Answered step by step

Verified Expert Solution

Question

1 Approved Answer

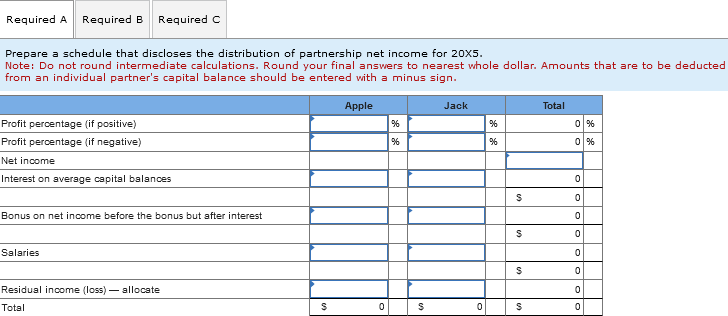

Required A Required B Required C Prepare a schedule that discloses the distribution of partnership net income for 20X5. Note: Do not round intermediate

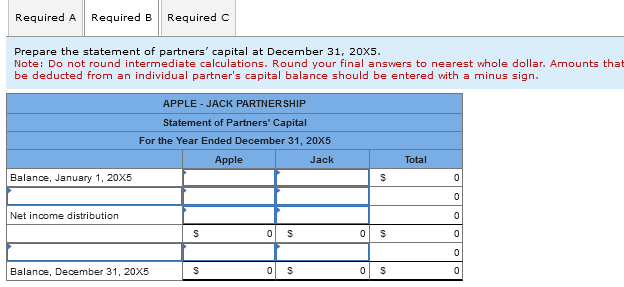

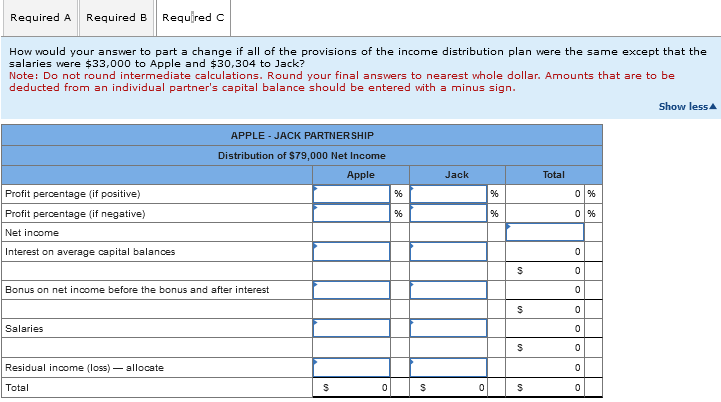

Required A Required B Required C Prepare a schedule that discloses the distribution of partnership net income for 20X5. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. Profit percentage (if positive) Profit percentage (if negative) Net income Interest on average capital balances Bonus on net income before the bonus but after interest Salaries Residual income (loss) - allocate Total Apple Jack Total % % 0% % % 0% 0 S 0 0 S 0 0 S 0 0 0 $ 0 $ 0 Required A Required B Required C Prepare the statement of partners' capital at December 31, 20X5. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that be deducted from an individual partner's capital balance should be entered with a minus sign. APPLE - JACK PARTNERSHIP Statement of Partners' Capital For the Year Ended December 31, 20X5 Apple Jack Total Balance, January 1, 20X5 S 0 0 Net income distribution 0 $ 0 $ 0 S 0 0 Balance, December 31, 20X5 S 0 $ 0 S 0 Required A Required B Required C How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $33,000 to Apple and $30,304 to Jack? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign. Apple Jack Total % % 0% % % 0% Profit percentage (if positive) Profit percentage (if negative) Net income Interest on average capital balances APPLE - JACK PARTNERSHIP Distribution of $79,000 Net Income Bonus on net income before the bonus and after interest Salaries Residual income (loss) - allocate Total 0 $ 0 0 S 0 0 $ 0 0 S S 0 $ 0 Show less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started