Required: Decide, where in the Cash Flow Statement (image of format attached at the end) each category will be shown. Follow the example below (first entry). Alternatively, just name the account in the cash flow statement (according to the format below) where the transactions should go to. Thank you

| Category (in 2019) | Place in the Cash Flow Statement | Sign / Amount |

| EXAMPLE: Company purchased a land to build a warehouse; 20000 paid in cash. | B-II-1. (Section B, subsection II, Entry 1) | minus 20000 |

| 1. Company received a cash subsidy from the government 40 000, recorded as deferred income. | | |

| 2. Company issued bonds and received 61 800 on bank account. | | |

| 3. Company repaid a trade payable via bank money transfer, 600. | | |

| 4. Company received 800 of interest from a loan provided to another (unrelated) enterprise. | | |

| 5. Company issued an interest note to a client for 200 for delayed payment. | | |

6. Company paid 7 600 to initiate financial lease for a car (classified as PPE).

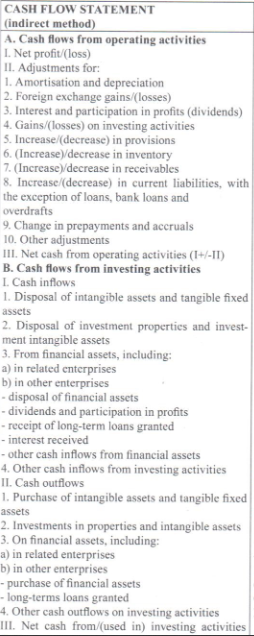

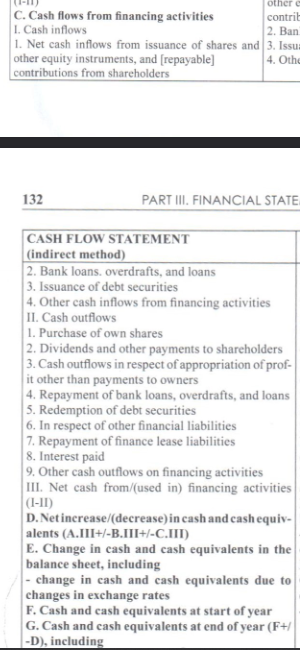

CASH FLOW STATEMENT (indirect method) A. Cash flows from operating activities I. Net profit/(loss) II. Adjustments for: 1. Amortisation and depreciation 2. Foreign exchange gains/(losses) 3. Interest and participation in profits (dividends) 4. Gains/(losses) on investing activities 5. Increase/(decrease) in provisions 6. (Increase)/decrease in inventory 7. (Increase)/decrease in receivables 8. Increase/(decrease) in current liabilities, with the exception of loans, bank loans and overdrafts 9. Change in prepayments and accruals 10. Other adjustments III. Net cash from operating activities (I+/-II) B. Cash flows from investing activities I. Cash inflows 1. Disposal of intangible assets and tangible fixed assets 2. Disposal of investment properties and investment intangible assets 3. From financial assets, including: a) in related enterprises b) in other enterprises - disposal of financial assets - dividends and participation in profits - receipt of long-term loans granted - interest received - other cash inflows from financial assets 4. Other cash inflows from investing activities II. Cash outflows 1. Purchase of intangible assets and tangible fixed assets 2. Investments in properties and intangible assets 3. On financial assets, including: a) in related enterprises b) in other enterprises - purchase of financial assets - long-terms loans granted 4. Other cash outflows on investing activities III. Net cash from/(used in) investing activities C. Cash flows from financing activities 1. Cash inflows 1. Net cash inflows from issuance of shares and other equity instruments, and [repayable] contributions from shareholders 132 PART III. FINANCIALSTATE. CASH FLOW STATEMENT (indirect method) 2. Bank loans. overdrafts, and loans 3. Issuance of debt securities 4. Other cash inflows from financing activities II. Cash outflows 1. Purchase of own shares 2. Dividends and other payments to shareholders 3. Cash outflows in respect of appropriation of profit other than payments to owners 4. Repayment of bank loans, overdrafts, and loans 5. Redemption of debt securities 6. In respect of other financial liabilities 7. Repayment of finance lease liabilities 8. Interest paid 9. Other cash outflows on financing activities III. Net cash from/(used in) financing activities (I-II) D. Net increase/(decrease) in cash and cash equivalents (A.III + /-B.III +/ C.III) E. Change in cash and cash equivalents in the balance sheet, including - change in cash and cash equivalents due to changes in exchange rates F. Cash and cash equivalents at start of year G. Cash and cash equivalents at end of year (F+I -D), including