Answered step by step

Verified Expert Solution

Question

1 Approved Answer

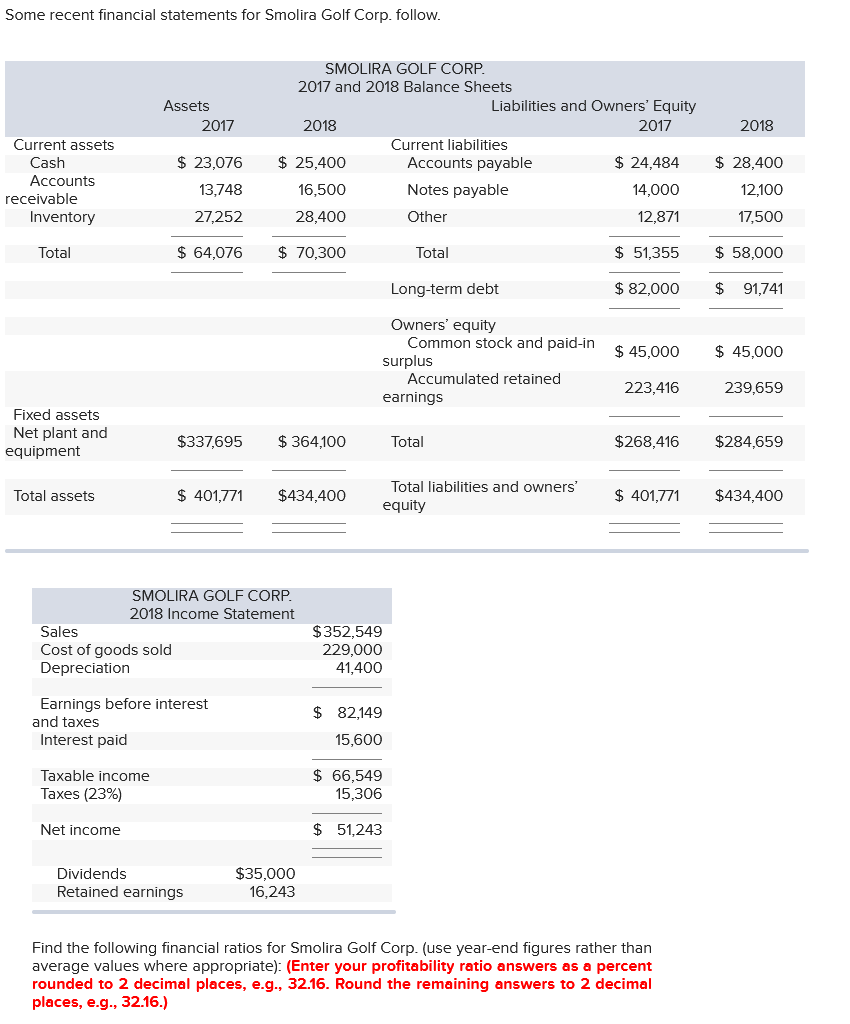

Required: a. Profit Margin % b. Return on Assets % c. Return on Equity % Some recent financial statements for Smolira Golf Corp. follow. Assets

Required:

a. Profit Margin %

b. Return on Assets %

c. Return on Equity %

Some recent financial statements for Smolira Golf Corp. follow. Assets 2017 2018 SMOLIRA GOLF CORP 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2018 2017 Current liabilities $ 25,400 Accounts payable $ 24,484 16,500 Notes payable 14,000 28,400 Other 12,871 $ 23,076 Current assets Cash Accounts receivable Inventory $ 28,400 12.100 13,748 27,252 17,500 Total $ 64,076 $ 70,300 Total $ 51,355 $ 58,000 Long-term debt $ 82,000 $ 91,741 Owners' equity Common stock and paid-in surplus Accumulated retained earnings $ 45,000 $ 45,000 223,416 239,659 Fixed assets Net plant and equipment $337,695 $ 364,100 Total $268,416 $284,659 Total assets $ 401,771 $434,400 Total liabilities and owners' equity $ 401,771 $434,400 SMOLIRA GOLF CORP. 2018 Income Statement Sales Cost of goods sold Depreciation $352,549 229,000 41,400 Earnings before interest and taxes Interest paid $ 82,149 15,600 Taxable income Taxes (23%) $ 66,549 15,306 Net income $ 51,243 Dividends Retained earnings $35,000 16,243 Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate): (Enter your profitability ratio answers as a percent rounded to 2 decimal places, e.g., 32.16. Round the remaining answers to 2 decimal places, e.g., 32.16.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started