Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Discuss the importance of culture in a merger and how Celcom Axiata and Digi.com can address culture more effectively. KUALA LUMPUR (Nov 30): The

Required:

Discuss the importance of culture in a merger and how Celcom Axiata and Digi.com can address culture more effectively.

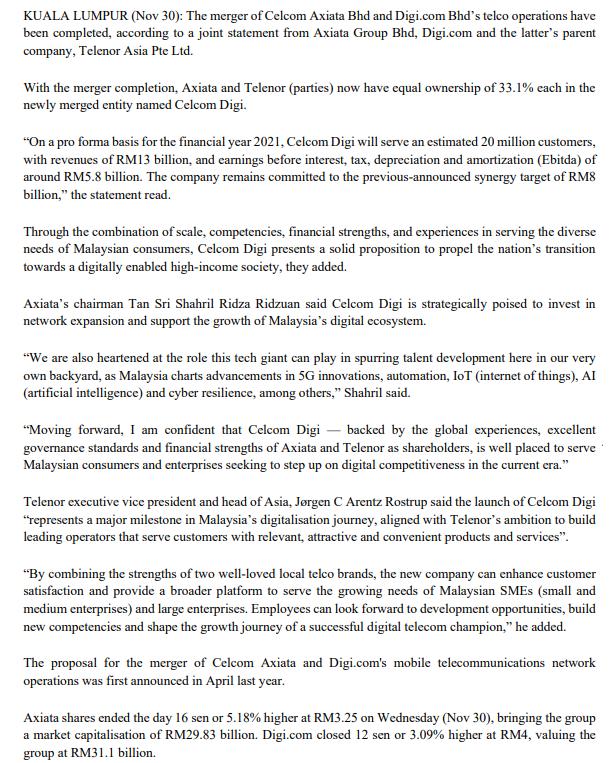

KUALA LUMPUR (Nov 30): The merger of Celcom Axiata Bhd and Digi.com Bhd's telco operations have been completed, according to a joint statement from Axiata Group Bhd, Digi.com and the latter's parent company, Telenor Asia Pte Ltd. With the merger completion, Axiata and Telenor (parties) now have equal ownership of 33.1% each in the newly merged entity named Celcom Digi. "On a pro forma basis for the financial year 2021, Celcom Digi will serve an estimated 20 million customers, with revenues of RM13 billion, and earnings before interest, tax, depreciation and amortization (Ebitda) of around RM5.8 billion. The company remains committed to the previous-announced synergy target of RM8 billion," the statement read. Through the combination of scale, competencies, financial strengths, and experiences in serving the diverse needs of Malaysian consumers, Celcom Digi presents a solid proposition to propel the nation's transition towards a digitally enabled high-income society, they added. Axiata's chairman Tan Sri Shahril Ridza Ridzuan said Celcom Digi is strategically poised to invest in network expansion and support the growth of Malaysia's digital ecosystem. "We are also heartened at the role this tech giant can play in spurring talent development here in our very own backyard, as Malaysia charts advancements in 5G innovations, automation, IoT (internet of things), AI (artificial intelligence) and cyber resilience, among others," Shahril said. "Moving forward, I am confident that Celcom Digi backed by the global experiences, excellent governance standards and financial strengths of Axiata and Telenor as shareholders, is well placed to serve Malaysian consumers and enterprises seeking to step up on digital competitiveness in the current era." Telenor executive vice president and head of Asia, Jrgen C Arentz Rostrup said the launch of Celcom Digi "represents a major milestone in Malaysia's digitalisation journey, aligned with Telenor's ambition to build leading operators that serve customers with relevant, attractive and convenient products and services". "By combining the strengths of two well-loved local telco brands, the new company can enhance customer satisfaction and provide a broader platform to serve the growing needs of Malaysian SMEs (small and medium enterprises) and large enterprises. Employees can look forward to development opportunities, build new competencies and shape the growth journey of a successful digital telecom champion," he added. The proposal for the merger of Celcom Axiata and Digi.com's mobile telecommunications network operations was first announced in April last year. Axiata shares ended the day 16 sen or 5.18% higher at RM3.25 on Wednesday (Nov 30), bringing the group a market capitalisation of RM29.83 billion. Digi.com closed 12 sen or 3.09% higher at RM4, valuing the group at RM31.1 billion.

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Culture plays a crucial role in any merger or acquisition as it can significantly impact the success or failure of the integration process The merger between Celcom Axiata and Digicom brings together ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started