Question

Required: (A) Show the new statement of financial position after the following transactions have occurred: (i) New plant purchased for $150K using $30K of cash

Required: (A) Show the new statement of financial position after the following transactions have occurred: (i) New plant purchased for $150K using $30K of cash and $120K of long-term debt. (ii) Inventory purchased for cash $45K (iii) Inventory sold for $40K on credit (use FIFO assumption). (iv) Old equipment valued at $50K written off as obsolete (cash of $5K paid to remove it). (v) Buildings (factory) depreciated by $100K (vi) All services previously treated as deferred revenue delivered satisfactorily (vii) New equity issued for $45K (received in full, in cash) (viii) New short-term debt of $120K raised and invested in technology (purchase of robot) (ix) Robot fails and rebuilt at cost of $30K using cash from bank (x) Robot software causes stoppages and depreciated to new book value of $25K. Extra information: Inventory is valued at cost and there have been no write-downs to market. There were 10 units of inventory in stock at the start of the period (they cost a total of $15K). There were 20 units of inventory purchased this period (at total cost $45K). There were 15 units of inventory sold during the period (for total retail price $40K). (B) Find the net income (accounting profit) for the period. (C) Using just 5 ratios that you choose as most insightful, give a short evaluation of the firms financial state after these transactions relative to the period start. List the ratios and calculations you use and explain your conclusion very briefly. (D) How accurate/objective, do you think, is the firms decision to revalue the robot to $25K. Explain in 3 lines max. (E) If there is inflation, will the FIFO assumption tend to reduce this periods profit or increase it? Why?

Please answer all parts

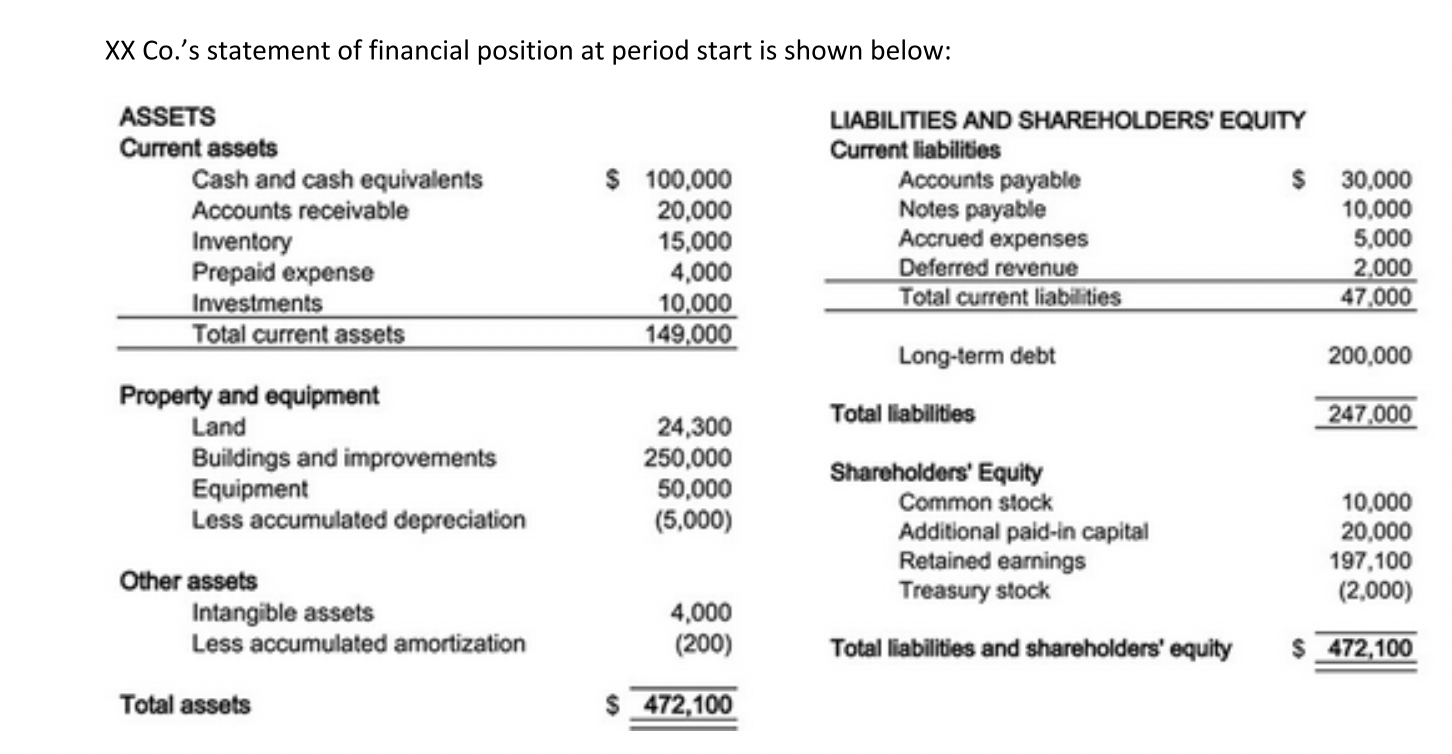

XX Co.'s statement of financial position at period start is shown below: XX Co.'s statement of financial position at period start is shown belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started