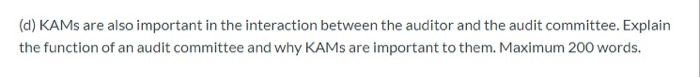

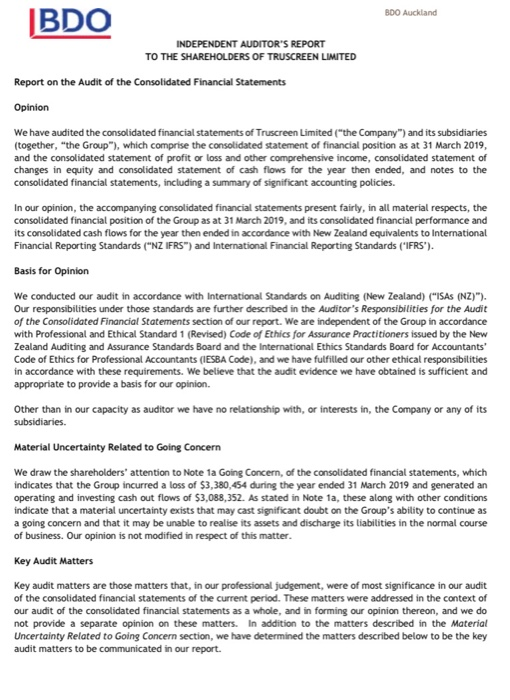

Required: (c) The Truscreen audit report also includes Key Audit Matters (KAMs). In what way do KAMs add value to the audit report? Explain why the KAM headed "Impairment assessment of definite life intangible assets" is included. Maximum 200 words. (d) KAMs are also important in the interaction between the auditor and the audit committee. Explain the function of an audit committee and why KAMs are important to them. Maximum 200 words. IBDO BDO Auckland INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF TRUSCREEN LIMITED Report on the Audit of the Consolidated Financial Statements Opinion We have audited the consolidated financial statements of Truscreen Limited ("the Company") and its subsidiaries (together, the Group"), which comprise the consolidated statement of financial position as at 31 March 2019, and the consolidated statement of profit or loss and other comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at 31 March 2019, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with New Zealand equivalents to International Financial Reporting Standards ("NZ IFRS) and International Financial Reporting Standards ("IFRS'). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (New Zealand) ("ISAS (NZ)"). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with Professional and Ethical Standard 1 (Revised) Code of Ethics for Assurance Practitioners issued by the New Zealand Auditing and Assurance Standards Board and the International Ethics Standards Board for Accountants' Code of Ethics for Professional Accountants (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other than in our capacity as auditor we have no relationship with, or interests in the Company or any of its subsidiaries. Material Uncertainty Related to Going Concern We draw the shareholders' attention to Note la Going Concern, of the consolidated financial statements, which indicates that the Group incurred a loss of $3,380,454 during the year ended 31 March 2019 and generated an operating and investing cash out flows of $3,088,352. As stated in Note ta, these along with other conditions indicate that a material uncertainty exists that may cast significant doubt on the Group's ability to continue as a going concern and that it may be unable to realise its assets and discharge its liabilities in the normal course of business. Our opinion is not modified in respect of this matter. Key Audit Matters Key audit matters are those matters that, in our professional judgement were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. In addition to the matters described in the Material Uncertainty Related to Going Concern section, we have determined the matters described below to be the key audit matters to be communicated in our report. BDO Auckland IBDO Key Audit Matter How The Matter Was Addressed in Our Audit NZ IFRS 15 - Revenue from Contracts with Customers As disclosed in Note 1, the Group has adopted NZ IFRS 15 We reviewed management's assessment of the Revenue from Contracts with Customers ("NZ IFRS 15") in application of NZ IFRS 15 as it related to the Zimbabwe the year ended 31 March 2019. The adoption of NZ IFRS 15 transaction. This included: is significant to the financial statements, due to the judgement required by the Directors in assessing whether - Assessing whether, at the time the sale was made, it transactions meet the criteria for recognition under NZ was probable that the consideration would be collected. IFRS 15. Obtaining an understanding of the sequence of events On the 20th of September 2018, the Group invoiced leading to the sale. $425,107 of goods to a customer in Zimbabwe on 45 day terms. At the date the invoice was raised, Zimbabwe, and Inspecting information that management sed its therefore the customer, faced a number of economic assessment of the probability of collection. foreign currency creditors as a result of US dollar Currency Researching Zimbabwe's economic environment and restrictions. the potential impact that the shortage of foreign currency might have on the repayment of the amount It was determined that the transaction did not meet NZ due. This included consultation with our network firm in IFRS 15 recognition criteria, as at the time of invoicing it Zimbabwe. was not probable that the Group would be able to collect the consideration to which it was entitled. - Reviewing correspondence between the Group and the purchaser in relation to the sale. The Group received payments of $110,166 from the customer before reporting date, which have been recognised as revenue. The balance of $314,941 has not been recognised in the financial statements. BDO Auckland IBDO Key Audit Matter Impairment assessment of definite life intangible assets How The Matter Was Addressed in Our Audit Intangible Assets have a carrying value of $8,261,063 are To assess whether the Group should recognise any material and significant to the financial position of the impairment to the intangible assets we: Group. The carrying value of this balance is considered to be a key audit matter due to the judgements involved in. Confirmed the methodologies adopted in the models assessing the recoverable value during impairment testing were consistent with accepted valuation under NZ IAS 36 Impairment of Assets (NZ IAS 36'). approaches. To derive recoverable value, the Directors have undertaken. Tested the calculations within the valuation models an impairment review which considers valuation models and evaluated the resulting valuation estimates. developed by management and their expert. The impairment review, prepared under NZ IAS 36 considered. Challenged the reasonableness of the assumptions both a discounted free cash flow and a revenue exit underpinning the revenue and net cash flow multiple valuation. The models, and the resulting valuation projections included in the valuation models. We estimates, are inherently subjective. agreed the basis for assumptions to external sources The determination of recoverable amount under NZ IAS 36 of information where available. requires the use of judgements and estimates when. Engaged Auditor's Experts to assess the valuation formulating assumptions underpinning forecast cashflow. methodologies and to evaluate the reasonableness of key inputs. Achievement of revenue and net cash flow projections, and the reliability of the valuation estimates, are dependent. Assessed Management's sensitivity analysis and the upon Truscreen successfully establishing its business model change in key assumptions (individually) that would and customer base in a number of countries. The Group be required for the Truscreen Cash Generating Unit has failed to achieve forecasts to date. This raises the risk to be impaired. We considered the likelihood of such of impairment arising in respect of the Intangible Assets. a change in those assumptions occurring. Further disclosure regarding the Group's intangible assets. Assessed the Group's implied enterprise valuation and valuation processes can be found in Note 16. with the most recent capital raises undertaken by the Group. BDO Auckland IBDO Key Audit Matter How The Matter Was Addressed in Our Audit Recognition and measurement of Research & Development ("R&D") Grant The Group has recognised $1,229,121 in R&D Grant income Our procedures included the following: and a corresponding $1,070,518 receivable in its financial statements as at 31 March 2019. We evaluated the R&D claim by inspecting relevant certifications to support the eligibility of the Group's The R&D Grant allows the Group to claim 43.5% of R&D activities for the 12 month period ended 31 March expenditure in cash from the Australian Tax Authority 2019. "ATO' in respect of eligible expenditure incurred towards research and development. We obtained and analysed the evidence provided by Management and Management's expert to support the The R&D Grant is material to the financial statements and carrying value of the RED grant receivable and the is a key audit matter because it involves the use of resulting R&D grant claimed. significant management judgement to determine both the nature of the costs incurred and their eligibility to be We engaged an auditor's expert to assess the claimed as part of the RED Grant. Market risk exists measurement and recognition of the R&D Grant claim surrounding Review Agency audits of R&D tax claims and the Group's entitlement to it. (AusIndustry and ATO) and in some instances their claw back of historic R&D claims. We obtained evidence of the Group's pre-approval of R&D activities, awarded by AusIndustry. In assessing the measurement of the R&D grant reported, Management engaged an expert to quantify the R&D claim We evaluated the competence and objectivity of the recognised as receivable at reporting date. independent expert used by management. Management's expert inspected the Group's records to We discussed with Management's and the Auditor's identify and quantify costs which are deemed to be eligible experts the risks facing current and historic R&D claims for claim. The R&D grant claim is subject to pre-approvals and their expectation on recovery. on the Group's R&D activities from Ausindustry before a claim can be made to recover the eligible R&D costs. We researched media coverage in respect of the ATO's audits and in some instances, claw-back of previously This amount remains outstanding subsequent to reporting paid R&D claims. date, and there is a risk that the balance may not be approved, for payment in full, by the ATO. The Company We discussed with Management's expert the basis used is yet to submit its claim for the 31 March 2019 tax period. to claim eligible costs under the R&D grant and their expectation in respect of the R&D claim's approval and Further disclosure regarding the R&D grant receivable is recoverability. included in Notes 6 and 12 to the financial statements. We assessed the Group's history in lodging and receiving successful claims. BDO Auckland JBDO Key Audit Matter How The Matter Was Addressed in Our Audit Capitalisation of property, plant and equipment ("Pilot Plant") In Note 15 to the consolidated financial statements, Management provided information and supporting the Group recognised additions of $410,031. Included documentation on their consideration when capitalising costs within additions is a Pilot Plant asset with a carrying associated with the Pilot Plant. value as at 31 March 2019 of $379,993. We evaluated Management's assessment by: The capitalisation of the Pilot Plant is material to the Observing the Plant's existence and operation; financial statements and is a key audit matter because Agreeing amounts capitalised to supporting of the judgement exercised by Management when documentation and assessing the reasonableness of capitalising related costs during the set up and costs capitalised; and deployment of the Pilot Plant. Where labour was capitalised inspecting employment agreements associated with capitalised Management considered under NZ IAS 16 Property staff costs and obtaining support for time capitalised. Plant and Equipment the appropriateness of costs capitalised in the Pilot Plant. Their consideration We obtained and reviewed an assessment from Management to included: support the useful life applied to the Pilot Plant The nature of the costs capitalised to bring We reviewed the impact that the Pilot Plant had in supporting the Pilot Plant to its working condition; forecast growth and obtained confirmation from Management of the units produced by the Pilot Plant to date. The economic benefit expected to be derived from the Pilot Plant; and The useful life of the Pilot Plant. Management considered whether any indicators existed that could mean the Pilot Plant is impaired under NZ IAS 36 Impairment of Assets. Information Other than the Consolidated Financial Statements and Auditors Report The directors are responsible for the Annual Report, which includes information other than the financial statements and auditor's report. Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of audit opinion or assurance conclusion on the other information. In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard. Directors' Responsibilities for the consolidated Financial Statements The directors are responsible on behalf of the Group for the preparation and fair presentation of the consolidated financial statements in accordance with NZ IFRS, and for such internal control as the directors determine is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, the directors are responsible on behalf of the Group for assessing the Group's ability to continue as a going concern, disclosing (refer note 1.a), as applicable, matters relating to going concern and using the going concern basis of accounting unless the directors either intend to Liquidate the Group or to cease operations, or have no realistic alternative but to do so. BDO Auckland IBDO Auditor's Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAS (NZ) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could reasonably be expected to influence the decisions of users taken on the basis of these consolidated financial statements. A further description of our responsibilities for the audit of the financial statements is located at the External Reporting Board's website at: https://www.xrb.govt.nz/standards-for-assurance-practitioners/auditors- responsibilities/audit-report-1/ This description forms part of our auditor's report. Who we Report to This report is made solely to the Company's shareholders, as a body. Our audit work has been undertaken so that we might state those matters which we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's shareholders, as a body, for our audit work, for this report or any of the opinions we have formed. The engagement partner on the audit resulting in this independent auditor's report is Richard Croucher. For and on behalf of: BDO Auckland BDO Auckland Auckland 28 06 2019 Required: (c) The Truscreen audit report also includes Key Audit Matters (KAMs). In what way do KAMs add value to the audit report? Explain why the KAM headed "Impairment assessment of definite life intangible assets" is included. Maximum 200 words. (d) KAMs are also important in the interaction between the auditor and the audit committee. Explain the function of an audit committee and why KAMs are important to them. Maximum 200 words. IBDO BDO Auckland INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF TRUSCREEN LIMITED Report on the Audit of the Consolidated Financial Statements Opinion We have audited the consolidated financial statements of Truscreen Limited ("the Company") and its subsidiaries (together, the Group"), which comprise the consolidated statement of financial position as at 31 March 2019, and the consolidated statement of profit or loss and other comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at 31 March 2019, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with New Zealand equivalents to International Financial Reporting Standards ("NZ IFRS) and International Financial Reporting Standards ("IFRS'). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (New Zealand) ("ISAS (NZ)"). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with Professional and Ethical Standard 1 (Revised) Code of Ethics for Assurance Practitioners issued by the New Zealand Auditing and Assurance Standards Board and the International Ethics Standards Board for Accountants' Code of Ethics for Professional Accountants (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other than in our capacity as auditor we have no relationship with, or interests in the Company or any of its subsidiaries. Material Uncertainty Related to Going Concern We draw the shareholders' attention to Note la Going Concern, of the consolidated financial statements, which indicates that the Group incurred a loss of $3,380,454 during the year ended 31 March 2019 and generated an operating and investing cash out flows of $3,088,352. As stated in Note ta, these along with other conditions indicate that a material uncertainty exists that may cast significant doubt on the Group's ability to continue as a going concern and that it may be unable to realise its assets and discharge its liabilities in the normal course of business. Our opinion is not modified in respect of this matter. Key Audit Matters Key audit matters are those matters that, in our professional judgement were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. In addition to the matters described in the Material Uncertainty Related to Going Concern section, we have determined the matters described below to be the key audit matters to be communicated in our report. BDO Auckland IBDO Key Audit Matter How The Matter Was Addressed in Our Audit NZ IFRS 15 - Revenue from Contracts with Customers As disclosed in Note 1, the Group has adopted NZ IFRS 15 We reviewed management's assessment of the Revenue from Contracts with Customers ("NZ IFRS 15") in application of NZ IFRS 15 as it related to the Zimbabwe the year ended 31 March 2019. The adoption of NZ IFRS 15 transaction. This included: is significant to the financial statements, due to the judgement required by the Directors in assessing whether - Assessing whether, at the time the sale was made, it transactions meet the criteria for recognition under NZ was probable that the consideration would be collected. IFRS 15. Obtaining an understanding of the sequence of events On the 20th of September 2018, the Group invoiced leading to the sale. $425,107 of goods to a customer in Zimbabwe on 45 day terms. At the date the invoice was raised, Zimbabwe, and Inspecting information that management sed its therefore the customer, faced a number of economic assessment of the probability of collection. foreign currency creditors as a result of US dollar Currency Researching Zimbabwe's economic environment and restrictions. the potential impact that the shortage of foreign currency might have on the repayment of the amount It was determined that the transaction did not meet NZ due. This included consultation with our network firm in IFRS 15 recognition criteria, as at the time of invoicing it Zimbabwe. was not probable that the Group would be able to collect the consideration to which it was entitled. - Reviewing correspondence between the Group and the purchaser in relation to the sale. The Group received payments of $110,166 from the customer before reporting date, which have been recognised as revenue. The balance of $314,941 has not been recognised in the financial statements. BDO Auckland IBDO Key Audit Matter Impairment assessment of definite life intangible assets How The Matter Was Addressed in Our Audit Intangible Assets have a carrying value of $8,261,063 are To assess whether the Group should recognise any material and significant to the financial position of the impairment to the intangible assets we: Group. The carrying value of this balance is considered to be a key audit matter due to the judgements involved in. Confirmed the methodologies adopted in the models assessing the recoverable value during impairment testing were consistent with accepted valuation under NZ IAS 36 Impairment of Assets (NZ IAS 36'). approaches. To derive recoverable value, the Directors have undertaken. Tested the calculations within the valuation models an impairment review which considers valuation models and evaluated the resulting valuation estimates. developed by management and their expert. The impairment review, prepared under NZ IAS 36 considered. Challenged the reasonableness of the assumptions both a discounted free cash flow and a revenue exit underpinning the revenue and net cash flow multiple valuation. The models, and the resulting valuation projections included in the valuation models. We estimates, are inherently subjective. agreed the basis for assumptions to external sources The determination of recoverable amount under NZ IAS 36 of information where available. requires the use of judgements and estimates when. Engaged Auditor's Experts to assess the valuation formulating assumptions underpinning forecast cashflow. methodologies and to evaluate the reasonableness of key inputs. Achievement of revenue and net cash flow projections, and the reliability of the valuation estimates, are dependent. Assessed Management's sensitivity analysis and the upon Truscreen successfully establishing its business model change in key assumptions (individually) that would and customer base in a number of countries. The Group be required for the Truscreen Cash Generating Unit has failed to achieve forecasts to date. This raises the risk to be impaired. We considered the likelihood of such of impairment arising in respect of the Intangible Assets. a change in those assumptions occurring. Further disclosure regarding the Group's intangible assets. Assessed the Group's implied enterprise valuation and valuation processes can be found in Note 16. with the most recent capital raises undertaken by the Group. BDO Auckland IBDO Key Audit Matter How The Matter Was Addressed in Our Audit Recognition and measurement of Research & Development ("R&D") Grant The Group has recognised $1,229,121 in R&D Grant income Our procedures included the following: and a corresponding $1,070,518 receivable in its financial statements as at 31 March 2019. We evaluated the R&D claim by inspecting relevant certifications to support the eligibility of the Group's The R&D Grant allows the Group to claim 43.5% of R&D activities for the 12 month period ended 31 March expenditure in cash from the Australian Tax Authority 2019. "ATO' in respect of eligible expenditure incurred towards research and development. We obtained and analysed the evidence provided by Management and Management's expert to support the The R&D Grant is material to the financial statements and carrying value of the RED grant receivable and the is a key audit matter because it involves the use of resulting R&D grant claimed. significant management judgement to determine both the nature of the costs incurred and their eligibility to be We engaged an auditor's expert to assess the claimed as part of the RED Grant. Market risk exists measurement and recognition of the R&D Grant claim surrounding Review Agency audits of R&D tax claims and the Group's entitlement to it. (AusIndustry and ATO) and in some instances their claw back of historic R&D claims. We obtained evidence of the Group's pre-approval of R&D activities, awarded by AusIndustry. In assessing the measurement of the R&D grant reported, Management engaged an expert to quantify the R&D claim We evaluated the competence and objectivity of the recognised as receivable at reporting date. independent expert used by management. Management's expert inspected the Group's records to We discussed with Management's and the Auditor's identify and quantify costs which are deemed to be eligible experts the risks facing current and historic R&D claims for claim. The R&D grant claim is subject to pre-approvals and their expectation on recovery. on the Group's R&D activities from Ausindustry before a claim can be made to recover the eligible R&D costs. We researched media coverage in respect of the ATO's audits and in some instances, claw-back of previously This amount remains outstanding subsequent to reporting paid R&D claims. date, and there is a risk that the balance may not be approved, for payment in full, by the ATO. The Company We discussed with Management's expert the basis used is yet to submit its claim for the 31 March 2019 tax period. to claim eligible costs under the R&D grant and their expectation in respect of the R&D claim's approval and Further disclosure regarding the R&D grant receivable is recoverability. included in Notes 6 and 12 to the financial statements. We assessed the Group's history in lodging and receiving successful claims. BDO Auckland JBDO Key Audit Matter How The Matter Was Addressed in Our Audit Capitalisation of property, plant and equipment ("Pilot Plant") In Note 15 to the consolidated financial statements, Management provided information and supporting the Group recognised additions of $410,031. Included documentation on their consideration when capitalising costs within additions is a Pilot Plant asset with a carrying associated with the Pilot Plant. value as at 31 March 2019 of $379,993. We evaluated Management's assessment by: The capitalisation of the Pilot Plant is material to the Observing the Plant's existence and operation; financial statements and is a key audit matter because Agreeing amounts capitalised to supporting of the judgement exercised by Management when documentation and assessing the reasonableness of capitalising related costs during the set up and costs capitalised; and deployment of the Pilot Plant. Where labour was capitalised inspecting employment agreements associated with capitalised Management considered under NZ IAS 16 Property staff costs and obtaining support for time capitalised. Plant and Equipment the appropriateness of costs capitalised in the Pilot Plant. Their consideration We obtained and reviewed an assessment from Management to included: support the useful life applied to the Pilot Plant The nature of the costs capitalised to bring We reviewed the impact that the Pilot Plant had in supporting the Pilot Plant to its working condition; forecast growth and obtained confirmation from Management of the units produced by the Pilot Plant to date. The economic benefit expected to be derived from the Pilot Plant; and The useful life of the Pilot Plant. Management considered whether any indicators existed that could mean the Pilot Plant is impaired under NZ IAS 36 Impairment of Assets. Information Other than the Consolidated Financial Statements and Auditors Report The directors are responsible for the Annual Report, which includes information other than the financial statements and auditor's report. Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of audit opinion or assurance conclusion on the other information. In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard. Directors' Responsibilities for the consolidated Financial Statements The directors are responsible on behalf of the Group for the preparation and fair presentation of the consolidated financial statements in accordance with NZ IFRS, and for such internal control as the directors determine is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, the directors are responsible on behalf of the Group for assessing the Group's ability to continue as a going concern, disclosing (refer note 1.a), as applicable, matters relating to going concern and using the going concern basis of accounting unless the directors either intend to Liquidate the Group or to cease operations, or have no realistic alternative but to do so. BDO Auckland IBDO Auditor's Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAS (NZ) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could reasonably be expected to influence the decisions of users taken on the basis of these consolidated financial statements. A further description of our responsibilities for the audit of the financial statements is located at the External Reporting Board's website at: https://www.xrb.govt.nz/standards-for-assurance-practitioners/auditors- responsibilities/audit-report-1/ This description forms part of our auditor's report. Who we Report to This report is made solely to the Company's shareholders, as a body. Our audit work has been undertaken so that we might state those matters which we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's shareholders, as a body, for our audit work, for this report or any of the opinions we have formed. The engagement partner on the audit resulting in this independent auditor's report is Richard Croucher. For and on behalf of: BDO Auckland BDO Auckland Auckland 28 06 2019