Question

Required: (A) Prepare a perpetual inventory record for this merchandise, using the last in, first out (LIFO) method of inventory valuation, to determine the businesss

Required:

(A) Prepare a perpetual inventory record for this merchandise, using the last in, first out (LIFO) method of inventory valuation, to determine the businesss cost of goods sold for the quarter and the value of ending inventory. (20 marks)

(B) Given that selling, distribution and administrative costs for the quarter were $77,300, $42,105 and $111,830 respectively, prepare an income statement for One Stop Electrical Shop for the period ended December 31, 2020 (6 marks)

(C) State the journal entries necessary to record the transactions on October 10 and October 31, assuming the company uses a: - Periodic inventory system - Perpetual Inventory System (8 marks)

(D) The owner of the business, Roger Lightfoot, has stated that his objective is to cut back on his tax liability as much as possible and at the same time have his balance sheet looking at its best and is of the view that the LIFO method would be best to achieve both. Do you agree with Roger? Explain your answer clearly distinguishing between the first in, first out (FIFO) and last in, first out (LIFO) methods of inventory valuation, with reference to IAS 2. (6 marks)

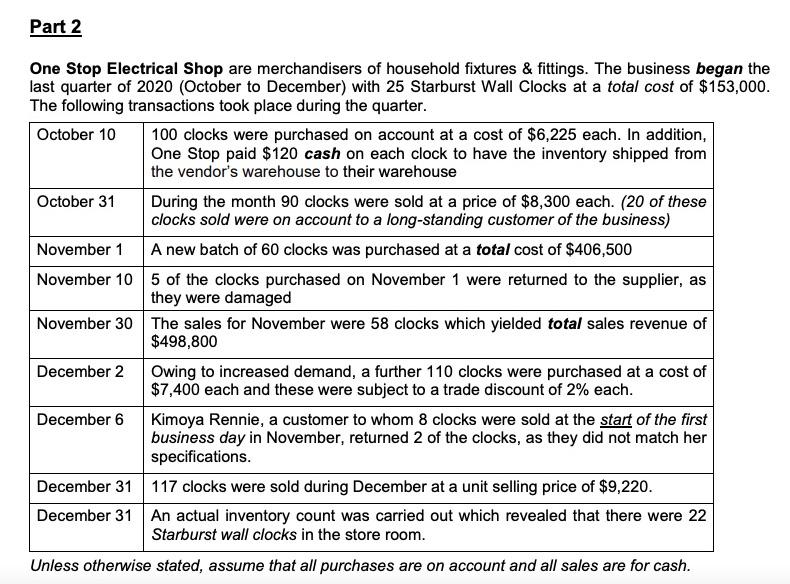

One Stop Electrical Shop are merchandisers of household fixtures \& fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started