Answered step by step

Verified Expert Solution

Question

1 Approved Answer

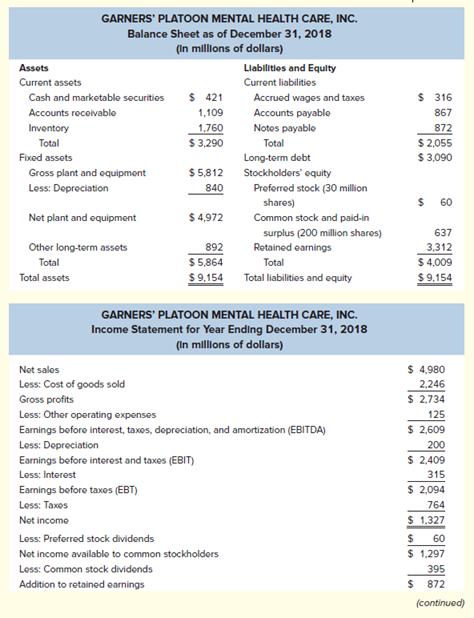

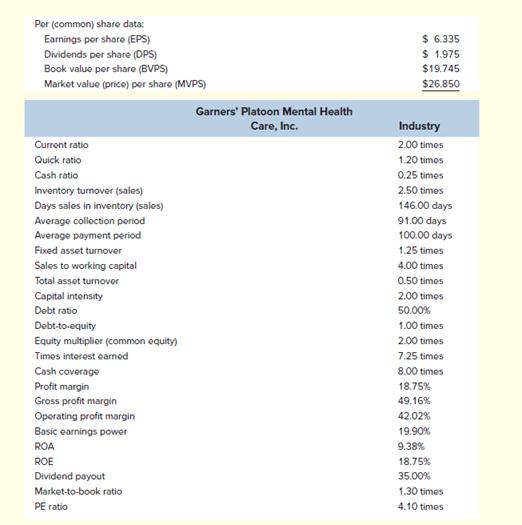

Required: Calculate the liquidity ratios (at least two). Calculate the inventory turnover ratio, capital intensity, and the total asset turnover ratios. Calculate the debt ratio

Required:

Calculate the liquidity ratios (at least two).

Calculate the inventory turnover ratio, capital intensity, and the total asset turnover ratios.

Calculate the debt ratio and debt-to-equity ratio. Discuss how you calculated these values.

GARNERS' PLATOON MENTAL HEALTH CARE, INC. Balance Sheet as of December 31, 2018 (in millions of dollars) Assots Current assets Cash and marketable securities Accounts receivable Inventory Total Fixed assets Gross plant and equipment Less: Depreciation Net plant and equipment Other long-term assets Total Total assets Not sales Less: Cost of goods sold $ 421 1,109 1,760 $ 3,290 $5,812 840 Earnings before taxes (EBT) Less: Taxes Net income $ 4,972 Liabilities and Equity Current liabilities GARNERS' PLATOON MENTAL HEALTH CARE, INC. Income Statement for Year Ending December 31, 2018 (in millions of dollars) Accrued wages and taxes Accounts payable Notes payable Total Long-term debt Stockholders' equity Preferred stock (30 million shares) Common stock and paid-in surplus (200 million shares) Retained earnings Total 892 $5,864 $9,154 Total liabilities and equity Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Depreciation Earnings before interest and taxes (EBIT) Less: Interest Less: Preferred stock dividends Not income available to common stockholders Less: Common stock dividends Addition to retained earnings $ 316 867 872 $ 2,055 $ 3,090 $ 60 $ 637 3,312 $ 4,009 $9,154 $ 4,980 2,246 $ 2,734 125 $ 2,609 200 $ 2,409 315 $ 2,094 764 $ 1.327 $ 60 $ 1.297 395 872 (continued)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Garners Platoon Mental Health Care Ratio Analysis Based on the provided financial statements here are the calculations and explanations for some key r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started