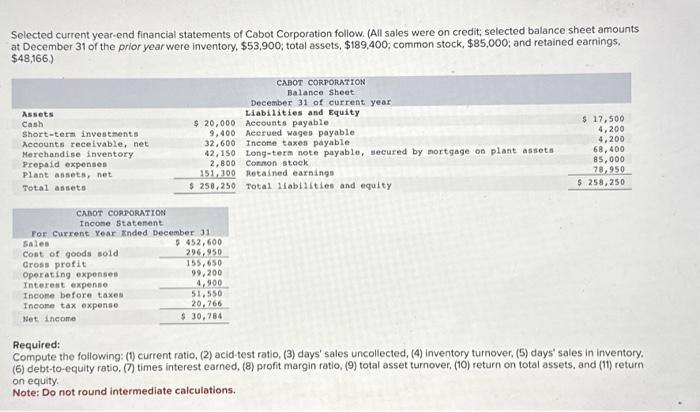

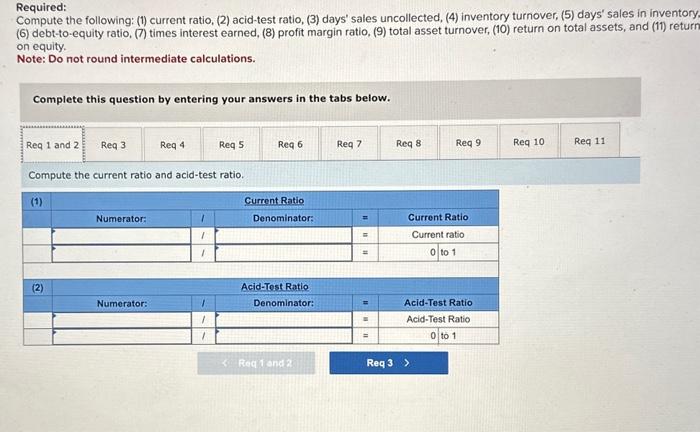

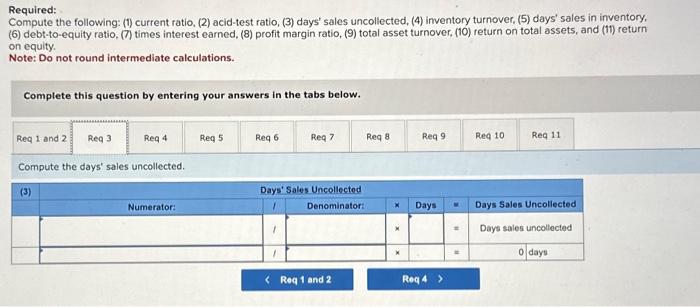

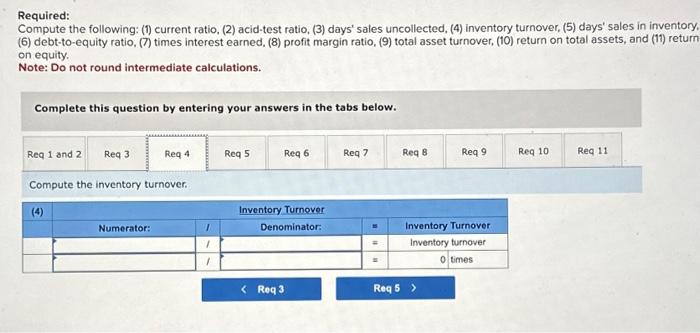

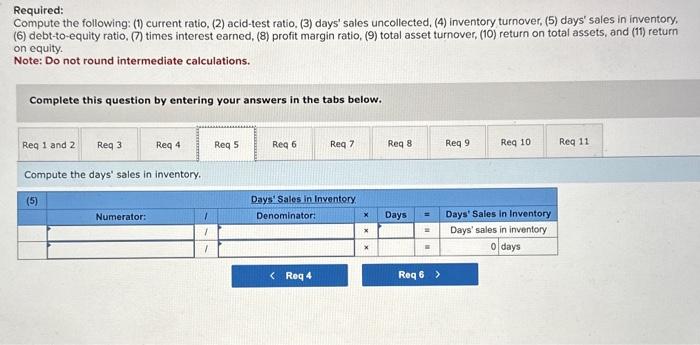

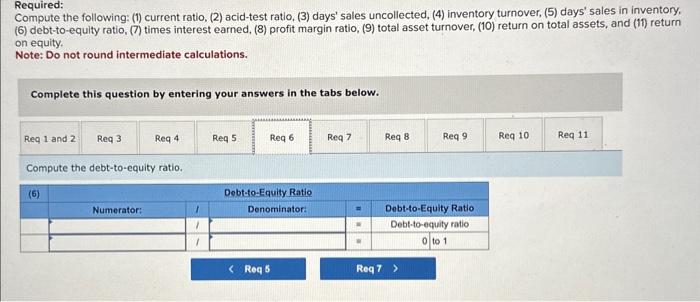

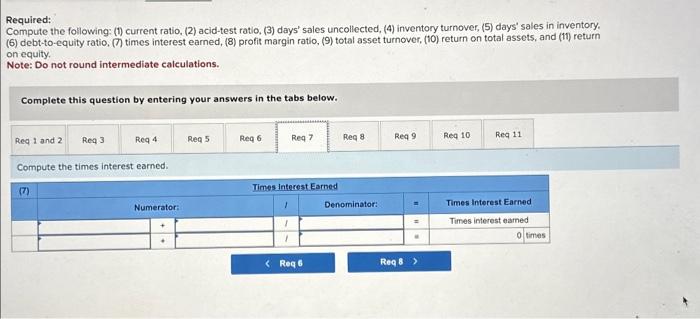

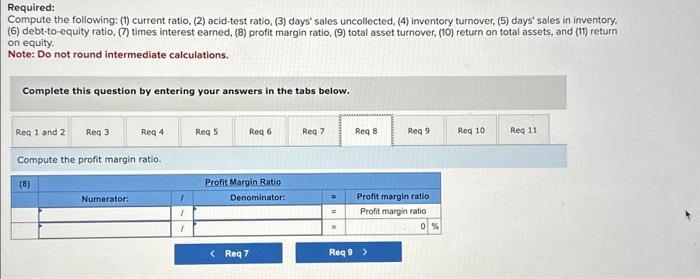

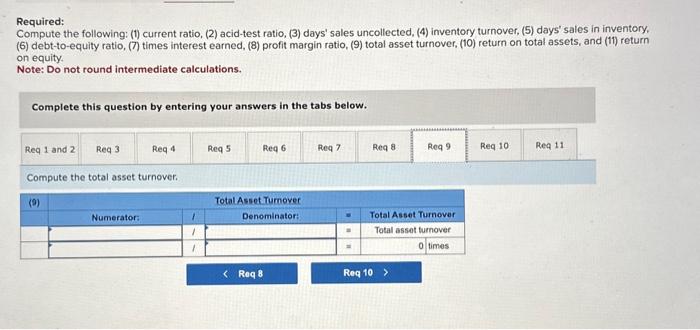

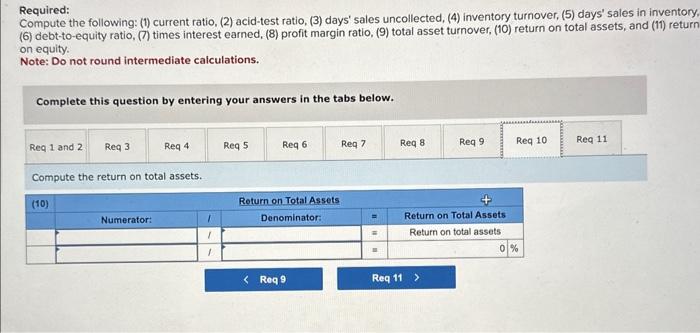

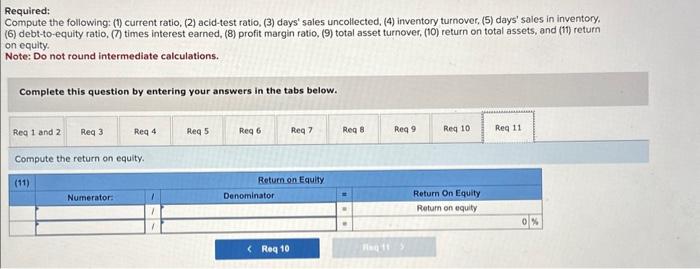

Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the return on total assets. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. 6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the times interest earned. Required: Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the days' sales in inventory. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-cquity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the profit margin ratio. Solected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $53,900; total assets, $189,400; common stock, $85,000; and retained earnings. $48,166. Required: Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the total asset turnover. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventon (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) retur on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the inventory turnover. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventor (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) retur on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory. 6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the return on equity. Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the debt-to-equity ratio. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the days' sales uncollected