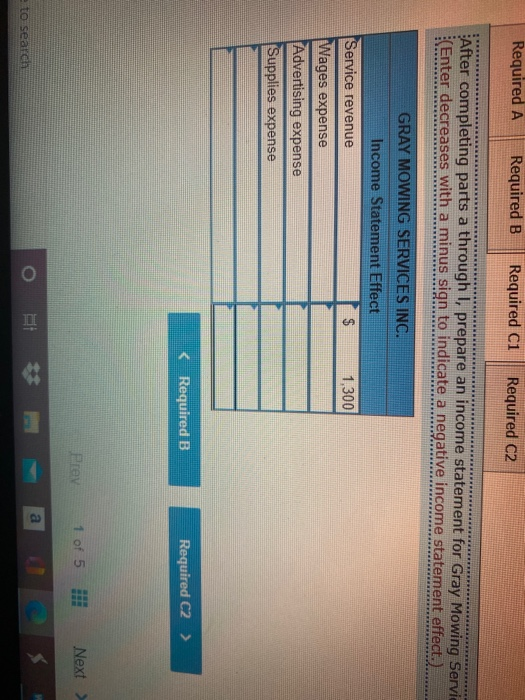

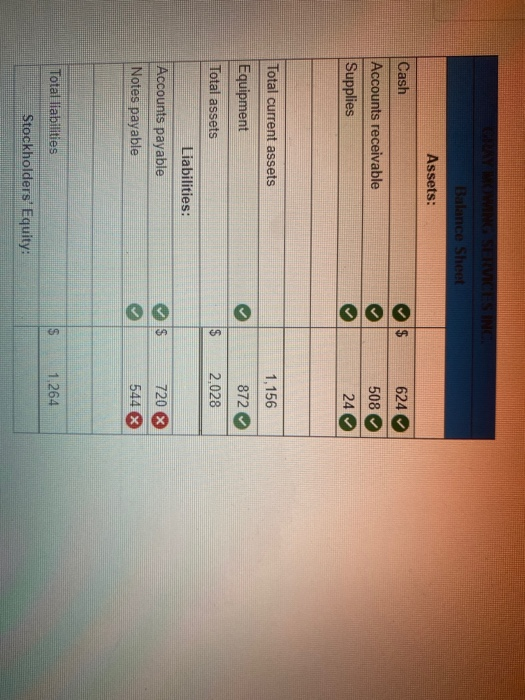

Help So The following are the transactions relating to the formation of Gray Mowing Services Inc. and its first month of operations. a. The firm was organized and the initial stockholders invested cash of $480. b. The company borrowed $720 from a relative of one of the initial stockholders; a short-term note was signed. c. Two zero-turn lawn mowers costing $384 each and a professional trimmer costing $104 were purchased for cash. The original list price of each mower was $488, but a discount was received because the seller was having a sale. d. Gasoline, oil , and several packages of trash bags were purchased for cash of $72. e. Advertising flyers announcing the formation of the business and a newspaper ad were purchased. The cost of these items, $136, will be paid in 30 days. f. During the first two weeks of operations, 47 lawns were mowed. The total revenue for this work was $564; $372 was collected in cash, and the balance will be received within 30 days. g. Employees were paid $336 for their work during the first two weeks. h. Additional gasoline, oil, and trash bags costing $88 were purchased for cash. i. In the last two weeks of the first month, revenues totaled $736, of which $300 was collected. j. Employee wages for the last two weeks totaled $408; these will be paid during the first week of the next month. k. It was determined that at the end of the month the cost of the gasoline, oil, and trash bags still on hand was $24. 1. Customers paid a total of $120 due from mowing services provided during the first two weeks. The revenue for these services was recognized in transaction f. Required: a. Record each transaction in the appropriate columns. Indicate the financial statement effect. b. Calculate the total assets, liabilities, and owners' equity at the end of the month and calculate the amount of net income for the month. c. After completing parts a through I, prepare an income statement for Gray Mowing Services Inc. for the month presented and a balance sheet at the end of the month. Prov 1 of 5 !!! Next > earch a CHEER my quired A Required B Required ci Required C2 cord each transaction in the appropriate columns. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative ASSETS Accounts Receivable LIABILITIES Notes Accounts Payable Payable STOCKHOLDERS' EQUITY Retained Earnings Revenue Cash Supplies Paid in + Capital 480 Equipment + Expenses a b 720 480 720 (872) (72) . 872 d. 72 1361 e f 192 564 9 h 372 (336) (88) 300 88 736 i 436 408 K (136) 1 (120) 120 624+ 508 - 24 + 720 + 872 - 0 544 + 480 1,300 Dande Prev 1 of 5 Next > O 7 a Complete this question by entering your answers in the tabs below. Required A Required B Required c1 Required C2 Calculate the total assets, liabilities, and owners' equity at the end of the month and calculate the month. es Assets GAGA 2,028 1.264 Liabilities Stockholders' Equity Net Income $ 284 5 Next Required A Required B Required ci Required C2 After completing parts a through I, prepare an income statement for Gray Mowing Servie (Enter decreases with a minus sign to indicate a negative income statement effect.) 1.300 GRAY MOWING SERVICES INC. Income Statement Effect Service revenue $ Wages expense Advertising expense Supplies expense Prev 1 of 5 Next > o a e to search Balance Sheet Assets: Cash 624 508 Accounts receivable Supplies 24 Total current assets 1,156 Equipment 872 $ 2.028 Total assets Liabilities: Accounts payable Notes payable $ 720 544 X Total liabilities A 1.264 Stockholders' Equity