Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Calculate the effect that the proposed policy will have on earnings before interest and tax (EBIT) and advise whether it would be better to

Required: Calculate the effect that the proposed policy will have on earnings before interest and tax (EBIT) and advise whether it would be better to switch to the new policy, or remain with the current one. (Assume a 365 day year)

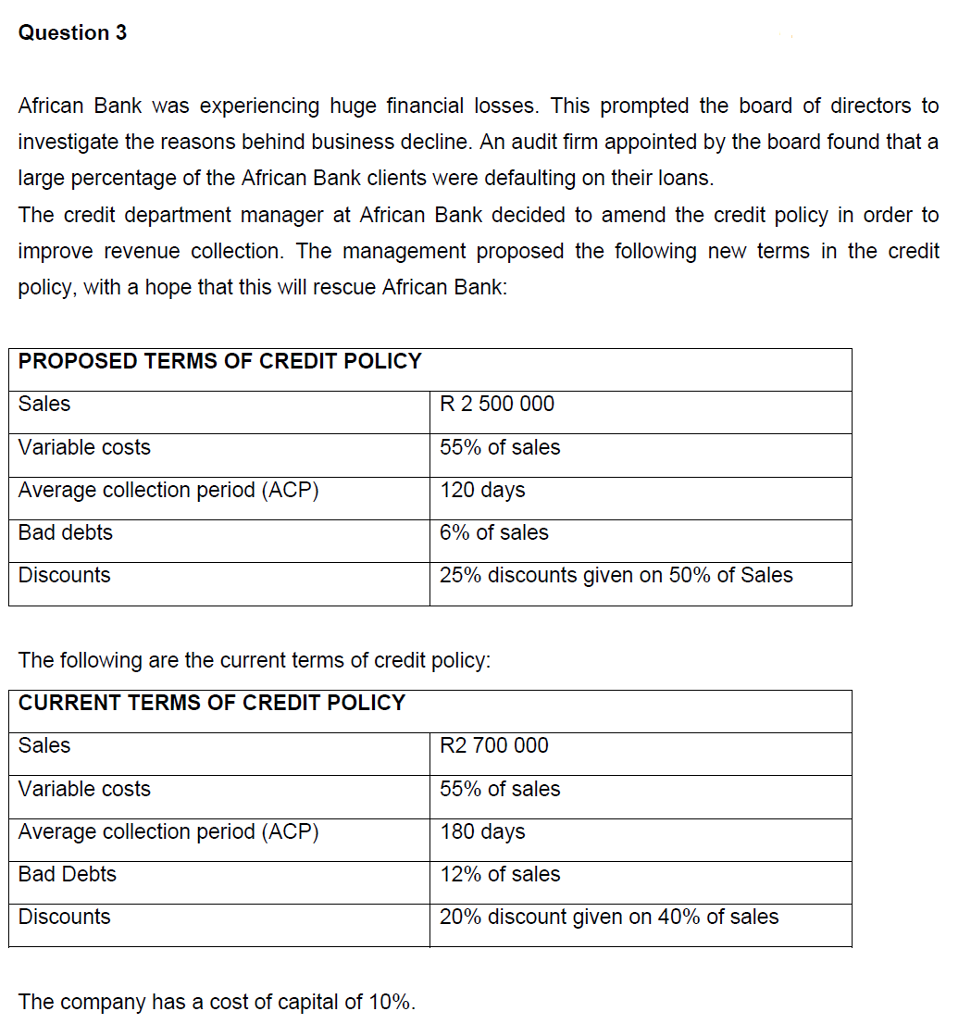

Question 3 African Bank was experiencing huge financial losses. This prompted the board of directors to investigate the reasons behind business decline. An audit firm appointed by the board found that a large percentage of the African Bank clients were defaulting on their loans The credit department manager at African Bank decided to amend the credit policy in order to improve revenue collection. The management proposed the following new terms in the credit policy, with a hope that this will rescue African Bank: PROPOSED TERMS OF CREDIT POLICY Sales Variable costs Average collection period (ACP) Bad debts Discounts R 2 500 000 55% of sales 120 days 6% of sales 25% discounts given on 50% of Sales The following are the current terms of credit policy: CURRENT TERMS OF CREDIT POLICY Sales Variable costs Average collection period (ACP) Bad Debts Discounts R2 700 000 55% of sales 180 days 12% of sales 20% discount given on 40% of sales The company has a cost of capital of 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started