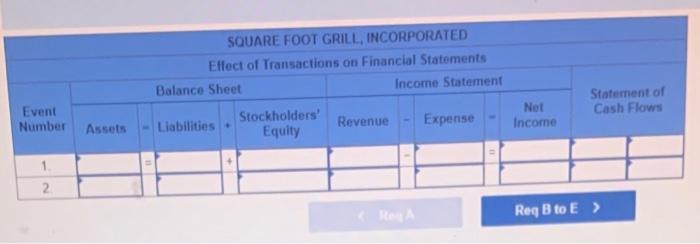

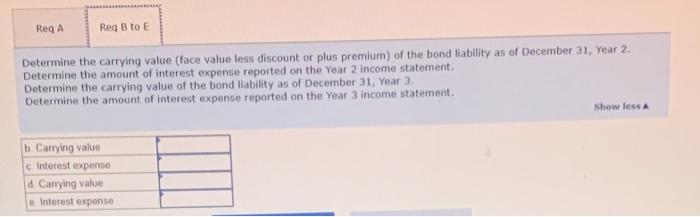

Required a. Use a financial statements model to demonstrate how (1) the January 1, Year 2 , bond istue and (2) the December 31, Year 2. recognition of interest expense, including the amortization of the premium and the cash payment, affects the company's linancial statements. b. Determine the cartying value (face value less discount of plus premium) of the bond liablity as of December 31, Year 2 c. Determine the amount of interest expense reported on the Year 2 income statement d. Determine the carrying value of the bond liability as of December 31, Year 3 e. Determine the amount of interest expense reported on the Year 3 income statement Complete this question by entering your answers in the tabs below. Use a financial statements model to demonstrate how (1) the lanuary 1, Yeal 2, bond issue and (2) the December 31, Year 2, recognition of interest expense, including the amortitation of the premium and the cash payment, affects the company's finandial statemente. investing activity, and Fa for linaneing activily, tot all cells requife ingut. SQUARE FOOT GRILL, INCORPORATED Effect of Transactions on Financial Statements Event Number 1.]= \begin{tabular}{l} Balance Sheet \\ Habilities + Stoc \\ \hline \end{tabular} Income Statement Statement of Cash Flows Equity - Revenue - Expense = Income \begin{tabular}{|l|l|l|l|} \hline \end{tabular} RegB to E> Determine the carrying value (face value less discount of plus premium) of the bond liability as of December 31 , rear 2. Determine the amount of interest expense reported on the Year 2 income statement. Determine the carrying value of the bond liability as of December 31 , Year 3 . Determine the amount of interest expense reported on the Year 3 income statement. Required a. Use a financial statements model to demonstrate how (1) the January 1, Year 2 , bond istue and (2) the December 31, Year 2. recognition of interest expense, including the amortization of the premium and the cash payment, affects the company's linancial statements. b. Determine the cartying value (face value less discount of plus premium) of the bond liablity as of December 31, Year 2 c. Determine the amount of interest expense reported on the Year 2 income statement d. Determine the carrying value of the bond liability as of December 31, Year 3 e. Determine the amount of interest expense reported on the Year 3 income statement Complete this question by entering your answers in the tabs below. Use a financial statements model to demonstrate how (1) the lanuary 1, Yeal 2, bond issue and (2) the December 31, Year 2, recognition of interest expense, including the amortitation of the premium and the cash payment, affects the company's finandial statemente. investing activity, and Fa for linaneing activily, tot all cells requife ingut. SQUARE FOOT GRILL, INCORPORATED Effect of Transactions on Financial Statements Event Number 1.]= \begin{tabular}{l} Balance Sheet \\ Habilities + Stoc \\ \hline \end{tabular} Income Statement Statement of Cash Flows Equity - Revenue - Expense = Income \begin{tabular}{|l|l|l|l|} \hline \end{tabular} RegB to E> Determine the carrying value (face value less discount of plus premium) of the bond liability as of December 31 , rear 2. Determine the amount of interest expense reported on the Year 2 income statement. Determine the carrying value of the bond liability as of December 31 , Year 3 . Determine the amount of interest expense reported on the Year 3 income statement