Question

Required: Calculate the following information. 1) Sales Rs. 2) Variable Manufacturing Cost Rs. 3) Fixed Manufacturing Cost according to absorption costing Rs. 4) Fixed Manufacturing

Required:

Calculate the following information.

1) Sales Rs.

2) Variable Manufacturing Cost Rs.

3) Fixed Manufacturing Cost according to absorption costing Rs.

4) Fixed Manufacturing Cost according to marginal costing Rs.

5) Total Manufacting Cost according to marginal costing Rs.

6) Total Manufacting Cost according to absorption costing Rs.

7) Opening Finished goods according to absorption costing Rs.

8) Opening Finished goods according to marignal costing Rs.

9) Closing Finished goods according to absorption costing Rs.

10) Closing Finished goods according to marginal costing Rs.

11) Gross Profit Rs.

12) Contribution Margin Rs.

13) Net Profit according to absorption costing Rs.

14) Net Profit according to marginal costing Rs.

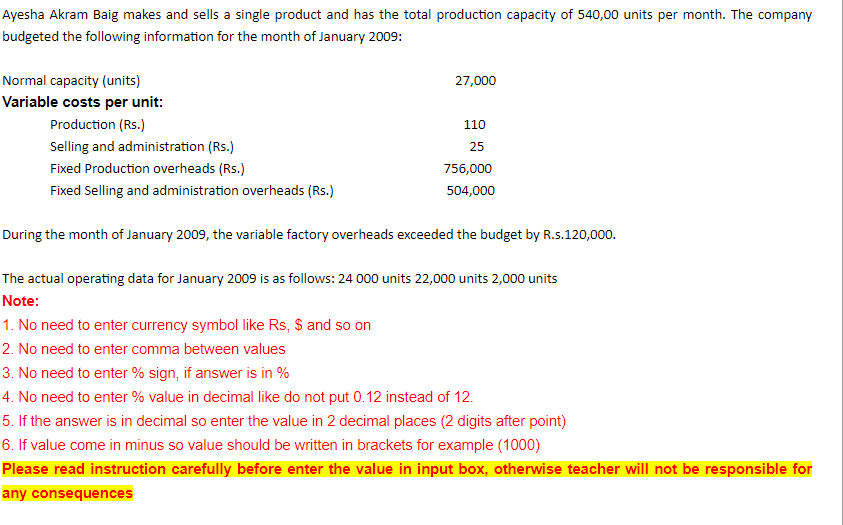

Ayesha Akram Baig makes and sells a single product and has the total production capacity of 540,00 units per month. The company budgeted the following information for the month of January 2009: 27,000 110 Normal capacity (units) Variable costs per unit: Production (Rs.) Selling and administration (Rs.) Fixed Production overheads (Rs.) Fixed Selling and administration overheads (Rs.) 25 756,000 504,000 During the month of January 2009, the variable factory overheads exceeded the budget by R.s.120,000. The actual operating data for January 2009 is as follows: 24 000 units 22,000 units 2,000 units Note: 1. No need to enter currency symbol like Rs, $ and so on 2. No need to enter comma between values 3. No need to enter % sign, if answer is in % 4. No need to enter % value in decimal like do not put 0.12 instead of 12. 5. If the answer is in decimal so enter the value in 2 decimal places (2 digits after point) 6. If value come in minus so value should be written in brackets for example (1000) Please read instruction carefully before enter the value in input box, otherwise teacher will not be responsible for any consequences Ayesha Akram Baig makes and sells a single product and has the total production capacity of 540,00 units per month. The company budgeted the following information for the month of January 2009: 27,000 110 Normal capacity (units) Variable costs per unit: Production (Rs.) Selling and administration (Rs.) Fixed Production overheads (Rs.) Fixed Selling and administration overheads (Rs.) 25 756,000 504,000 During the month of January 2009, the variable factory overheads exceeded the budget by R.s.120,000. The actual operating data for January 2009 is as follows: 24 000 units 22,000 units 2,000 units Note: 1. No need to enter currency symbol like Rs, $ and so on 2. No need to enter comma between values 3. No need to enter % sign, if answer is in % 4. No need to enter % value in decimal like do not put 0.12 instead of 12. 5. If the answer is in decimal so enter the value in 2 decimal places (2 digits after point) 6. If value come in minus so value should be written in brackets for example (1000) Please read instruction carefully before enter the value in input box, otherwise teacher will not be responsible for any consequencesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started