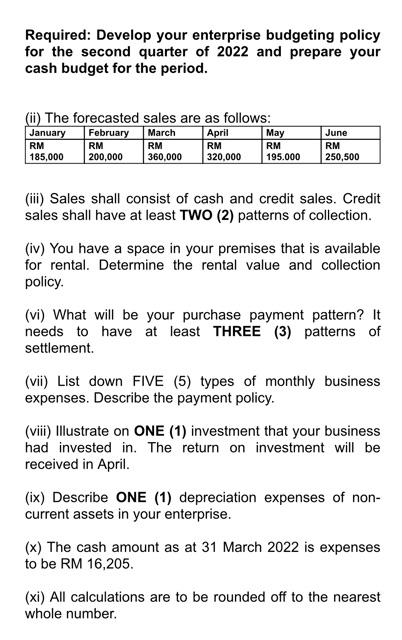

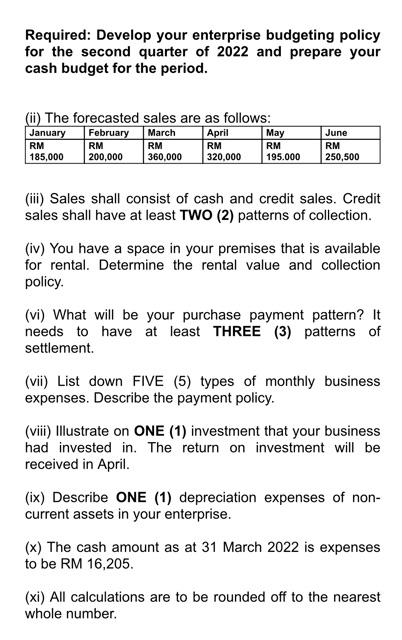

Required: Develop your enterprise budgeting policy for the second quarter of 2022 and prepare your cash budget for the period. (i) The forecasted sales are as follows: January February March April May RM RM RM RM RM 185,000 200,000 360,000 320,000 195.000 June RM 250,500 (iii) Sales shall consist of cash and credit sales. Credit sales shall have at least TWO (2) patterns of collection. (iv) You have a space in your premises that is available for rental. Determine the rental value and collection policy. (vi) What will be your purchase payment pattern? It needs to have at least THREE (3) patterns of settlement. (vii) List down FIVE (5) types of monthly business expenses. Describe the payment policy. (viii) Illustrate on ONE (1) investment that your business had invested in. The return on investment will be received in April. (ix) Describe ONE (1) depreciation expenses of non- current assets in your enterprise. (x) The cash amount as at 31 March 2022 is expenses to be RM 16,205. (xi) All calculations are to be rounded off to the nearest whole number. Required: Develop your enterprise budgeting policy for the second quarter of 2022 and prepare your cash budget for the period. (i) The forecasted sales are as follows: January February March April May RM RM RM RM RM 185,000 200,000 360,000 320,000 195.000 June RM 250,500 (iii) Sales shall consist of cash and credit sales. Credit sales shall have at least TWO (2) patterns of collection. (iv) You have a space in your premises that is available for rental. Determine the rental value and collection policy. (vi) What will be your purchase payment pattern? It needs to have at least THREE (3) patterns of settlement. (vii) List down FIVE (5) types of monthly business expenses. Describe the payment policy. (viii) Illustrate on ONE (1) investment that your business had invested in. The return on investment will be received in April. (ix) Describe ONE (1) depreciation expenses of non- current assets in your enterprise. (x) The cash amount as at 31 March 2022 is expenses to be RM 16,205. (xi) All calculations are to be rounded off to the nearest whole number