Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: .: Calculate the net profit for Desh Fashion for the next three years. 2. Should the MD go ahead with his plan? Critically evaluate

Required:

.: Calculate the net profit for Desh Fashion for the next three years.

2. Should the MD go ahead with his plan? Critically evaluate your answer based on Kaplans (2009) Risk Management Framework (i.e. three levels of risk).

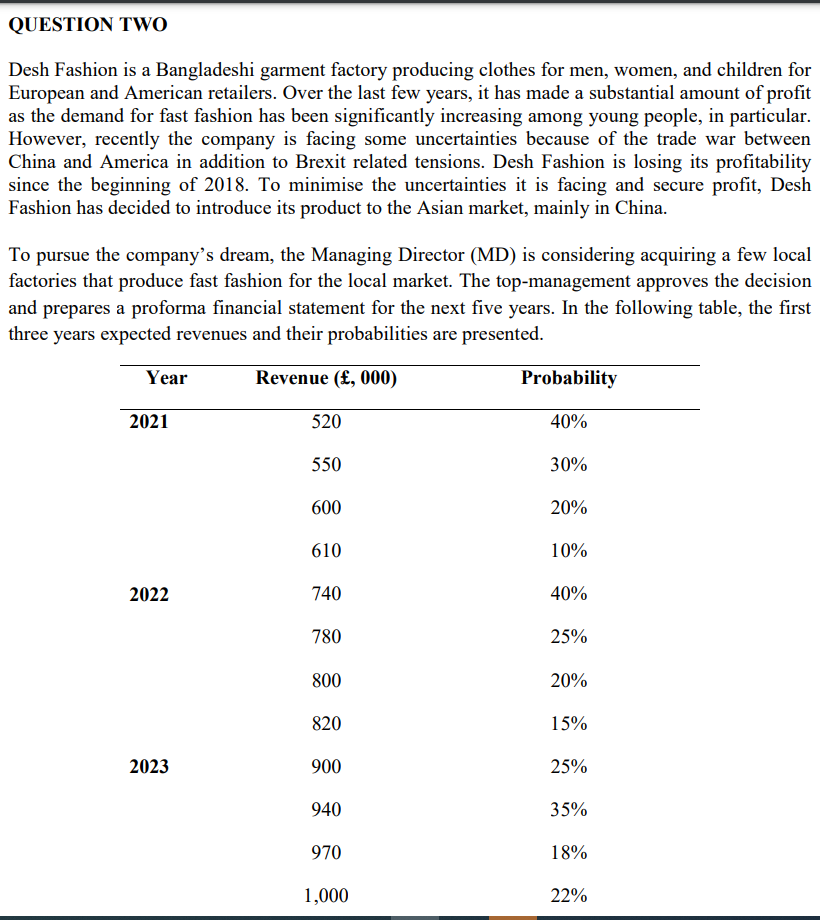

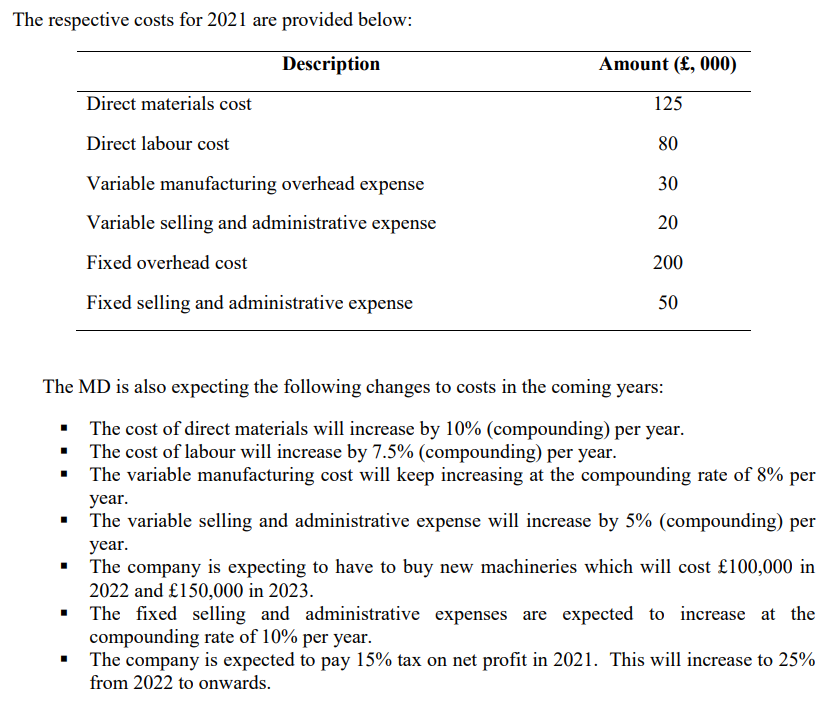

QUESTION TWO Desh Fashion is a Bangladeshi garment factory producing clothes for men, women, and children for European and American retailers. Over the last few years, it has made a substantial amount of profit as the demand for fast fashion has been significantly increasing among young people, in particular. However, recently the company is facing some uncertainties because of the trade war between China and America in addition to Brexit related tensions. Desh Fashion is losing its profitability since the beginning of 2018. To minimise the uncertainties it is facing and secure profit, Desh Fashion has decided to introduce its product to the Asian market, mainly in China. To pursue the company's dream, the Managing Director (MD) is considering acquiring a few local factories that produce fast fashion for the local market. The top-management approves the decision and prepares a proforma financial statement for the next five years. In the following table, the first three years expected revenues and their probabilities are presented. Revenue (, 000) Year 2021 2022 2023 520 550 600 610 740 780 800 820 900 940 970 1,000 Probability 40% 30% 20% 10% 40% 25% 20% 15% 25% 35% 18% 22% The respective costs for 2021 are provided below: Description Direct materials cost Direct labour cost Variable manufacturing overhead expense Variable selling and administrative expense Fixed overhead cost Fixed selling and administrative expense Amount (, 000) 125 80 30 20 200 50 The MD is also expecting the following changes to costs in the coming years: The cost of direct materials will increase by 10% (compounding) per year. The cost of labour will increase by 7.5% (compounding) per year. The variable manufacturing cost will keep increasing at the compounding rate of 8% per year. The variable selling and administrative expense will increase by 5% (compounding) per year. The company is expecting to have to buy new machineries which will cost 100,000 in 2022 and 150,000 in 2023. The fixed selling and administrative expenses are expected to increase at the compounding rate of 10% per year. The company is expected to pay 15% tax on net profit in 2021. This will increase to 25% from 2022 to onwardsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started