Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: (a)Prepare a statement showing the overhead cost budgeted for each department, showing the basis of apportionment used. (b)Calculate suitable overhead absorption rates. A furniture-making

Required:

(a)Prepare a statement showing the overhead cost budgeted for each department, showing the basis of apportionment used.

(b)Calculate suitable overhead absorption rates.

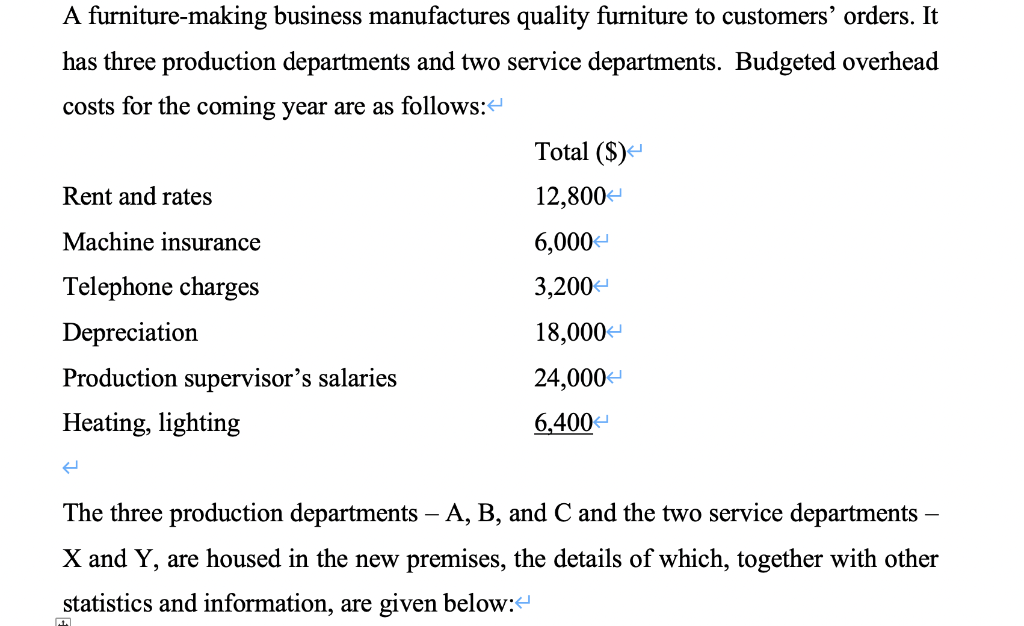

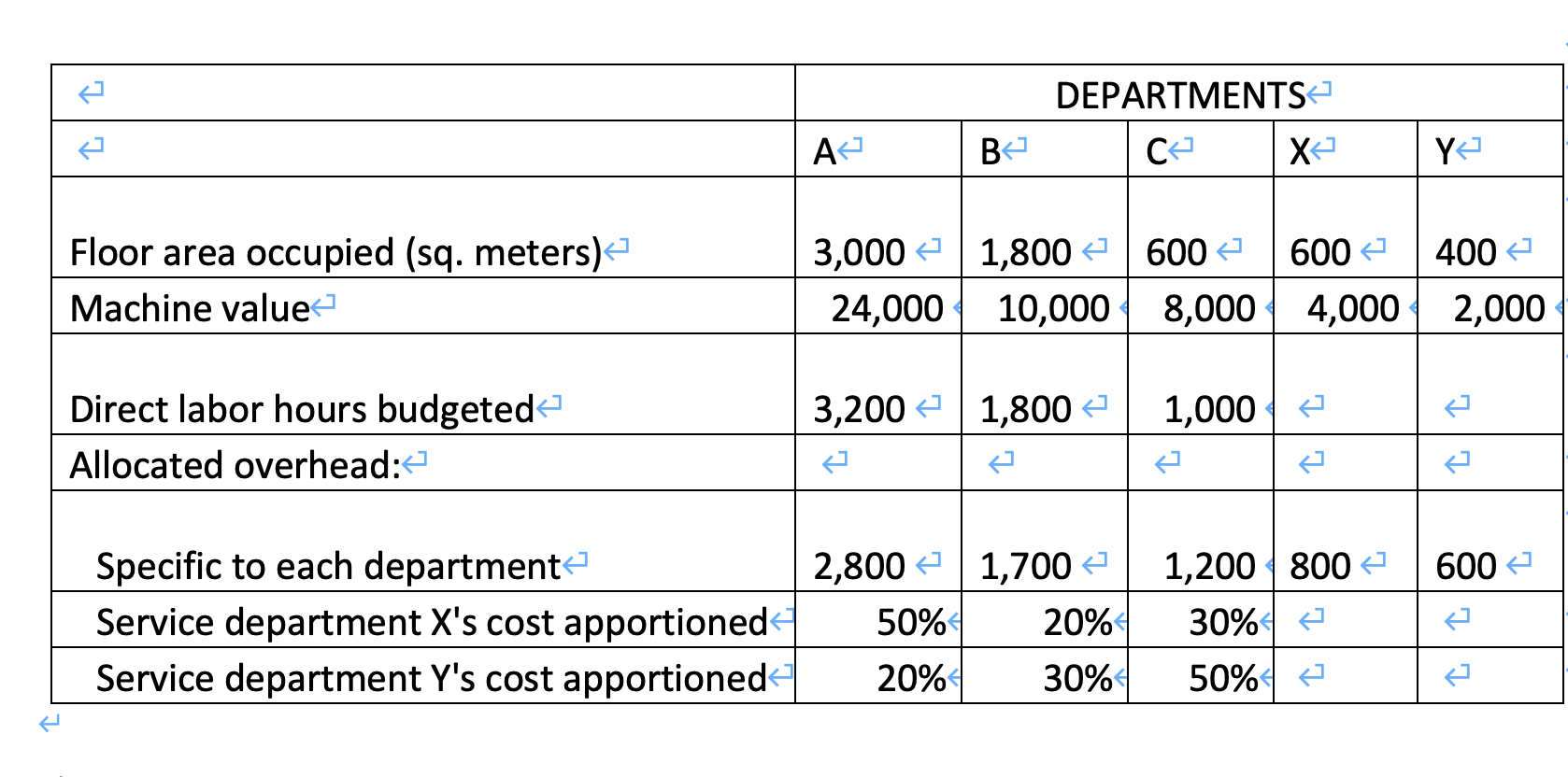

A furniture-making business manufactures quality furniture to customers' orders. It has three production departments and two service departments. Budgeted overhead costs for the coming year are as follows: The three production departments A,B, and C and the two service departments X and Y, are housed in the new premises, the details of which, together with other statistics and information, are given below: \begin{tabular}{|l|r|r|r|l|l|} \hline & \multicolumn{5}{|c|}{ DEPARTMENTS } \\ \hline & \multicolumn{1}{|c|}{ A } & B & C & X & Y \\ \hline Floor area occupied (sq. meters) & 3,000 & 1,800 & 600 & 600 & 400 \\ \hline Machine value & 24,000 & 10,000 & 8,000 & 4,000 & 2,000 \\ \hline Direct labor hours budgeted & 3,200 & 1,800 & 1,000 & & \\ \hline Allocated overhead: & & & & & \\ \hline Specific to each department & & & & & \\ \hline Service department X 's cost apportioned & 50% & 20% & 30% & & \\ \hline Service department Y's cost apportioned & 20% & 30% & 50% & & \\ \hline \end{tabular} A furniture-making business manufactures quality furniture to customers' orders. It has three production departments and two service departments. Budgeted overhead costs for the coming year are as follows: The three production departments A,B, and C and the two service departments X and Y, are housed in the new premises, the details of which, together with other statistics and information, are given below: \begin{tabular}{|l|r|r|r|l|l|} \hline & \multicolumn{5}{|c|}{ DEPARTMENTS } \\ \hline & \multicolumn{1}{|c|}{ A } & B & C & X & Y \\ \hline Floor area occupied (sq. meters) & 3,000 & 1,800 & 600 & 600 & 400 \\ \hline Machine value & 24,000 & 10,000 & 8,000 & 4,000 & 2,000 \\ \hline Direct labor hours budgeted & 3,200 & 1,800 & 1,000 & & \\ \hline Allocated overhead: & & & & & \\ \hline Specific to each department & & & & & \\ \hline Service department X 's cost apportioned & 50% & 20% & 30% & & \\ \hline Service department Y's cost apportioned & 20% & 30% & 50% & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started