Question

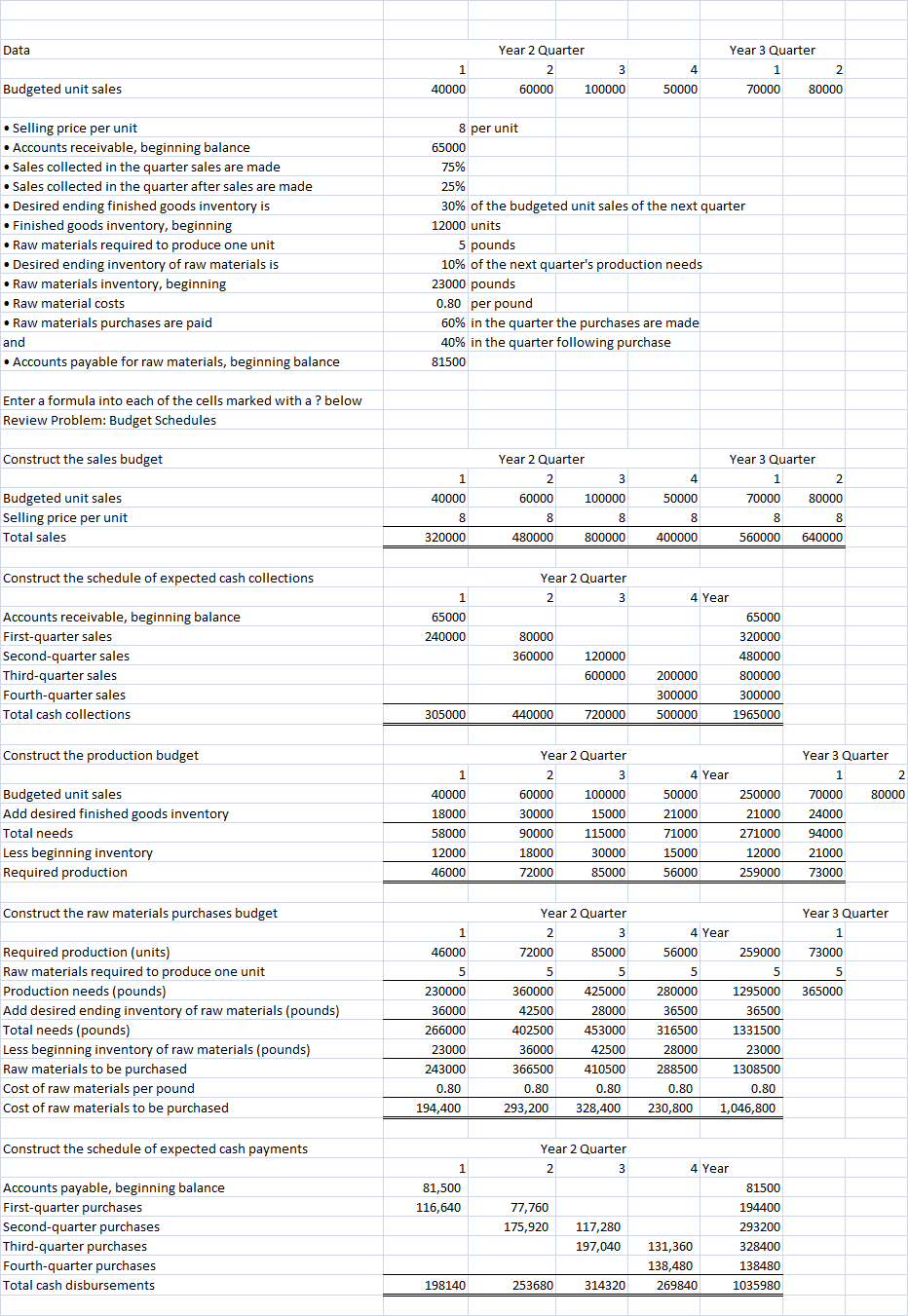

Required: ** Based off the spreadsheet please answer the following questions** 1.Check your worksheet by changing the budgeted unit sales in Quarter 2 of Year

Required: ** Based off the spreadsheet please answer the following questions**

1.Check your worksheet by changing the budgeted unit sales in Quarter 2 of Year 2 in cell C5 to 75,000 units. The total expected cash collections for the year should now be $2,085,000. If you do not get this answer, find the errors in your worksheet and correct them. Have the total cash disbursements for the year changed? Why or why not?

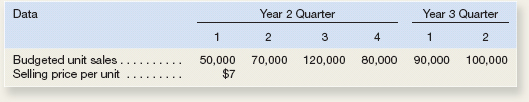

2.The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget:

a. What are the total expected cash collections for the year under this revised budget?

b. What is the total required production for the year under this revised budget?

c. What is the total cost of raw materials to be purchased for the year under this revised budget?

d. What are the total expected cash disbursements for raw materials for the year under this revised budget?

e. After seeing this revised budget, the production manager cautioned that due to the limited availability of a complex milling machine, the plant can produce no more than 90,000 units in any one quarter. Is this a potential problem? If so, what can be done about it?

Year 2 Budgeted unit sales 100000 Selling price per unit Accounts receivable, beginning balance .Sales collected in the quarter sales are made .Sales collected in the quarter after sales are made 30% of the budgeted unit sales of the next quarter Desired ending finished goods inventory is e Finished goods inventory, beginning . Raw materials required to produce one unit 10% of the next quarter's production needs 23000 pounds Desired ending inventory of raw materials is . Raw materials inventory, beginning e Raw material costs . Raw materials purchases are paid 60% in the quarter the purchases are made 40% in the quarter following purchase Accounts payable for raw materials, beginning balance 81500 Enter a formula into each of the cells marked with a? below Review Problem: Budget Schedules Construct the sales budget Year 1 2 Budgeted unit sales Selling price per unit Total sales 100000 560000 640000 Construct the schedule of expected cash collections 2 4 Year Accounts receivable, beginning balance First-quarter sales Second-quarter sales Third-quarter sales Fourth-quarter sales Total cash collections 600000200000 1965000 Construct the production budget 4 Year Budgeted unit sales Add desired finished goods invento 100000 25000070000 21000 24000 271000 94000 12000 21000 259000 73000 80000 18000 30000 21000 71000 Less beginning invento Required production 18000 30000 Construct the raw materials purchases budget 2 4 Year Required production (units) Raw materials required to produce one unit Production needs (pounds) Add desired ending inventory of raw materials (pounds) Total needs (pounds) Less beginning inventory of raw materials (pounds) Raw materials to be purchased Cost of raw materials per pound Cost of raw materials to be purchased 425000 1295000 365000 36000 266000 23000 243000 36500 1331500 23000 316500 28000 402500 453000 410500 194,400 293,200 328,400 230,800 1,046,800 Construct the schedule of expected cash payments 4 Year 81,500 116,640 Accounts payable, beginning balance First-quarter purchases Second-quarter purchases Third-quarter purchases Fourth-quarter purchases Total cash disbursements 81500 175,920 117,280 293200 197,040131,360 138,480 198140 253680 314320 269840 1035980Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started