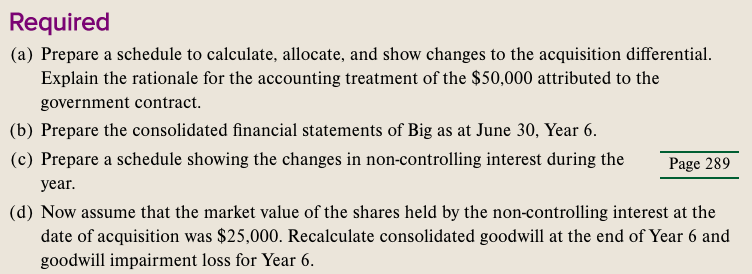

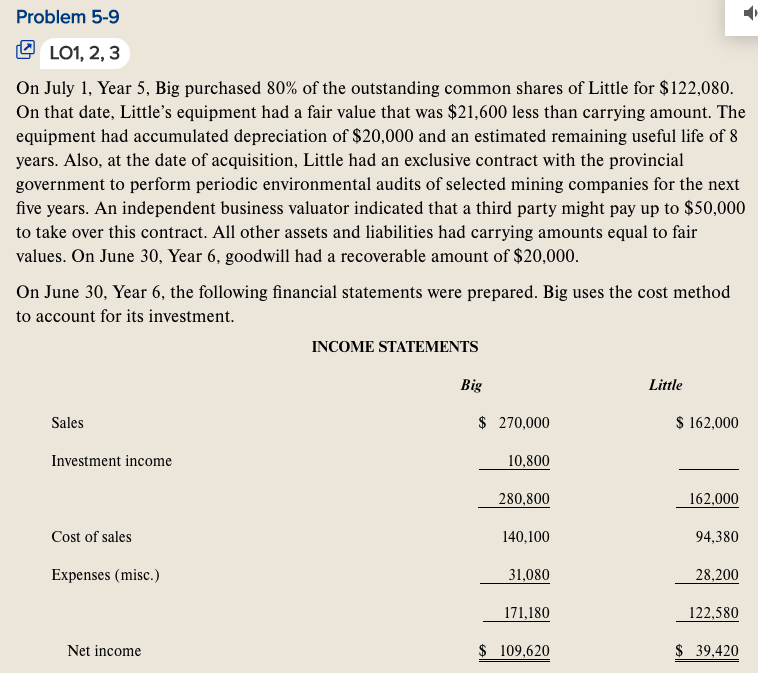

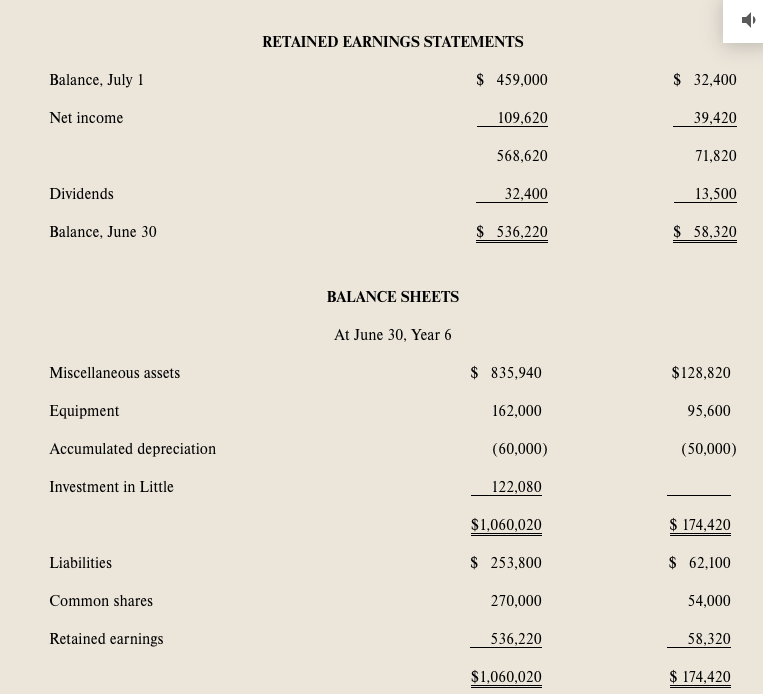

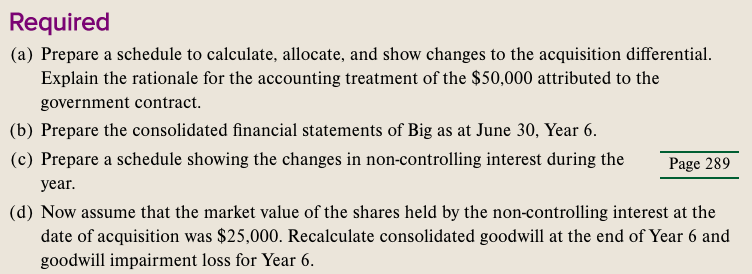

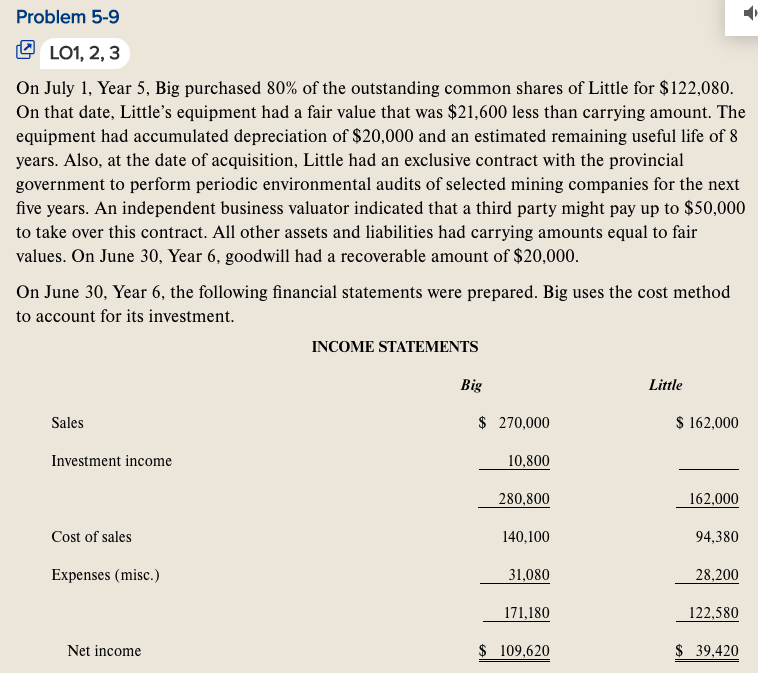

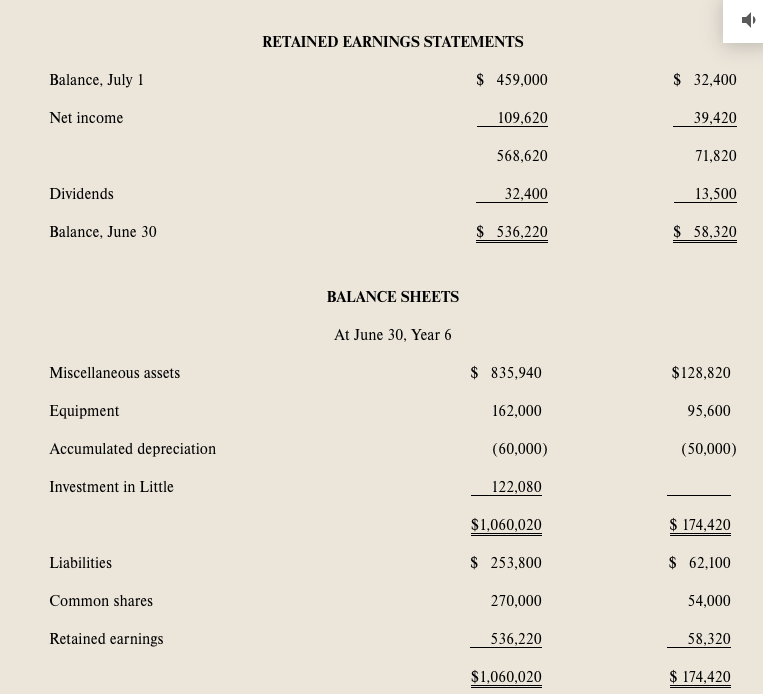

Required (a) Prepare a schedule to calculate, allocate, and show changes to the acquisition differential. Explain the rationale for the accounting treatment of the $50,000 attributed to the government contract. (b) Prepare the consolidated financial statements of Big as at June 30, Year 6. (c) Prepare a schedule showing the changes in non-controlling interest during the Page 289 year. (d) Now assume that the market value of the shares held by the non-controlling interest at the date of acquisition was $25,000. Recalculate consolidated goodwill at the end of Year 6 and goodwill impairment loss for Year 6. Problem 5-9 BLO1, 2, 3 On July 1, Year 5, Big purchased 80% of the outstanding common shares of Little for $122,080. On that date, Little's equipment had a fair value that was $21,600 less than carrying amount. The equipment had accumulated depreciation of $20,000 and an estimated remaining useful life of 8 years. Also, at the date of acquisition, Little had an exclusive contract with the provincial government to perform periodic environmental audits of selected mining companies for the next five years. An independent business valuator indicated that a third party might pay up to $50,000 to take over this contract. All other assets and liabilities had carrying amounts equal to fair values. On June 30, Year 6, goodwill had a recoverable amount of $20,000. On June 30, Year 6, the following financial statements were prepared. Big uses the cost method to account for its investment. INCOME STATEMENTS Big Little Sales $ 270,000 $ 162,000 Investment income 10,800 280,800 162,000 Cost of sales 140,100 94,380 Expenses (misc) 31,080 28,200 171,180 122,580 Net income $ 109,620 $ 39,420 i RETAINED EARNINGS STATEMENTS Balance, July 1 $ 459,000 $ 32,400 Net income 109,620 39,420 568,620 71,820 Dividends 32,400 13,500 Balance, June 30 $ 536,220 58,320 BALANCE SHEETS At June 30, Year 6 Miscellaneous assets $ 835,940 $128,820 Equipment 162,000 95,600 Accumulated depreciation (60,000) (50,000) Investment in Little 122,080 $1,060,020 $ 174,420 Liabilities $ 253,800 $ 62.100 Common shares 270,000 54,000 Retained earnings 536,220 58,320 $1,060,020 $ 174,420 Required (a) Prepare a schedule to calculate, allocate, and show changes to the acquisition differential. Explain the rationale for the accounting treatment of the $50,000 attributed to the government contract. (b) Prepare the consolidated financial statements of Big as at June 30, Year 6. (c) Prepare a schedule showing the changes in non-controlling interest during the Page 289 year. (d) Now assume that the market value of the shares held by the non-controlling interest at the date of acquisition was $25,000. Recalculate consolidated goodwill at the end of Year 6 and goodwill impairment loss for Year 6. Problem 5-9 BLO1, 2, 3 On July 1, Year 5, Big purchased 80% of the outstanding common shares of Little for $122,080. On that date, Little's equipment had a fair value that was $21,600 less than carrying amount. The equipment had accumulated depreciation of $20,000 and an estimated remaining useful life of 8 years. Also, at the date of acquisition, Little had an exclusive contract with the provincial government to perform periodic environmental audits of selected mining companies for the next five years. An independent business valuator indicated that a third party might pay up to $50,000 to take over this contract. All other assets and liabilities had carrying amounts equal to fair values. On June 30, Year 6, goodwill had a recoverable amount of $20,000. On June 30, Year 6, the following financial statements were prepared. Big uses the cost method to account for its investment. INCOME STATEMENTS Big Little Sales $ 270,000 $ 162,000 Investment income 10,800 280,800 162,000 Cost of sales 140,100 94,380 Expenses (misc) 31,080 28,200 171,180 122,580 Net income $ 109,620 $ 39,420 i RETAINED EARNINGS STATEMENTS Balance, July 1 $ 459,000 $ 32,400 Net income 109,620 39,420 568,620 71,820 Dividends 32,400 13,500 Balance, June 30 $ 536,220 58,320 BALANCE SHEETS At June 30, Year 6 Miscellaneous assets $ 835,940 $128,820 Equipment 162,000 95,600 Accumulated depreciation (60,000) (50,000) Investment in Little 122,080 $1,060,020 $ 174,420 Liabilities $ 253,800 $ 62.100 Common shares 270,000 54,000 Retained earnings 536,220 58,320 $1,060,020 $ 174,420