Answered step by step

Verified Expert Solution

Question

1 Approved Answer

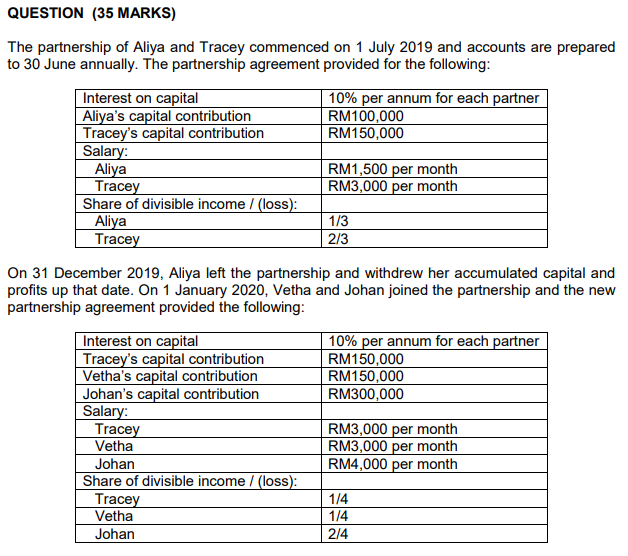

Required: Calculate the statutory income of each partner from the partnership for the year of assessment 2020. QUESTION (35 MARKS) The partnership of Aliya and

Required:

Calculate the statutory income of each partner from the partnership for the year of assessment 2020.

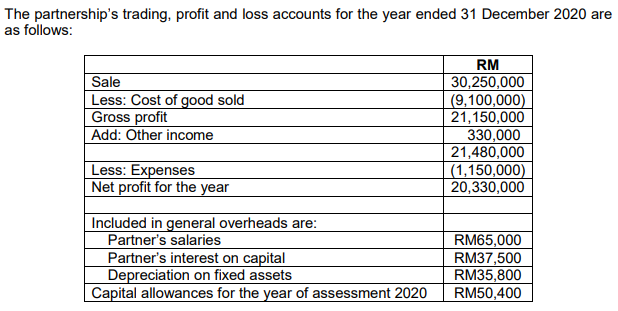

QUESTION (35 MARKS) The partnership of Aliya and Tracey commenced on 1 July 2019 and accounts are prepared to 30 June annually. The partnership agreement provided for the following: Interest on capital 10% per annum for each partner Aliya's capital contribution RM100,000 Tracey's capital contribution RM150,000 Salary: Aliya RM1,500 per month Tracey RM3,000 per month Share of divisible income / (loss): Aliya 1/3 Tracey 2/3 On 31 December 2019, Aliya left the partnership and withdrew her accumulated capital and profits up that date. On 1 January 2020, Vetha and Johan joined the partnership and the new partnership agreement provided the following: 10% per annum for each partner RM150,000 RM150,000 RM300,000 Interest on capital Tracey's capital contribution Vetha's capital contribution Johan's capital contribution Salary: Tracey Vetha Johan Share of divisible income / (loss): Tracey Vetha Johan RM3,000 per month RM3,000 per month RM4,000 per month 1/4 1/4 2/4 The partnership's trading, profit and loss accounts for the year ended 31 December 2020 are as follows: Sale Less: Cost of good sold Gross profit Add: Other income RM 30,250,000 (9,100,000) 21,150,000 330,000 21,480,000 (1,150,000) 20,330,000 Less: Expenses Net profit for the year Included in general overheads are: Partner's salaries Partner's interest on capital Depreciation on fixed assets Capital allowances for the year of assessment 2020 RM65,000 RM37,500 RM35,800 RM50,400 QUESTION (35 MARKS) The partnership of Aliya and Tracey commenced on 1 July 2019 and accounts are prepared to 30 June annually. The partnership agreement provided for the following: Interest on capital 10% per annum for each partner Aliya's capital contribution RM100,000 Tracey's capital contribution RM150,000 Salary: Aliya RM1,500 per month Tracey RM3,000 per month Share of divisible income / (loss): Aliya 1/3 Tracey 2/3 On 31 December 2019, Aliya left the partnership and withdrew her accumulated capital and profits up that date. On 1 January 2020, Vetha and Johan joined the partnership and the new partnership agreement provided the following: 10% per annum for each partner RM150,000 RM150,000 RM300,000 Interest on capital Tracey's capital contribution Vetha's capital contribution Johan's capital contribution Salary: Tracey Vetha Johan Share of divisible income / (loss): Tracey Vetha Johan RM3,000 per month RM3,000 per month RM4,000 per month 1/4 1/4 2/4 The partnership's trading, profit and loss accounts for the year ended 31 December 2020 are as follows: Sale Less: Cost of good sold Gross profit Add: Other income RM 30,250,000 (9,100,000) 21,150,000 330,000 21,480,000 (1,150,000) 20,330,000 Less: Expenses Net profit for the year Included in general overheads are: Partner's salaries Partner's interest on capital Depreciation on fixed assets Capital allowances for the year of assessment 2020 RM65,000 RM37,500 RM35,800 RM50,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started