Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required calculate accumulated depreciation for both cars calculate profit and lost on sale of first car using straight line of depreciation and financial year finishing

required

calculate accumulated depreciation for both cars

calculate profit and lost on sale of first car

using straight line of depreciation and financial year finishing 2019/20

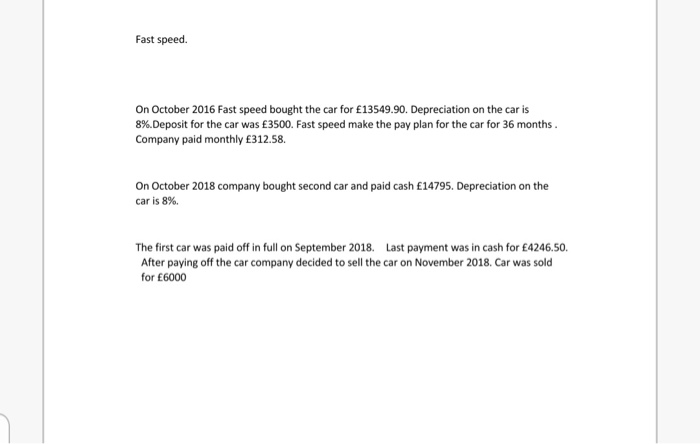

Fast speed. On October 2016 Fast speed bought the car for 13549.90. Depreciation on the car is 8%.Deposit for the car was 3500. Fast speed make the pay plan for the car for 36 months Company paid monthly 312.58. On October 2018 company bought second car and paid cash 14795. Depreciation on the car is 8%. The first car was paid off in full on September 2018. Last payment was in cash for 4246.50. After paying off the car company decided to sell the car on November 2018. Car was sold for 6000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started