Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Calculate the deferred tax balance as it will appear in the Statement of Financial Position of Beta as at 31 December 2009 and 2010

Required

Calculate the deferred tax balance as it will appear in the Statement of Financial Position of Beta as at 31 December 2009 and 2010 in accordance with the Statement of Financial Position method, as well as the following amounts that will be disclosed separately in profit or loss for 2010: (i) Tax rate change (assume that the rate change is applied on the opening balance of deferred tax); and (ii) Deferred tax expense/income (excluding rate change)

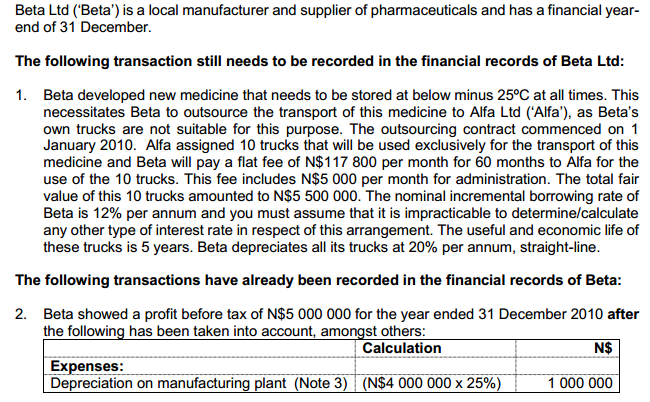

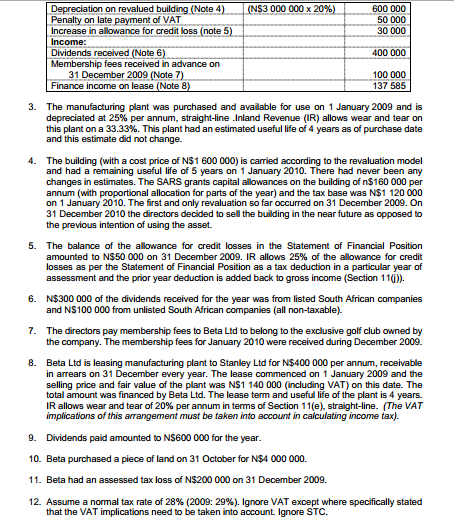

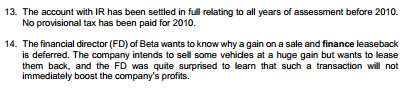

Beta Ltd ('Beta') is a local manufacturer and supplier of pharmaceuticals and has a financial yearend of 31 December. The following transaction still needs to be recorded in the financial records of Beta Ltd: 1. Beta developed new medicine that needs to be stored at below minus 25C at all times. This necessitates Beta to outsource the transport of this medicine to Alfa Ltd ('Alfa'), as Beta's own trucks are not suitable for this purpose. The outsourcing contract commenced on 1 January 2010. Alfa assigned 10 trucks that will be used exclusively for the transport of this medicine and Beta will pay a flat fee of N$117800 per month for 60 months to Alfa for the use of the 10 trucks. This fee includes N$5000 per month for administration. The total fair value of this 10 trucks amounted to N$5500000. The nominal incremental borrowing rate of Beta is 12% per annum and you must assume that it is impracticable to determine/calculate any other type of interest rate in respect of this arrangement. The useful and economic life of these trucks is 5 years. Beta depreciates all its trucks at 20% per annum, straight-line. The following transactions have already been recorded in the financial records of Beta: 2. Beta showed a profit before tax of N$5000000 for the year ended 31 December 2010 after the following has been taken into account, amonqst others: 3. The manufacturing plant was purchased and available for use on 1 January 2009 and is depreciated at 25% per annum, straight-line .Inland Revenue (IR) allows wear and tear on this plant on a 33.33%. This plant had an estimated useful life of 4 years as of purchase date and this estimate did not change. 4. The building (with a cost price of N\$1 600000 ) is carried according to the revaluation model and had a remaining useful life of 5 years on 1 January 2010 . There had never been any changes in estimates. The SARS grants capital allowances on the building of $160000 per annum (with proportional allocation for parts of the year) and the tax base was N\$1 120000 on 1 January 2010. The first and only revaluation so far occurred on 31 December 2009. On 31 December 2010 the directors decided to sell the building in the near future as opposed to the previous intention of using the asset. 5. The balance of the allowance for credit losses in the Statement of Financial Position amounted to N\$50 000 on 31 December 2009 . IR allows 25% of the allowance for credit losses as per the Statement of Financial Position as a tax deduction in a particular year of assessment and the prior year deduction is added back to gross income (Section 11(j)). 6. N\$300 000 of the dividends received for the year was from listed South African companies and NS100 000 from unlisted South African companies (all non-taxable). 7. The directors pay membership fees to Beta Ltd to belong to the exclusive golf club owned by the company. The membership fees for January 2010 were received during December 2009. 8. Beta Ltd is leasing manufacturing plant to Stanley Ltd for N\$400 000 per annum, receivable in arrears on 31 December every year. The lease commenced on 1 January 2009 and the selling price and fair value of the plant was NS1 140000 (including VAT) on this date. The total amount was financed by Beta Ltd. The lease term and useful life of the plant is 4 years. IR allows wear and tear of 20% per annum in terms of Section 11(e), straight-line. (The VAT implications of this arrangement must be taken into account in calculating income tax). 9. Dividends paid amounted to NS600 000 for the year. 10. Beta purchased a piece of land on 31 October for N\$4 000000 . 11. Beta had an assessed tax loss of N\$200 000 on 31 December 2009. 12. Assume a normal tax rate of 28%(2009:29%). Ignore VAT except where specifically stated that the VAT implications need to be taken into account. lgnore STC. 13. The account with IR has been settled in full relating to all years of assessment before 2010 . No provisional tax has been paid for 2010. 14. The financial director (FD) of Beta wants to know why a gain on a sale and finance leaseback is deferred. The company intends to sell some vehicles at a huge gain but wants to lease them back, and the FD was quite surprised to learn that such a transaction will not immediately boost the company's profits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started