Answered step by step

Verified Expert Solution

Question

1 Approved Answer

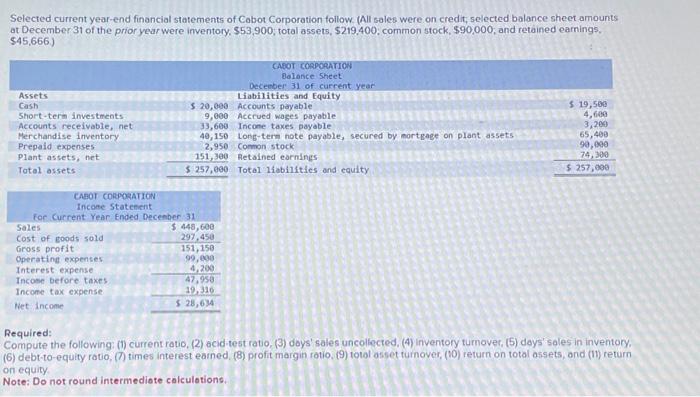

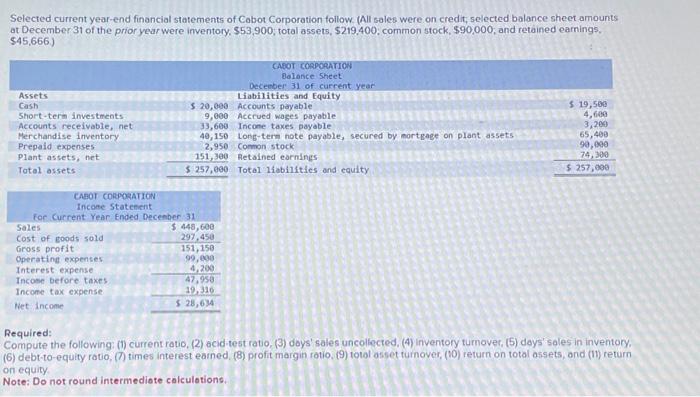

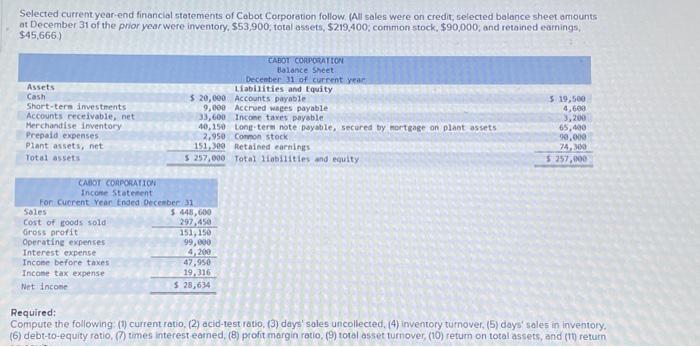

Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio,

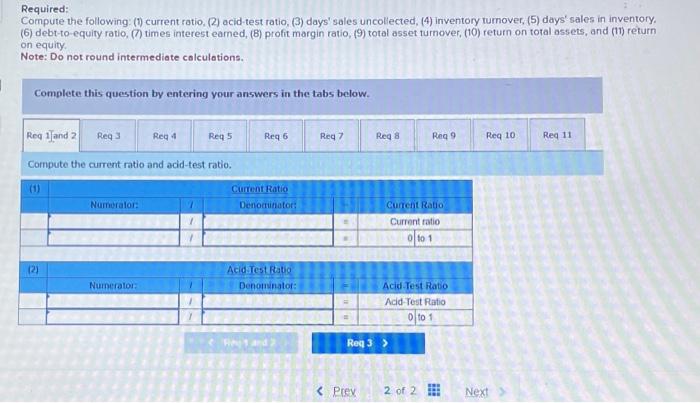

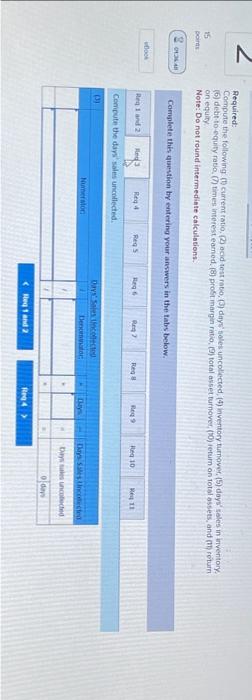

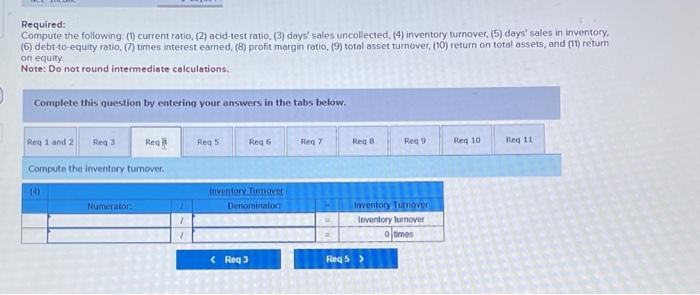

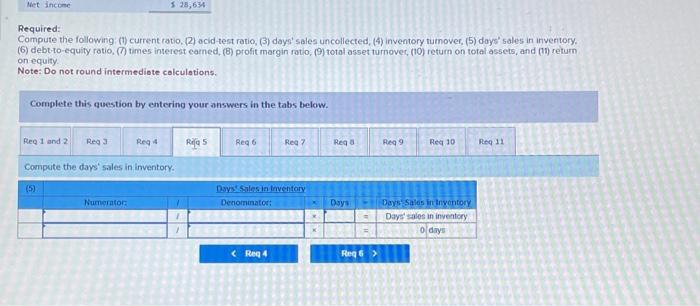

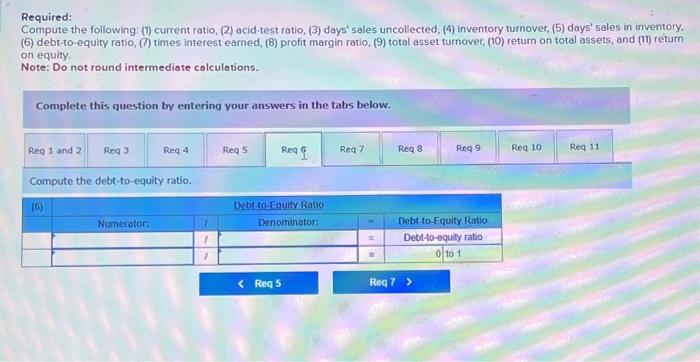

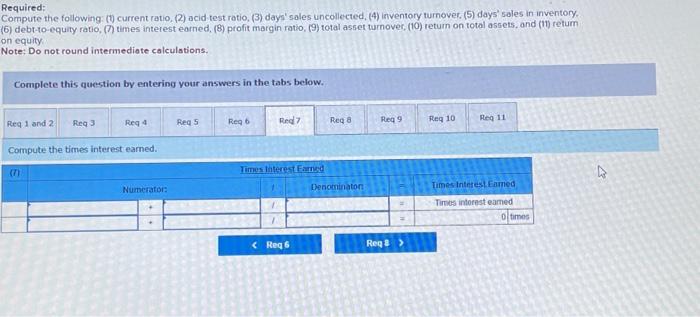

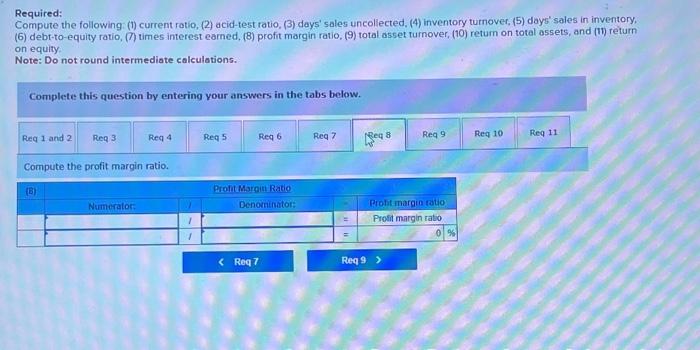

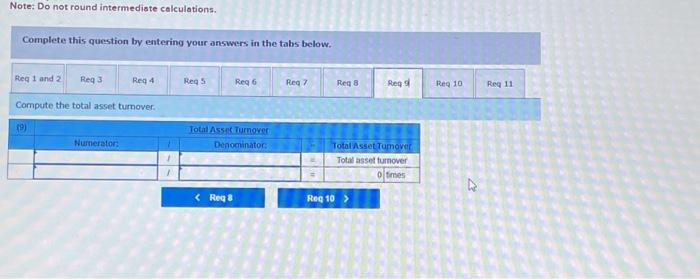

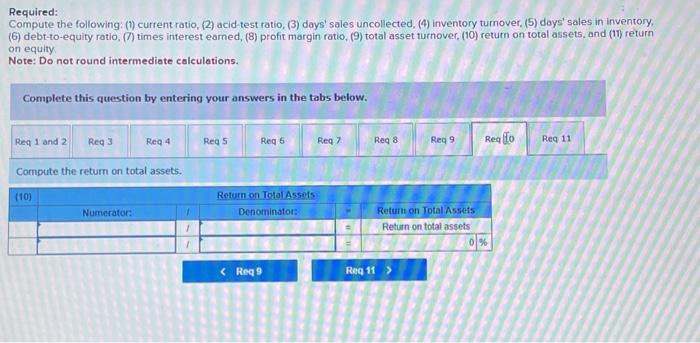

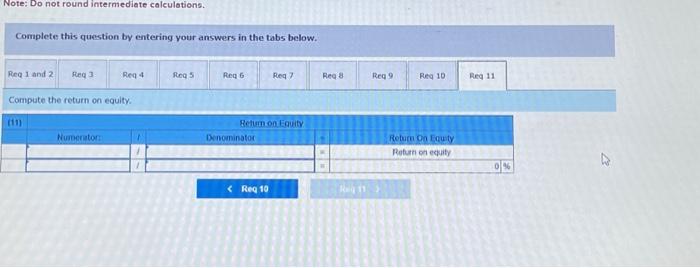

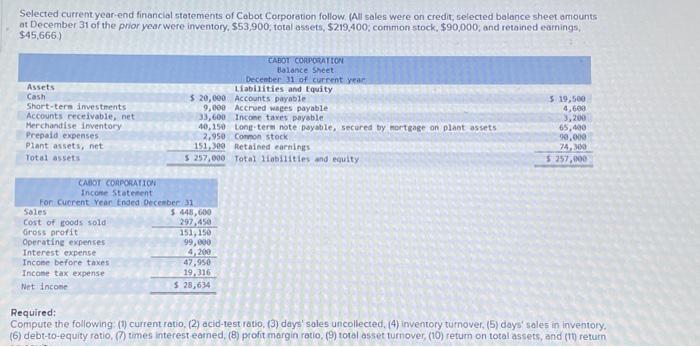

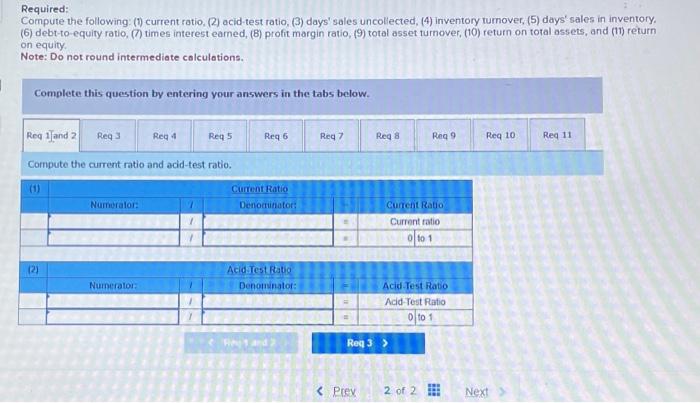

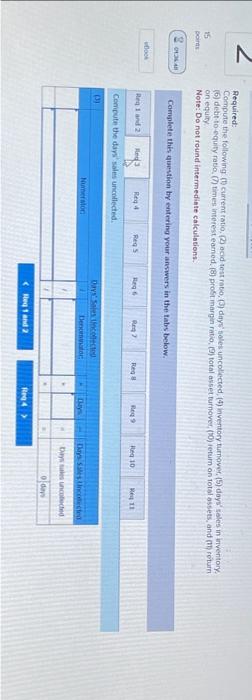

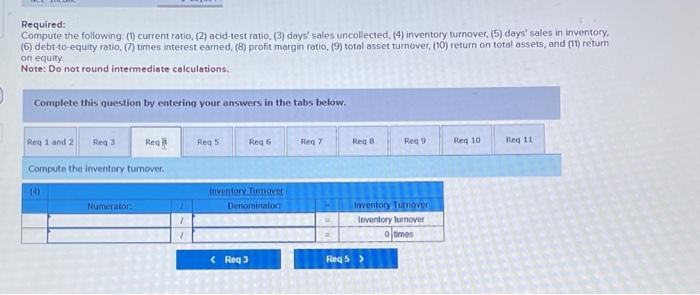

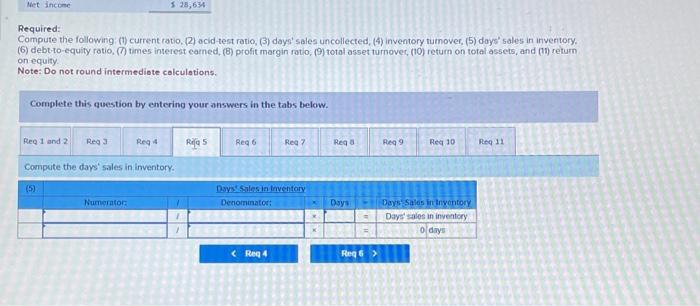

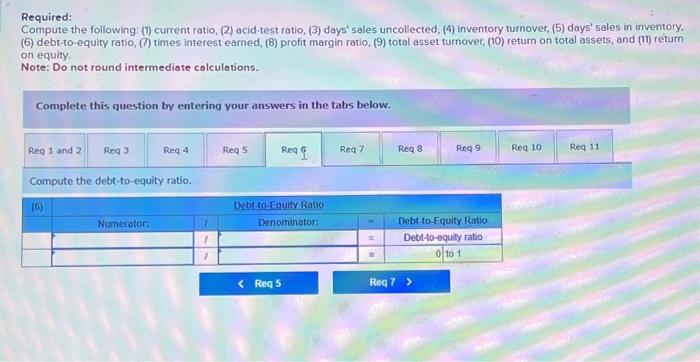

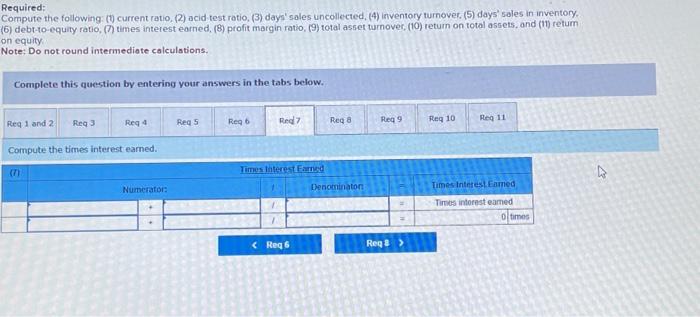

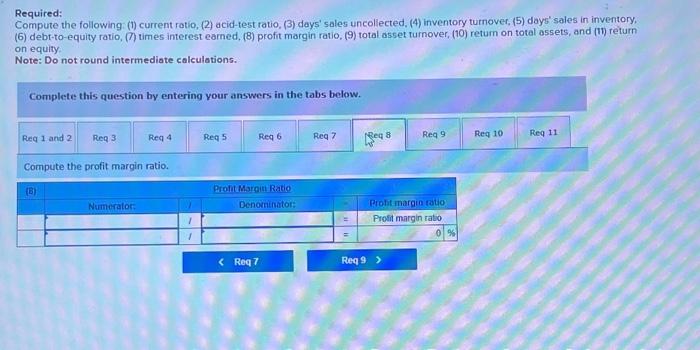

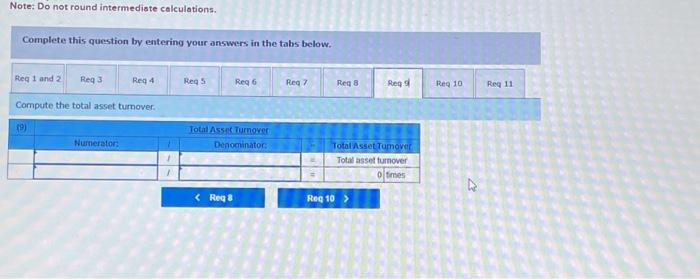

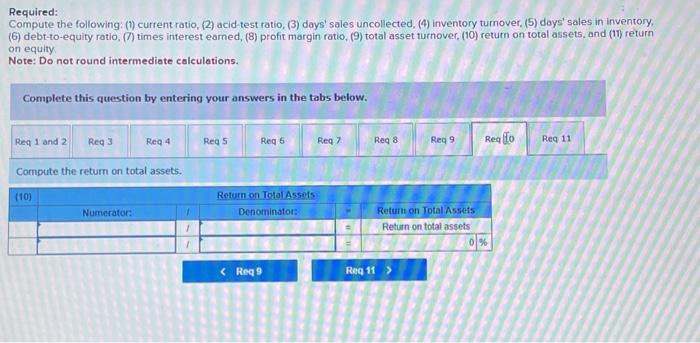

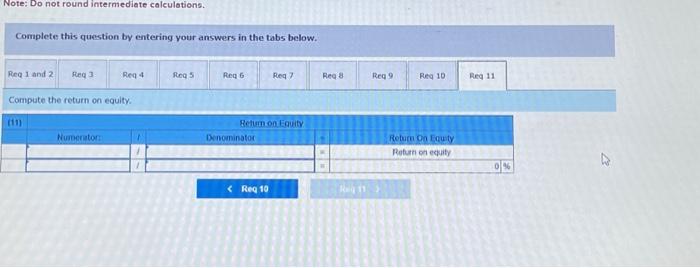

Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the debt-to-equity ratio. Required: Compute the following: (1) current ratio, (2) acid test rotio, (3) dayn' sales uncollected, (4) inventory turnover. (5) days' sales in inventory. 6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) retum on total assets, and (11) retum on equity. Note: Do not round intermediate calculations. Complete this question by entering vour answers in the tabs below. Compute the times interest eamed. Note: Do not round intermediste calculations. Complete this question by entering your answers in the tabs below. Compute the total asset turnover. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (70) retum on total assets, and (11) return on equity. Note: Do not round intermediate colculations. Complete this question by entering your answers in the tabs below. Compute the inventory turnover. Note: Do not round interniediate calculotions. Complete this question by entering your answers in the tabs below. Compate the retum on equity. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the return on total assets. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) retum on total assets, and (11) return on equity Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the profit margin ratio. Selected current year-end financial statements of Cabot Corporotion follow. (Ail sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory, $53,900, total assets, $219,400; common 5 tock, $90,000; and retained earnings, $45,666) Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory tumover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return Aequired: on equity. Note: Do not round intermedinte calculations. Complete this araestion by entering vour answers in the tabs below. Comicute the dars sales uncollected. Required: Compute the following: (1) current ratio, (2) ocid-test ratio, (3) days' sales uncollected, (4) inventory tumover, (5) days' sales in inveritory. (6) debt-to-equity rotio, (7) times interest carned, (8) profit margin ratio, (9) total asset tumovec, (10) return on toral assets, and (ii) return on equity. Note: Do not round intermediete colculations. Complete this question by entering your answers in the tabs below. Compute the days' sales in inventory. Selected current year-end financial statements of Cabot Corporation follow. (All soles were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $53,900, total assets, $219,400; common stock, $90,000; and retained earnings. $45,666 ) Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) doys' sales uncollected, (4) inventory tumover, (5) doys' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin fotio. (9) total asset tumover, (10) return on totol assets, ond (11) return on equity. Note: Do not round intermediate colculations. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory rumover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest eamed, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio

Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the debt-to-equity ratio. Required: Compute the following: (1) current ratio, (2) acid test rotio, (3) dayn' sales uncollected, (4) inventory turnover. (5) days' sales in inventory. 6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) retum on total assets, and (11) retum on equity. Note: Do not round intermediate calculations. Complete this question by entering vour answers in the tabs below. Compute the times interest eamed. Note: Do not round intermediste calculations. Complete this question by entering your answers in the tabs below. Compute the total asset turnover. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (70) retum on total assets, and (11) return on equity. Note: Do not round intermediate colculations. Complete this question by entering your answers in the tabs below. Compute the inventory turnover. Note: Do not round interniediate calculotions. Complete this question by entering your answers in the tabs below. Compate the retum on equity. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the return on total assets. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) retum on total assets, and (11) return on equity Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the profit margin ratio. Selected current year-end financial statements of Cabot Corporotion follow. (Ail sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory, $53,900, total assets, $219,400; common 5 tock, $90,000; and retained earnings, $45,666) Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory tumover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return Aequired: on equity. Note: Do not round intermedinte calculations. Complete this araestion by entering vour answers in the tabs below. Comicute the dars sales uncollected. Required: Compute the following: (1) current ratio, (2) ocid-test ratio, (3) days' sales uncollected, (4) inventory tumover, (5) days' sales in inveritory. (6) debt-to-equity rotio, (7) times interest carned, (8) profit margin ratio, (9) total asset tumovec, (10) return on toral assets, and (ii) return on equity. Note: Do not round intermediete colculations. Complete this question by entering your answers in the tabs below. Compute the days' sales in inventory. Selected current year-end financial statements of Cabot Corporation follow. (All soles were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $53,900, total assets, $219,400; common stock, $90,000; and retained earnings. $45,666 ) Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) doys' sales uncollected, (4) inventory tumover, (5) doys' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin fotio. (9) total asset tumover, (10) return on totol assets, ond (11) return on equity. Note: Do not round intermediate colculations. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory rumover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest eamed, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started