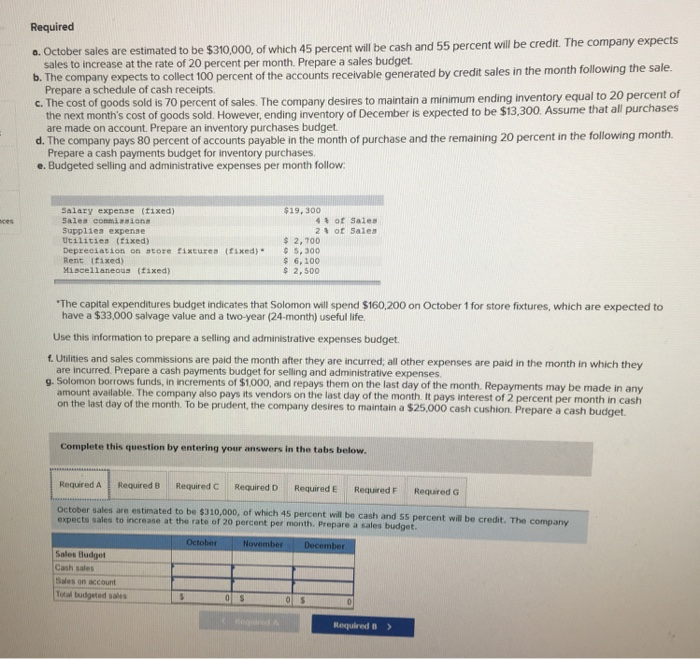

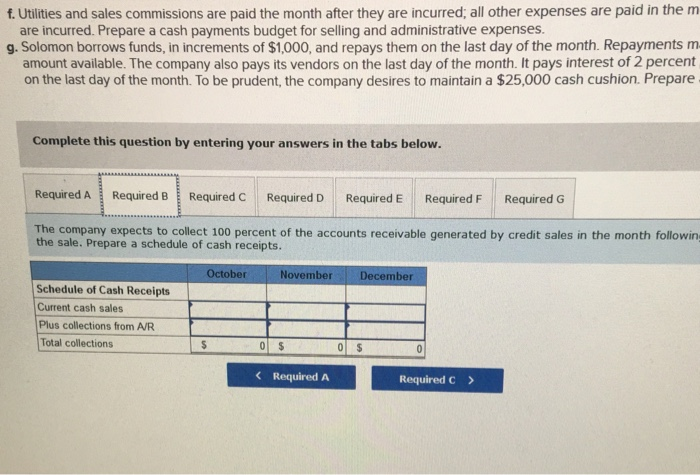

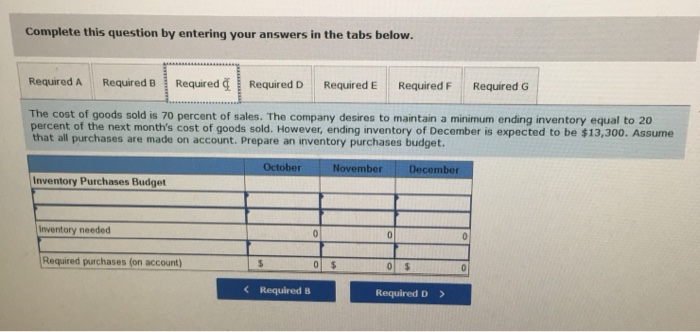

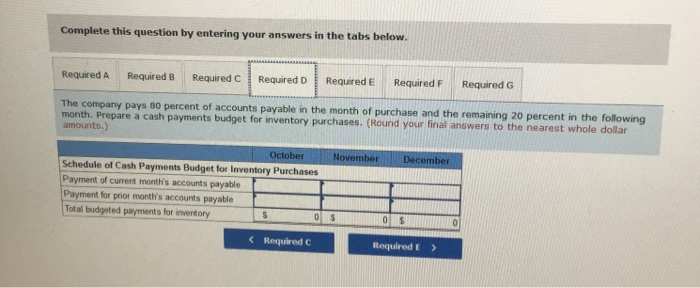

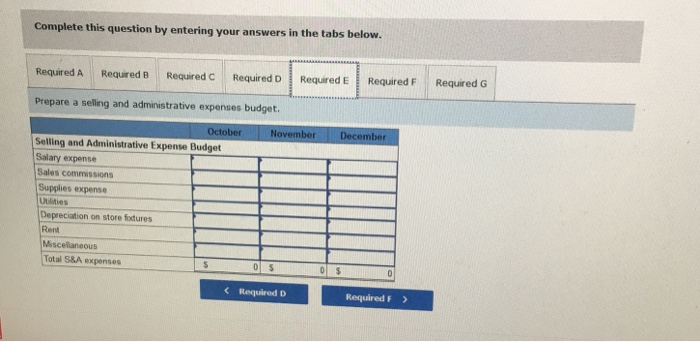

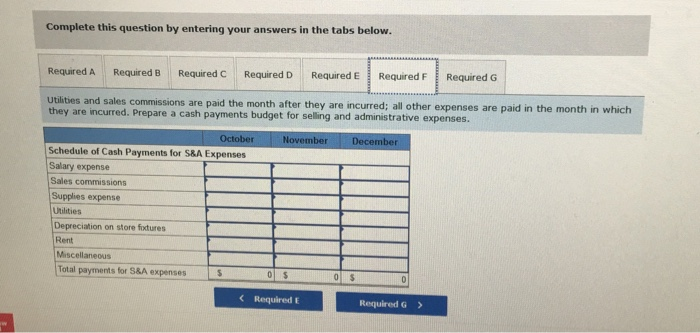

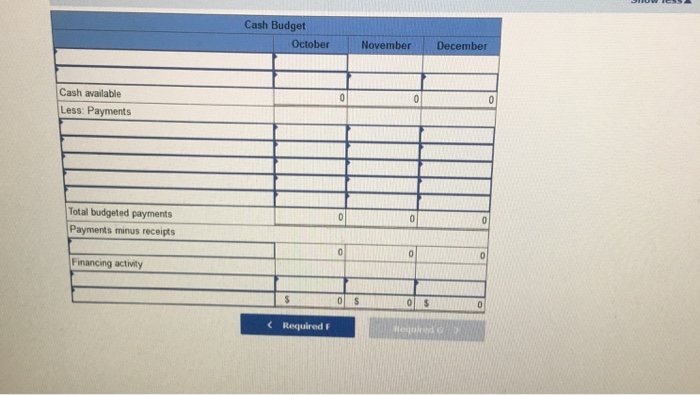

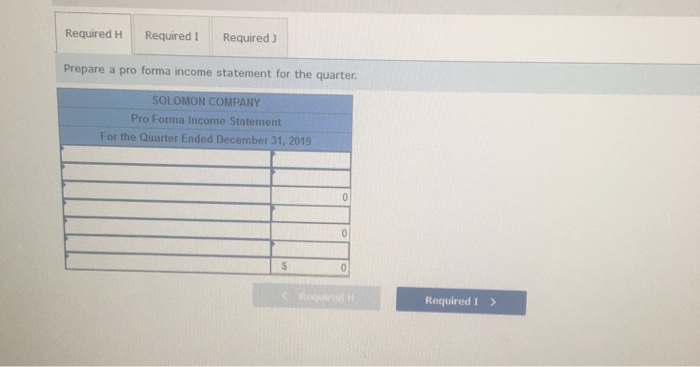

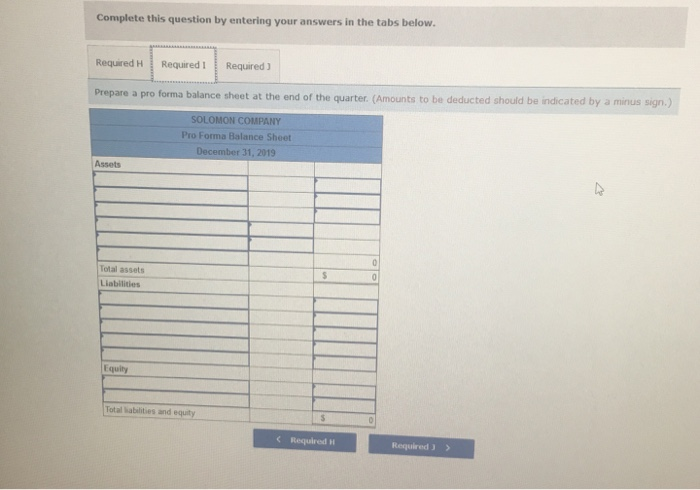

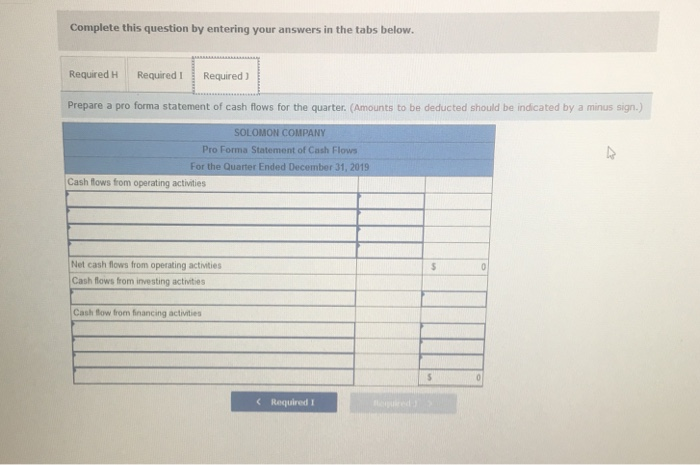

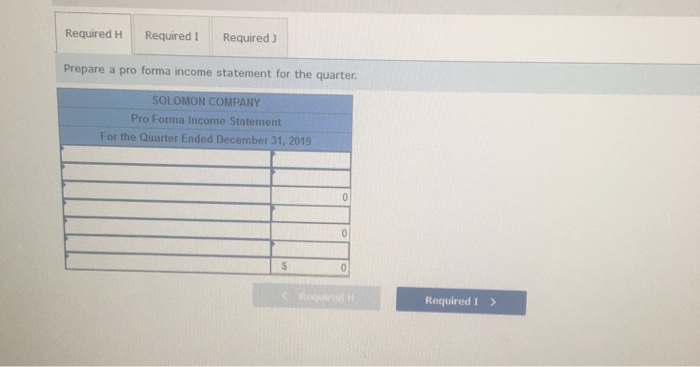

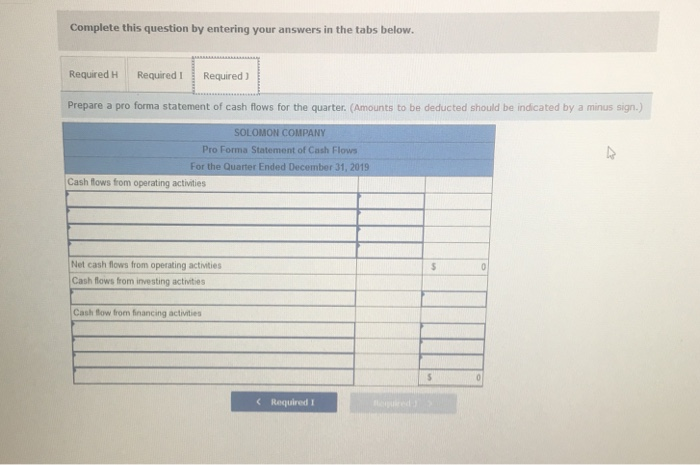

Required a. October sales are estimated to be $310,000, of which 45 percent will be cash and 55 percent will be credit. The company expects b. The company expects to collect 100 percent of the accounts receivable generated by credit sales in the mon c. The cost of goods sold is 70 percent of sales. The company desires to maintain a minimum ending inventory equal to 20 percent of sales to increase at the rate of 20 percent per month. Prepare a sales budget Prepare a schedule of cash receipts the next month's cost of goods sold. However, ending inventory of December is expected to be $13,300. Assume that all purchases th following the sale. are made on account. Prepare an inventory purchases budget d. The company pays 80 percent of accounts payable in the month of purchase and the remaining 20 percent in the following month e. Budgeted selling and administrative expenses per month follow: Prepare a cash payments budget for inventory purchases $19,300 Salary expense (fixed) Salea commiasions Supplies expense Utilities (fixed) Depzeciation on atore fixtures (fsxed)5,300 Rent (fixed) Miscellaneous (fixed) 4t of Sales 2% of Sale s 2,700 6,100 s 2,500 The capital expenditures budget indicates that Solomon will spend $160,200 on October 1 for store fixtures, which are expected to have a $33,000 salvage value and a two-year (24-month) useful life. Use this information to prepare a selling and administrative expenses budget f. Utilities and sales commissions are paid the month after they are incurred, all other expenses are paid in the month in which they g. Solomon borrows funds, in increments of $1000, and repays them on the last day of the month. Repayments may be made in any are incurred. Prepare a cash payments budget for selling and administrative expenses amount available. The company also pays its vendors on the last day of the month. It pays interest of 2 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $25,000 cash cushion. Prepare a cash budget. Complete this question by entering your answers in the tabs below Required ARequired B Required C Required D Required E Required F Requred G sales are estimated to be $310,000, of which 45 percent will be cash and ss percent will be credit. The company ts sales to increase at the rate of 20 percent per month, Prepare a sales budget October October November December Sales Budget Cash salers Sales on account Total budgeted sales Required B >