Answered step by step

Verified Expert Solution

Question

1 Approved Answer

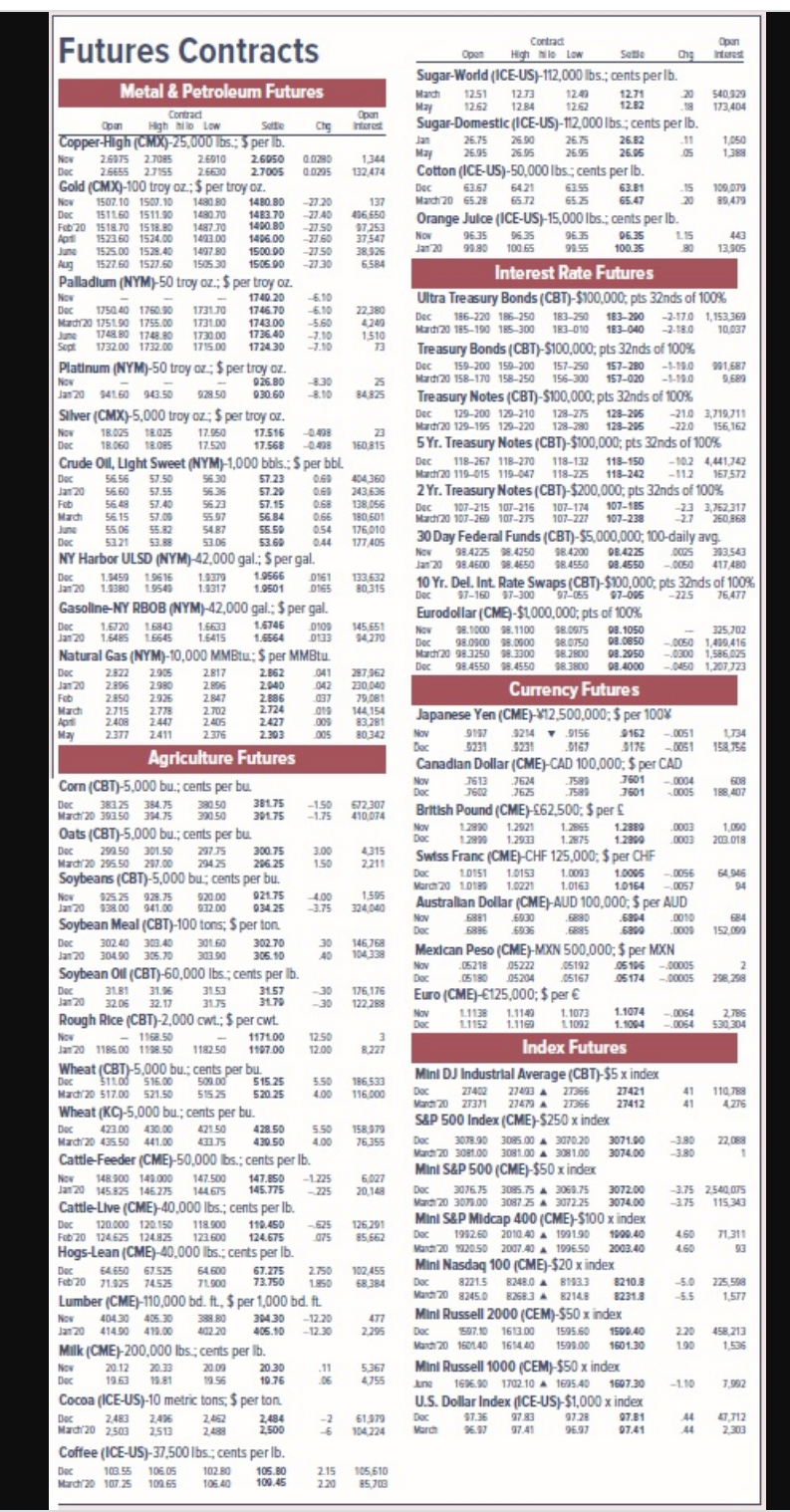

Required: a. Refer to Figure 17.1 and locate the E-Mini contract on the Standard & Poor's 500 Index. If the margin requirement is 15% of

Required: a. Refer to Figure 17.1 and locate the E-Mini contract on the Standard \& Poor's 500 Index. If the margin requirement is 15% of the futures price times the multiplier of $50, how much must you deposit with your broker to buy one December contract? (Do not round intermediate calculations.) b. If the December futures price increases to 3,104 , what percentage return will you earn on your investment? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. If the December futures price falls by 1.2%, what is the percentage gain or loss on your investment? (Input the amount as positive value. Do not round intermediate calculations. Round your answer to 2 decimal places.) Futures Contracts Corn (CBT)-5,000 bu.; cents per bu. DocMrar20Soybeans(CBT)5,000bu;centsperbu.290.50295.50301.50287.00207.75204253007286.25 Soybeans (CBT)-5,000 bu; cents per bu. Navlar20SoybeanMeal(CBT)-100tons;92535138.00928.75941.00920.00932.00921.75034.25 DocJanzoSoybeanOIl(CBT)-60,000lbs;centsperllb.302.6030490303.40305.70301.6030390302.70305.10 DosJan20RoughPice(CBT)-2,000cut.31.8132.05$percott31.9632.1731.5331.7531.573170 Rough Rice (CBT)-2,000 cwt.; $ per cwt. Curency Futures Japanese Yen (CME)- 12,500,000;$ per 100% Cattlefeeder (CME)-50,000 bs.; cents per lb. Mini S\&P 500 (CME)-\$50 x index Lumber (CME)-110,000 bd. ft., $ per 1,000 bd. ft. Milk (CME)-200,000 lbs; cents per lb. DocVartiz0807.101501401613.00164.401595.601590.001502.401601.30 NavDoc20.1219.6320.3312.8120.0010.5620.3010.76.11.065.3674.75MinlRussell1000(CEM)-550indexine1635.90 Cocoa (ICE-US)-10 metric tons, $ per ton. DocMrar20Coffee(ICE-US)-37,500lbs;;centsperlb.2,4832,5032,4962,5132,4522,4832,4842,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started