Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Compute ONLY the net cash flows from operating activities section of consolidatod Cash flows statement for this business comibination for the year ending December

Required:

Required:

Compute ONLY the net cash flows from operating activities section of consolidatod Cash flows statement for this business comibination for the year ending December 31, 2023. Use indirect method.

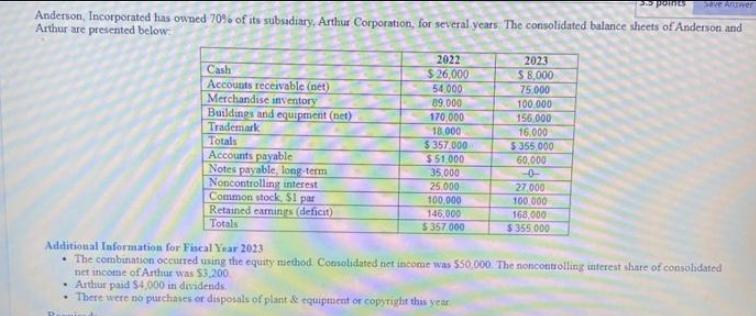

points Save Antwer Anderson, Incorporated has owned 70% of its subsidiary, Arthur Corporation, for several years. The consolidated balance sheets of Anderson and Arthur are presented below: Cash Accounts receivable (net) Merchandise inventory Buildings and equipment (net) Trademark Totals Accounts payable Notes payable, long-term Noncontrolling interest Common stock, $1 par Retained earnings (deficit) Totals 2022 $26,000 54.000 89,000 170,000 18,000 $357,000 $51.000 35,000 25.000 100,000 146,000 $357.000 2023 $8,000 Arthur paid $4,000 in dividends There were no purchases or disposals of plant & equipment or copyright this year 75.000 100.000 156 000 16,000 $355.000 60,000 -0 27.000 100.000 168,000 $355.000 Additional Information for Fiscal Year 2023 The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Net Cash Flows from Operating Activities Consolidated Cash Flows Statement Description Amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started