Required:

- Compute the tax payable of Teknokrat Sdn Bhd for the year of assessment 2016.

- Explain your treatment of the items stated below:

- the gain on disposal of non-current asset ;

- the leave passage for staff;

- the depreciation; and the dividend income .

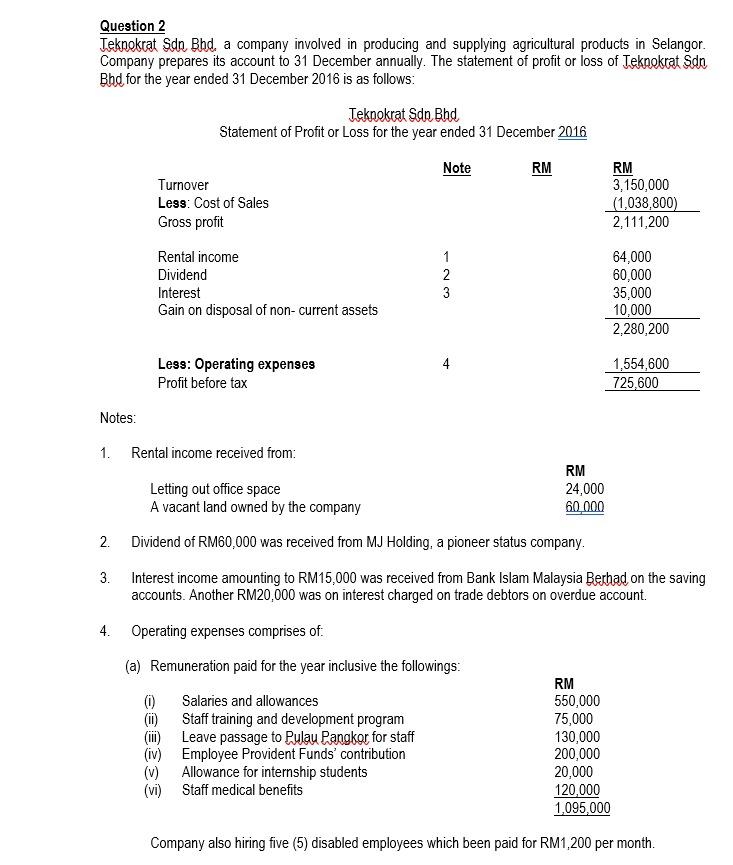

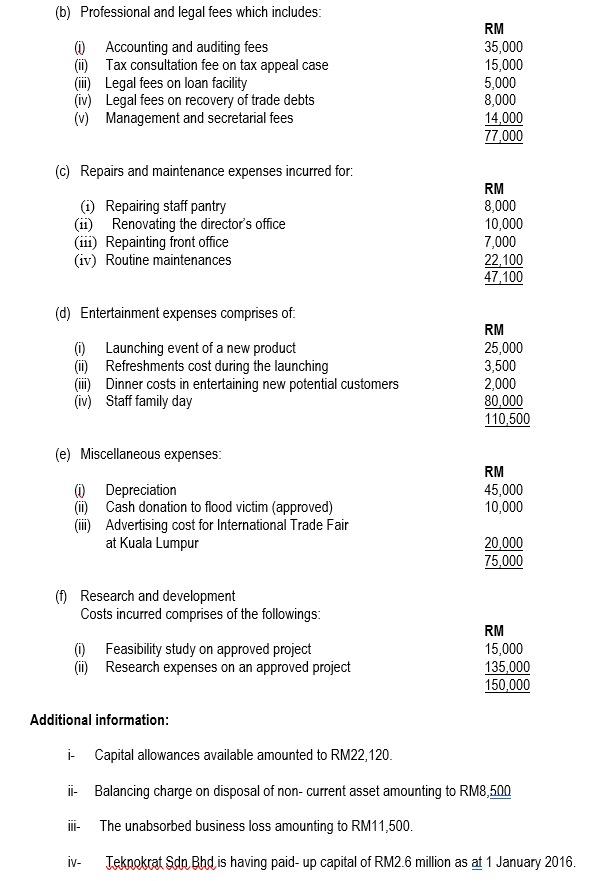

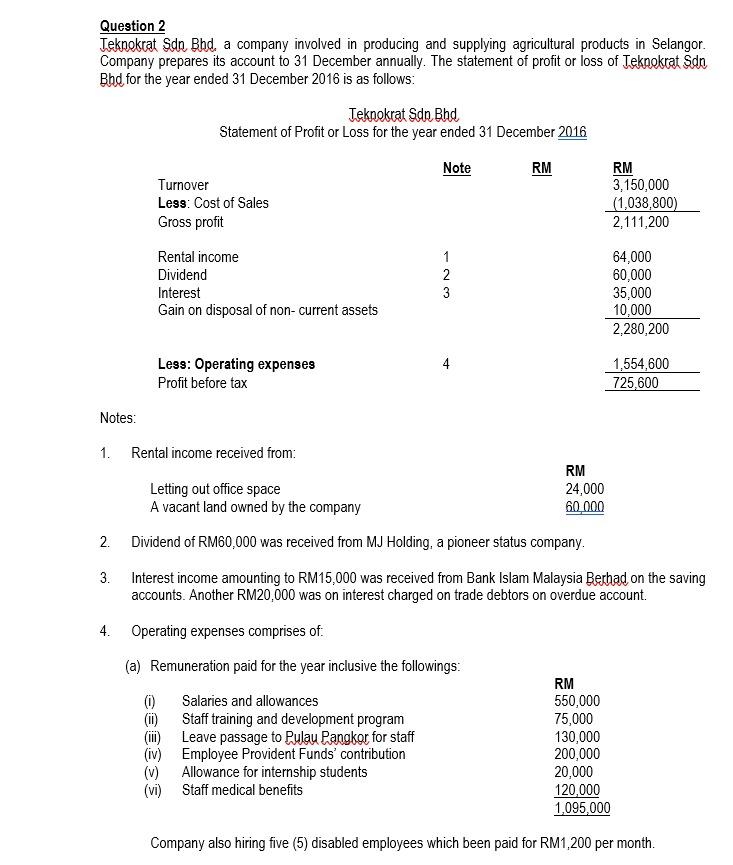

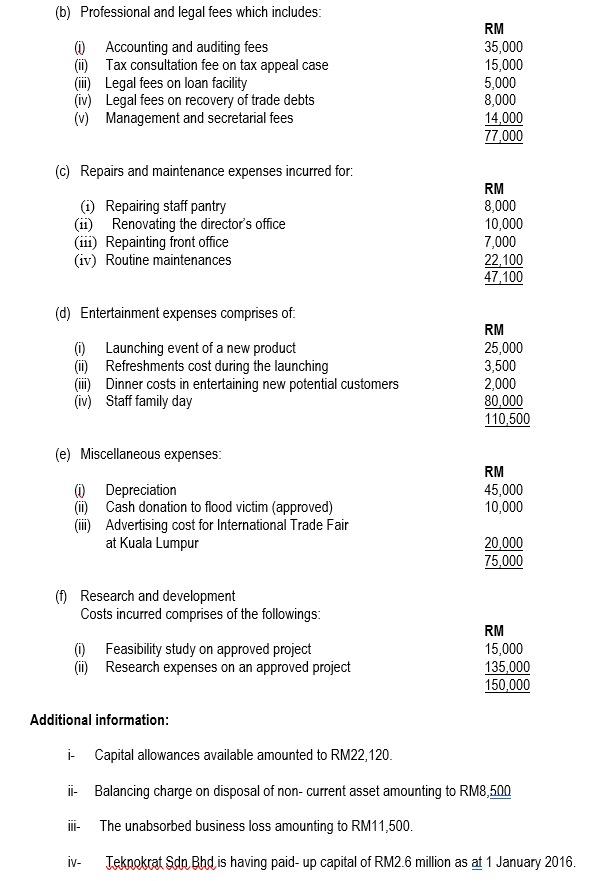

Question 2 Teknokrat Sdn Bhd, a company involved in producing and supplying agricultural products in Selangor. Company prepares its account to 31 December annually. The statement of profit or loss of Teknokrat Sdn Bhd for the year ended 31 December 2016 is as follows: Teknokrat Sdn Bhd Statement of Profit or Loss for the year ended 31 December 2016 Note RM Turnover Less: Cost of Sales Gross profit RM 3,150,000 (1,038,800) 2,111,200 Rental income Dividend Interest Gain on disposal of non-current assets 1 2 3 64,000 60,000 35,000 10,000 2,280,200 4 Less: Operating expenses Profit before tax 1,554,600 725.600 Notes: 1. Rental income received from: RM Letting out office space 24,000 A vacant land owned by the company 60.000 2. Dividend of RM60,000 was received from MJ Holding, a pioneer status company. 3. Interest income amounting to RM15,000 was received from Bank Islam Malaysia Berhad on the saving accounts. Another RM20,000 was on interest charged on trade debtors on overdue account. 4. Operating expenses comprises of (a) Remuneration paid for the year inclusive the followings: RM (0) Salaries and allowances 550,000 Staff training and development program 75,000 Leave passage to Pulau Pangkor for staff 130,000 (iv) Employee Provident Funds' contribution 200,000 (v) Allowance for internship students 20,000 (vi) Staff medical benefits 120,000 1,095,000 Company also hiring five (5) disabled employees which been paid for RM1,200 per month. (b) Professional and legal fees which includes: Accounting and auditing fees () Tax consultation fee on tax appeal case (ii) Legal fees on loan facility (iv) Legal fees on recovery of trade debts (v) Management and secretarial fees RM 35,000 15,000 5,000 8,000 14,000 77,000 (c) Repairs and maintenance expenses incurred for: (1) Repairing staff pantry (11) Renovating the director's office (111) Repainting front office (iv) Routine maintenances RM 8,000 10,000 7,000 22,100 47,100 (d) Entertainment expenses comprises of. 0 Launching event of a new product (1) Refreshments cost during the launching (ii) Dinner costs in entertaining new potential customers (iv) Staff family day RM 25,000 3,500 2,000 80,000 110,500 (e) Miscellaneous expenses RM 45,000 10,000 0 Depreciation () Cash donation to flood victim (approved) (i) Advertising cost for International Trade Fair at Kuala Lumpur 20,000 75,000 (f) Research and development Costs incurred comprises of the followings: 0 Feasibility study on approved project (i) Research expenses on an approved project RM 15,000 135,000 150,000 Additional information: i Capital allowances available amounted to RM22,120 - Balancing charge on disposal of non-current asset amounting to RM8,500 The unabsorbed business loss amounting to RM11,500. iv Teknokrat Sdn Bhd is having paid-up capital of RM2.6 million as at 1 January 2016. Question 2 Teknokrat Sdn Bhd, a company involved in producing and supplying agricultural products in Selangor. Company prepares its account to 31 December annually. The statement of profit or loss of Teknokrat Sdn Bhd for the year ended 31 December 2016 is as follows: Teknokrat Sdn Bhd Statement of Profit or Loss for the year ended 31 December 2016 Note RM Turnover Less: Cost of Sales Gross profit RM 3,150,000 (1,038,800) 2,111,200 Rental income Dividend Interest Gain on disposal of non-current assets 1 2 3 64,000 60,000 35,000 10,000 2,280,200 4 Less: Operating expenses Profit before tax 1,554,600 725.600 Notes: 1. Rental income received from: RM Letting out office space 24,000 A vacant land owned by the company 60.000 2. Dividend of RM60,000 was received from MJ Holding, a pioneer status company. 3. Interest income amounting to RM15,000 was received from Bank Islam Malaysia Berhad on the saving accounts. Another RM20,000 was on interest charged on trade debtors on overdue account. 4. Operating expenses comprises of (a) Remuneration paid for the year inclusive the followings: RM (0) Salaries and allowances 550,000 Staff training and development program 75,000 Leave passage to Pulau Pangkor for staff 130,000 (iv) Employee Provident Funds' contribution 200,000 (v) Allowance for internship students 20,000 (vi) Staff medical benefits 120,000 1,095,000 Company also hiring five (5) disabled employees which been paid for RM1,200 per month. (b) Professional and legal fees which includes: Accounting and auditing fees () Tax consultation fee on tax appeal case (ii) Legal fees on loan facility (iv) Legal fees on recovery of trade debts (v) Management and secretarial fees RM 35,000 15,000 5,000 8,000 14,000 77,000 (c) Repairs and maintenance expenses incurred for: (1) Repairing staff pantry (11) Renovating the director's office (111) Repainting front office (iv) Routine maintenances RM 8,000 10,000 7,000 22,100 47,100 (d) Entertainment expenses comprises of. 0 Launching event of a new product (1) Refreshments cost during the launching (ii) Dinner costs in entertaining new potential customers (iv) Staff family day RM 25,000 3,500 2,000 80,000 110,500 (e) Miscellaneous expenses RM 45,000 10,000 0 Depreciation () Cash donation to flood victim (approved) (i) Advertising cost for International Trade Fair at Kuala Lumpur 20,000 75,000 (f) Research and development Costs incurred comprises of the followings: 0 Feasibility study on approved project (i) Research expenses on an approved project RM 15,000 135,000 150,000 Additional information: i Capital allowances available amounted to RM22,120 - Balancing charge on disposal of non-current asset amounting to RM8,500 The unabsorbed business loss amounting to RM11,500. iv Teknokrat Sdn Bhd is having paid-up capital of RM2.6 million as at 1 January 2016