Question

Required: A. Take yourself as the assessor of the IRD, express your own opinion whether in this case Professor Wong would be subject to Hong

Required:

A. Take yourself as the assessor of the IRD, express your own opinion whether in this case Professor Wong would be subject to Hong Kong profits tax in respect of her income on the teaching assignment.

B. Take yourself as the tax representative of Professor Wong, express your opinion whether in this case Professor Wong would be subject to Hong Kong profits tax in respect of her income on the teaching assignment.

C Disregarding your answer in (A) and (B) above, assuming that Professor Wong is subject to Hong Kong profits tax, calculate her profits tax liability in respect to her income received from the teaching assignment. It is assumed that the assessor has agreed that 80% of her accommodation and messing expenses incurred in Hong Kong are accepted as business expenses.

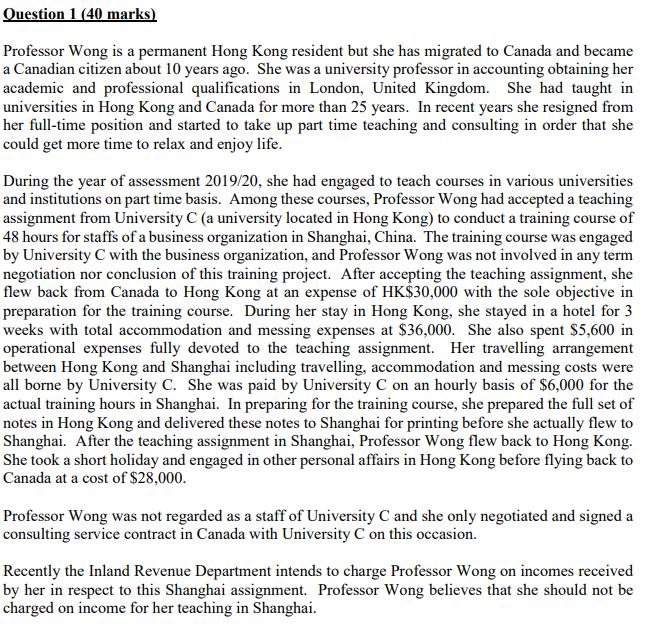

Question 1 (40 marks) Professor Wong is a permanent Hong Kong resident but she has migrated to Canada and became a Canadian citizen about 10 years ago. She was a university professor in accounting obtaining her academic and professional qualifications in London, United Kingdom. She had taught in universities in Hong Kong and Canada for more than 25 years. In recent years she resigned from her full-time position and started to take up part time teaching and consulting in order that she could get more time to relax and enjoy life. During the year of assessment 2019/20, she had engaged to teach courses in various universities and institutions on part time basis. Among these courses, Professor Wong had accepted a teaching assignment from University C (a university located in Hong Kong) to conduct a training course of 48 hours for staffs of a business organization in Shanghai, China. The training course was engaged by University C with the business organization, and Professor Wong was not involved in any term negotiation nor conclusion of this training project. After accepting the teaching assignment, she flew back from Canada to Hong Kong at an expense of HK$30,000 with the sole objective in preparation for the training course. During her stay in Hong Kong, she stayed in a hotel for 3 weeks with total accommodation and messing expenses at $36,000. She also spent $5,600 in operational expenses fully devoted to the teaching assignment. Her travelling arrangement between Hong Kong and Shanghai including travelling, accommodation and messing costs were all borne by University C. She was paid by University C on an hourly basis of $6,000 for the actual training hours in Shanghai. In preparing for the training course, she prepared the full set of notes in Hong Kong and delivered these notes to Shanghai for printing before she actually flew to Shanghai. After the teaching assignment in Shanghai, Professor Wong flew back to Hong Kong. She took a short holiday and engaged in other personal affairs in Hong Kong before flying back to Canada at a cost of $28,000. Professor Wong was not regarded as a staff of University C and she only negotiated and signed a consulting service contract in Canada with University C on this occasion. Recently the Inland Revenue Department intends to charge Professor Wong on incomes received by her in respect to this Shanghai assignment. Professor Wong believes that she should not be charged on income for her teaching in Shanghai.

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Required A Take yourself as the assess or of the IR D and express your own opinion on whether in thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started