Question

REQUIRED: (a) Using the information above, you are required to complete the Job Cost sheet to show all the total product costs for Job A;

REQUIRED: (a) Using the information above, you are required to complete the Job Cost sheet to show all the total product costs for Job A; which includes 15 units of paper hats and 10 units of chains. (b) the company CEO, has asked you to help in identifying some other method for allocating overhead in the determination of product cost. Identify at least one other possible way of allocating the overhead and hence RECALCULATE the product cost of the job A (c) You are also required to respond to the following questions: List one advantage and a disadvantage of using direct labor hours as a basis for allocating manufacturing overhead costs. What can you conclude about the product cost of Job A based on the two allocation methods which you have used in (a) and (b) above?

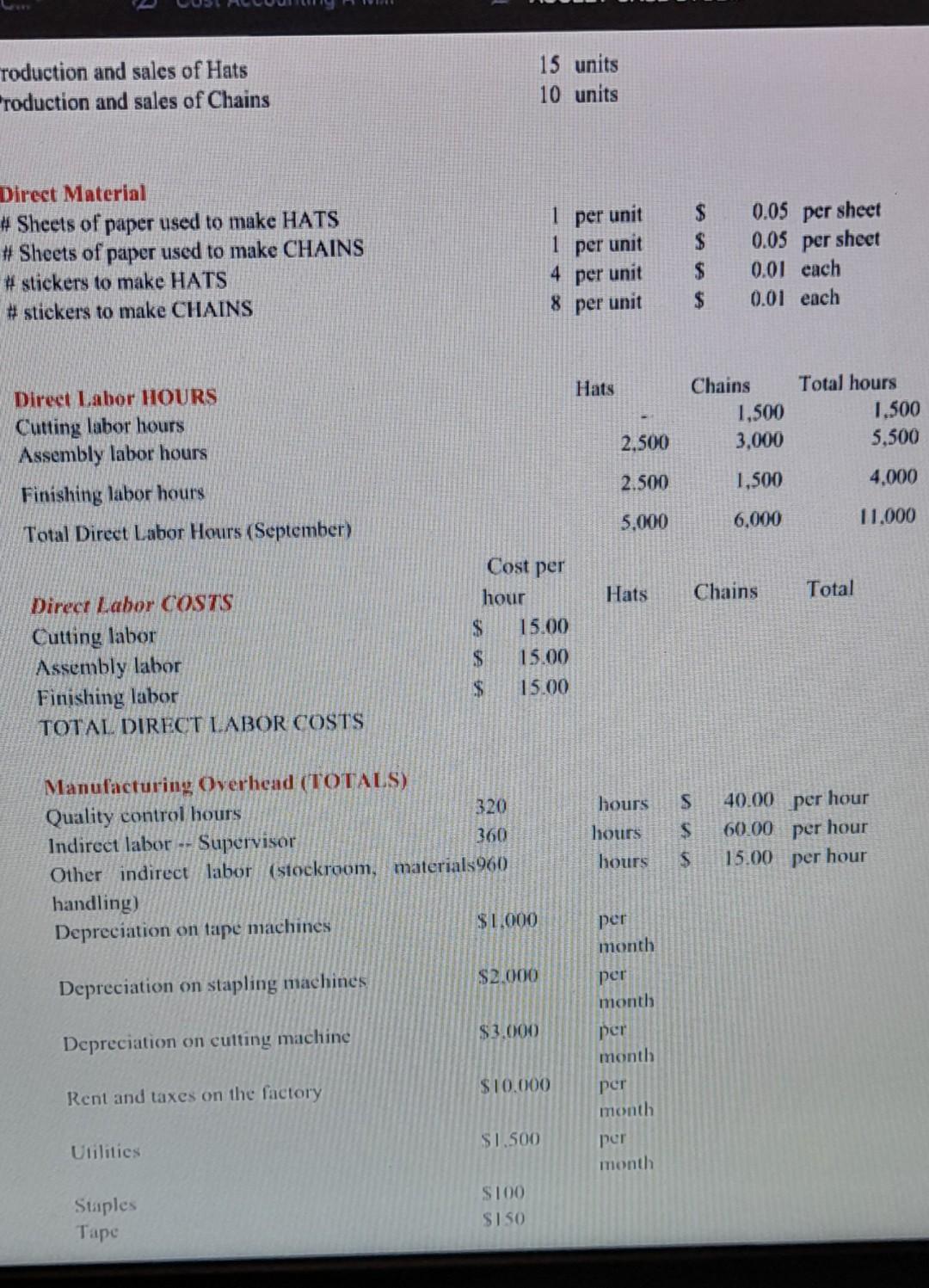

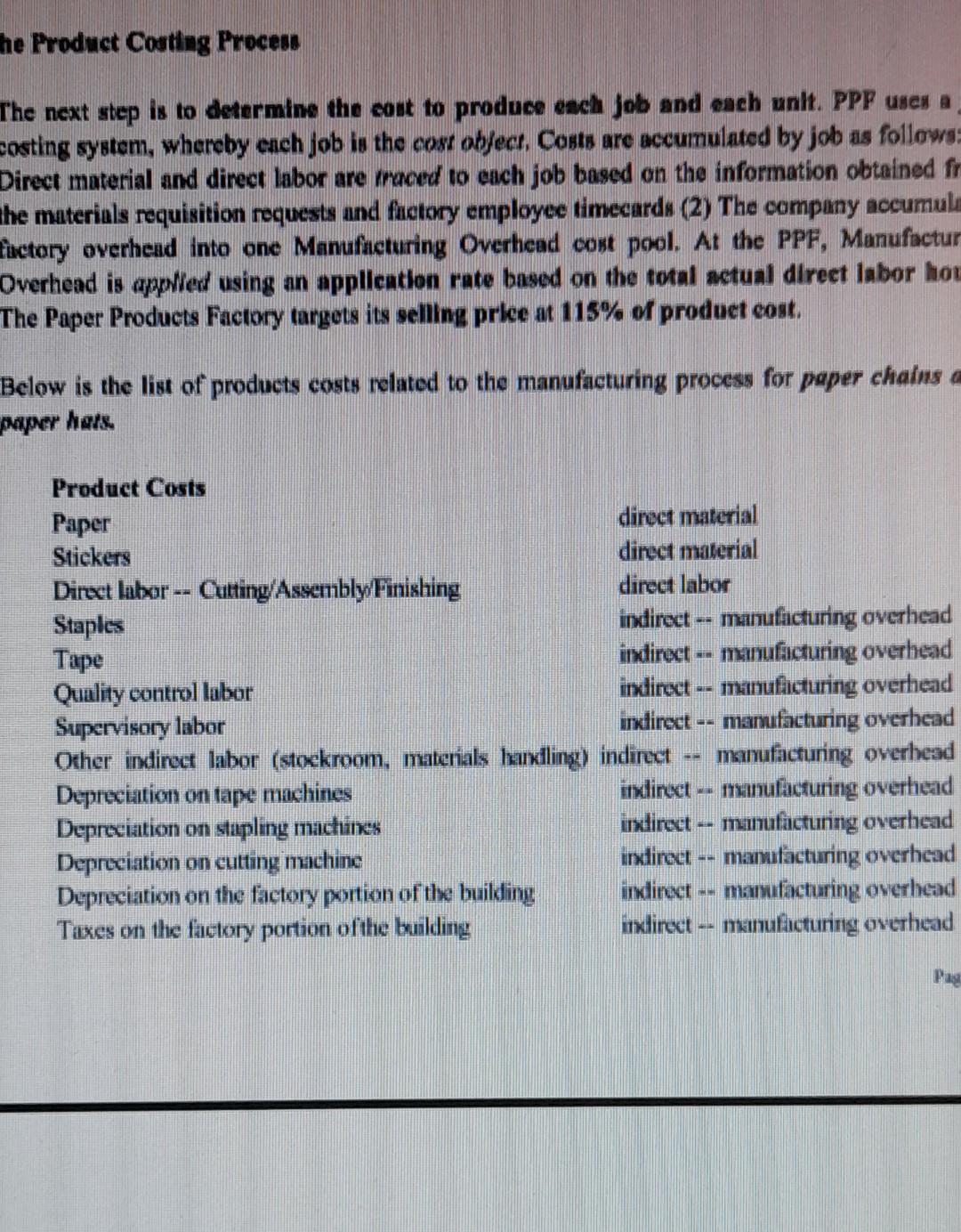

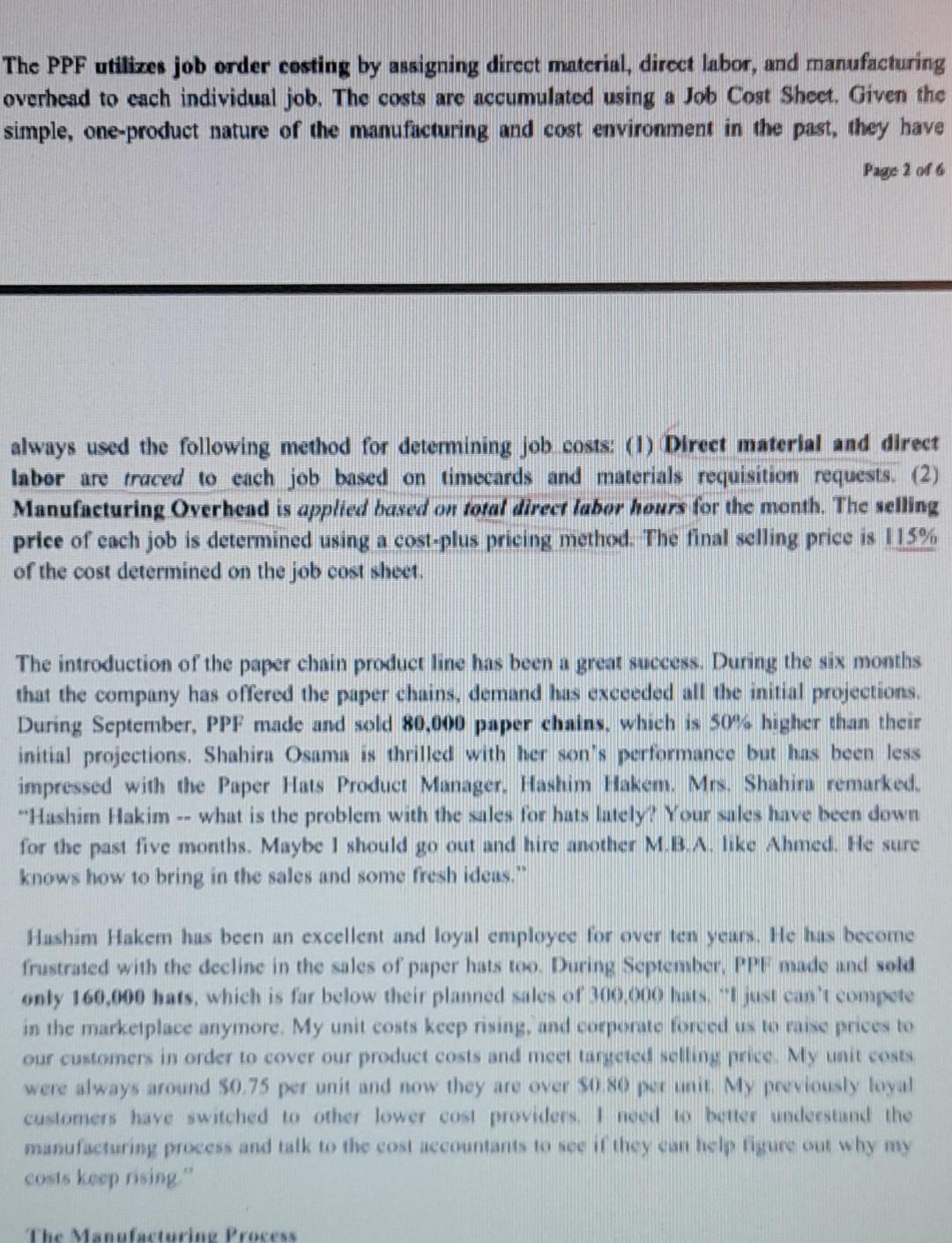

roduction and sales of Hats Production and sales of Chains 15 units 10 units 1 Direct Material # Sheets of paper used to make HATS # Sheets of paper used to make CHAINS #stickers to make HATS # stickers to make CHAINS 1 per unit per unit 4 per unit 8 per unit $ $ $ $ 0.05 per sheet 0.05 per sheet 0.01 each 0.01 each Hats Chains 1,500 3,000 Total hours 1.500 5,500 2.500 Direct Labor HOURS Cutting labor hours Assembly labor hours Finishing labor hours Total Direct Labor Hours (September) 2.500 1,500 4.000 5.000 6,000 11.000 Hats Chains Total Direct Labor COSTS Cutting labor Assembly labor Finishing labor TOTAL DIRECT LABOR COSTS Cost per hour S 15.00 $ 15.00 $ 15.00 s Manufacturing Overhead (TOTALS) Quality control hours 320 Indirect labor -- Supervisor 360 Other indirect labor (stockroom, materials 960 handling) Depreciation on tape machines $1.000 hours hours hours $ $ 40.00 per hour 60.00 per hour 15.00 per hour per month $2.000 Depreciation on stapling machines per month $3.000 Depreciation on cutting machine per month $10.000 Rent and taxes on the factory per month $1.500 per Utilities month S100 Suples Tape SISO he Product Coating Process The next step is to determine the cost to produce each job and each unit. PPP unes a costing system, whereby each job is the cost object, Costs are accumulated by job as follows: Direct material and direct labor are rraced to each job based on the information obtained fr the materials requisition requests and factory employee timecards (2) The company accumula Factory overhead into one Manufacturing Overhead cost pool. At the PPF, Manufactur Overhead is appried using an application rate based on the total actual direct labor hou The Paper Products Factory targets its selling price at 115% of product cost. Below is the list of products costs related to the manufacturing process for paper chains paper hars. Product Costs Paper direct material Stickers direct material Dinxt labor -- Cutting/Assembly Finishing direct labor Staples indirect -- manufacturing overhead Tape indirect -- manufacturing overhead Quality control labor indirect -- manufacturing overhead Supervisory labor Indirect -- manufacturing overhead Other indirect labor (stockroom, materials luxdling) indirect manufacturing overhead Depreciation on tape machines indirect - manufacturing overhead Depreciation on stapling machines inxdirect -- minufacturing overhead Depreciation on cutting machine indirect -- manufacturing overhead Depreciation on the factory portion of the building indirect -- manufacturing overhead Taxes on the factory portion ofthe building indirect -- minufacturing overhead W Pass The PPF utilizes job order costing by assigning direct material, direct labor, and manufacturing overhead to each individual job. The costs are accumulated using a Job Cost Shect. Given the simple, one-product nature of the manufacturing and cost environment in the past, they have Page 2 of 6 always used the following method for determining Job costs: (1) Direct material and direct labor are traced to each job based on timecards and materials requisition requests. (2) Manufacturing Overhend is applied based on total direct labor hours for the month. The selling price of each job is determined using a cost-plus prieing method. The final selling price is 115% of the cost determined on the job cost sheet. The introduction of the paper chain product line has been a great success. During the six months that the company has offered the paper chains, demand has exceeded all the initial projections. During September, PPF made and sold 80.000 paper chains, which is $0% higher than their initial projections, Shahirn Osama is thrilled with her son's performance but has been less impressed with the Paper Hats Product Manager. Hashim Hakem. Mr. Shahir remarked, "Hashim Hakim -- what is the problem with the sales for bats lately? Your sales have been down for the past five months. Maybe I should go out and hire another MB A, like Ahmed. He sure knows how to bring in the sales and some fresh ideas, Hashim Hakem has been an excellent and loyal employee for over ten years. He has become frustrated with the decline in the sales of paper hats too. During September, PPE made and sold only 160,000 hats, which is for below their planned sales of 100.000 bets just can't compete in the marketplace anymore. My unit costs keep rising, and corporate forced us to raise prices to our customers in order to cover our product costs and meet taructed selling price. My unit costs were always around $0.75 per unit and now they are over So no puc unit My previously loyal customers have switched to other lower cost providers. I need to better understand the manufacturing process and talk to the cost accountants to see if they can help figure out why my costs keep nising." The Manufacturing Process roduction and sales of Hats Production and sales of Chains 15 units 10 units 1 Direct Material # Sheets of paper used to make HATS # Sheets of paper used to make CHAINS #stickers to make HATS # stickers to make CHAINS 1 per unit per unit 4 per unit 8 per unit $ $ $ $ 0.05 per sheet 0.05 per sheet 0.01 each 0.01 each Hats Chains 1,500 3,000 Total hours 1.500 5,500 2.500 Direct Labor HOURS Cutting labor hours Assembly labor hours Finishing labor hours Total Direct Labor Hours (September) 2.500 1,500 4.000 5.000 6,000 11.000 Hats Chains Total Direct Labor COSTS Cutting labor Assembly labor Finishing labor TOTAL DIRECT LABOR COSTS Cost per hour S 15.00 $ 15.00 $ 15.00 s Manufacturing Overhead (TOTALS) Quality control hours 320 Indirect labor -- Supervisor 360 Other indirect labor (stockroom, materials 960 handling) Depreciation on tape machines $1.000 hours hours hours $ $ 40.00 per hour 60.00 per hour 15.00 per hour per month $2.000 Depreciation on stapling machines per month $3.000 Depreciation on cutting machine per month $10.000 Rent and taxes on the factory per month $1.500 per Utilities month S100 Suples Tape SISO he Product Coating Process The next step is to determine the cost to produce each job and each unit. PPP unes a costing system, whereby each job is the cost object, Costs are accumulated by job as follows: Direct material and direct labor are rraced to each job based on the information obtained fr the materials requisition requests and factory employee timecards (2) The company accumula Factory overhead into one Manufacturing Overhead cost pool. At the PPF, Manufactur Overhead is appried using an application rate based on the total actual direct labor hou The Paper Products Factory targets its selling price at 115% of product cost. Below is the list of products costs related to the manufacturing process for paper chains paper hars. Product Costs Paper direct material Stickers direct material Dinxt labor -- Cutting/Assembly Finishing direct labor Staples indirect -- manufacturing overhead Tape indirect -- manufacturing overhead Quality control labor indirect -- manufacturing overhead Supervisory labor Indirect -- manufacturing overhead Other indirect labor (stockroom, materials luxdling) indirect manufacturing overhead Depreciation on tape machines indirect - manufacturing overhead Depreciation on stapling machines inxdirect -- minufacturing overhead Depreciation on cutting machine indirect -- manufacturing overhead Depreciation on the factory portion of the building indirect -- manufacturing overhead Taxes on the factory portion ofthe building indirect -- minufacturing overhead W Pass The PPF utilizes job order costing by assigning direct material, direct labor, and manufacturing overhead to each individual job. The costs are accumulated using a Job Cost Shect. Given the simple, one-product nature of the manufacturing and cost environment in the past, they have Page 2 of 6 always used the following method for determining Job costs: (1) Direct material and direct labor are traced to each job based on timecards and materials requisition requests. (2) Manufacturing Overhend is applied based on total direct labor hours for the month. The selling price of each job is determined using a cost-plus prieing method. The final selling price is 115% of the cost determined on the job cost sheet. The introduction of the paper chain product line has been a great success. During the six months that the company has offered the paper chains, demand has exceeded all the initial projections. During September, PPF made and sold 80.000 paper chains, which is $0% higher than their initial projections, Shahirn Osama is thrilled with her son's performance but has been less impressed with the Paper Hats Product Manager. Hashim Hakem. Mr. Shahir remarked, "Hashim Hakim -- what is the problem with the sales for bats lately? Your sales have been down for the past five months. Maybe I should go out and hire another MB A, like Ahmed. He sure knows how to bring in the sales and some fresh ideas, Hashim Hakem has been an excellent and loyal employee for over ten years. He has become frustrated with the decline in the sales of paper hats too. During September, PPE made and sold only 160,000 hats, which is for below their planned sales of 100.000 bets just can't compete in the marketplace anymore. My unit costs keep rising, and corporate forced us to raise prices to our customers in order to cover our product costs and meet taructed selling price. My unit costs were always around $0.75 per unit and now they are over So no puc unit My previously loyal customers have switched to other lower cost providers. I need to better understand the manufacturing process and talk to the cost accountants to see if they can help figure out why my costs keep nising." The Manufacturing ProcessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started