Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Determine the incremental cost or benefit of buying the devices (AA10) from the outside supplier. Would you recommend that SunTech Electronics manufacture the devices

Required:

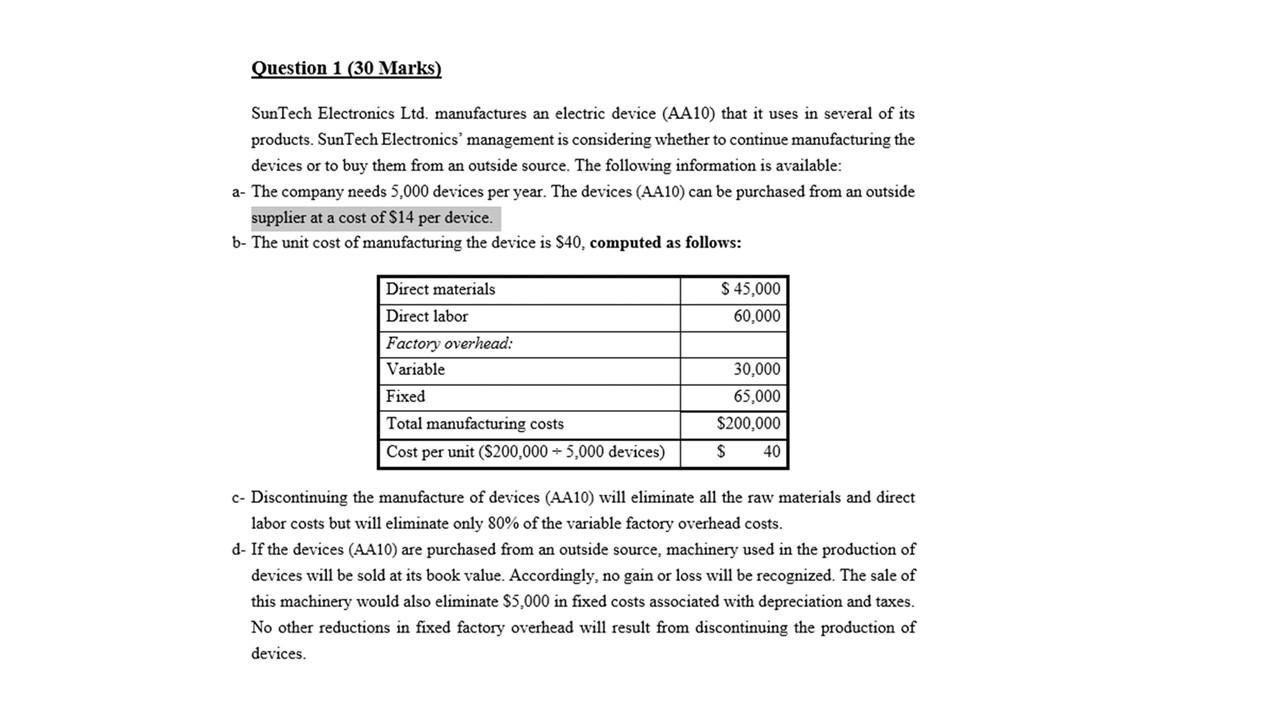

- Determine the incremental cost or benefit of buying the devices (AA10) from the outside supplier. Would you recommend that SunTech Electronics manufacture the devices or buy them from an outside source? (Prepare a schedule to determine the incremental cost or benefit of buying the devices from an outside supplier.) (20 marks)

- Assume that if the devices (AA10) are purchased from an outside source, the factory space previously used to produce devices (AA10) can be used to manufacture an additional 3,000 electric devices (BB50) per year. Electric devices (BB50) have an estimated contribution margin of $7 per unit. The manufacture of the additional electric devices (BB50) would have no effect on fixed factory overhead. Would this new assumption change your recommendation as to whether to make or buy the devices (AA10)? In support of your conclusion, prepare a schedule showing the incremental cost or benefit of buying the devices (AA10) from the outside source and using the factory space to produce additional devices (BB50). (5 marks)

- What nonfinancial concerns should SunTech Electronics Ltd. take into consideration? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started