Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required.: Calculate the variable overhead spending variance and the variable overhead efficiency variance. Valley Company uses a standard cost system to control production costs. For

Required.: Calculate the variable overhead spending variance and the variable overhead efficiency variance.

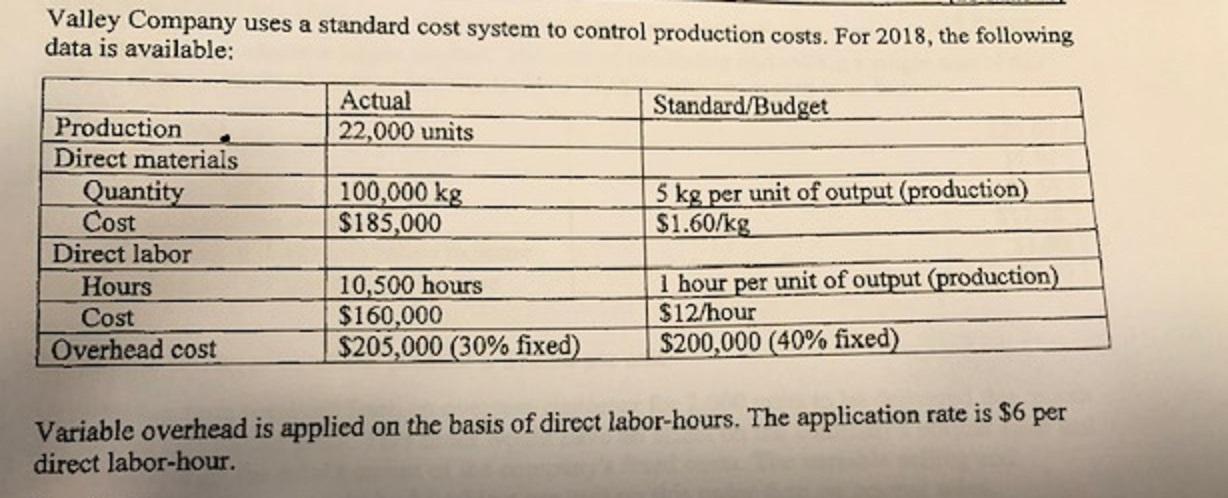

Required.: Calculate the variable overhead spending variance and the variable overhead efficiency variance. Valley Company uses a standard cost system to control production costs. For 2018, the following data is available: Actual Standard/Budget Production Direct materials Quantity Cost 22,000 units 100,000 kg $185,000 5 kg per unit of output (production) $1.60/kg Direct labor 10,500 hours $160,000 $205,000 (30% fixed) 1 hour per unit of output (production) $12/hour Hours Cost Overhead cost $200,000 (40% fixed) Variable overhead is applied on the basis of direct labor-hours. The application rate is $6 per direct labor-hour.

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Actual variable overhead 205000 70 143500 Variable overhead spending variance Act...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started