Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: a) Prepare the consolidated statement of financial position for EM group at 31st March b) Explain the nature and accounting treatment of pre-acquisition profits

Required: a) Prepare the consolidated statement of financial position for EM group at 31st March

b) Explain the nature and accounting treatment of pre-acquisition profits

c) Define the term goodwill AND explain, with justification, its treatment in consolidated financial statements under IFRS.

.

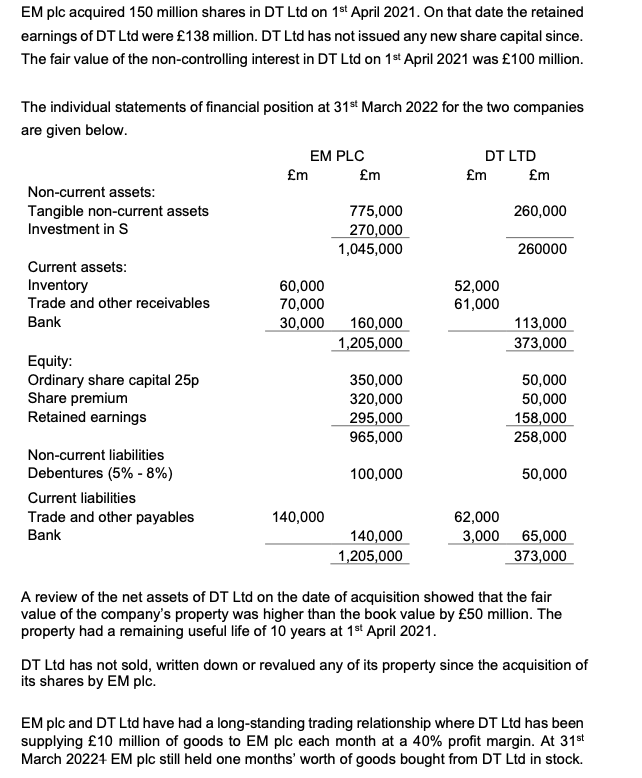

EM plc acquired 150 million shares in DT Ltd on 1st April 2021. On that date the retained earnings of DT Ltd were 138 million. DT Ltd has not issued any new share capital since. The fair value of the non-controlling interest in DT Ltd on 1st April 2021 was 100 million. The individual statements of financial position at 31st March 2022 for the two companies are niven helnu A review of the net assets of DT Ltd on the date of acquisition showed that the fair value of the company's property was higher than the book value by 50 million. The property had a remaining useful life of 10 years at 1st April 2021. DT Ltd has not sold, written down or revalued any of its property since the acquisition of its shares by EM plc. EM plc and DT Ltd have had a long-standing trading relationship where DT Ltd has been supplying 10 million of goods to EM plc each month at a 40% profit margin. At 31st March 20221 EM plc still held one months' worth of goods bought from DT Ltd in stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started