Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: For Apple Pies only, compute the variable manufacturing costs per unit, full unit cost per unit, variable cost per unit, full absorption cost per

Required:

For Apple Pies only, compute the variable manufacturing costs per unit, full unit cost per unit, variable cost per unit, full absorption cost per unit, prime cost per unit, conversion cost per unit, profit margin per unit, contribution margin per unit, and gross margin per unit.

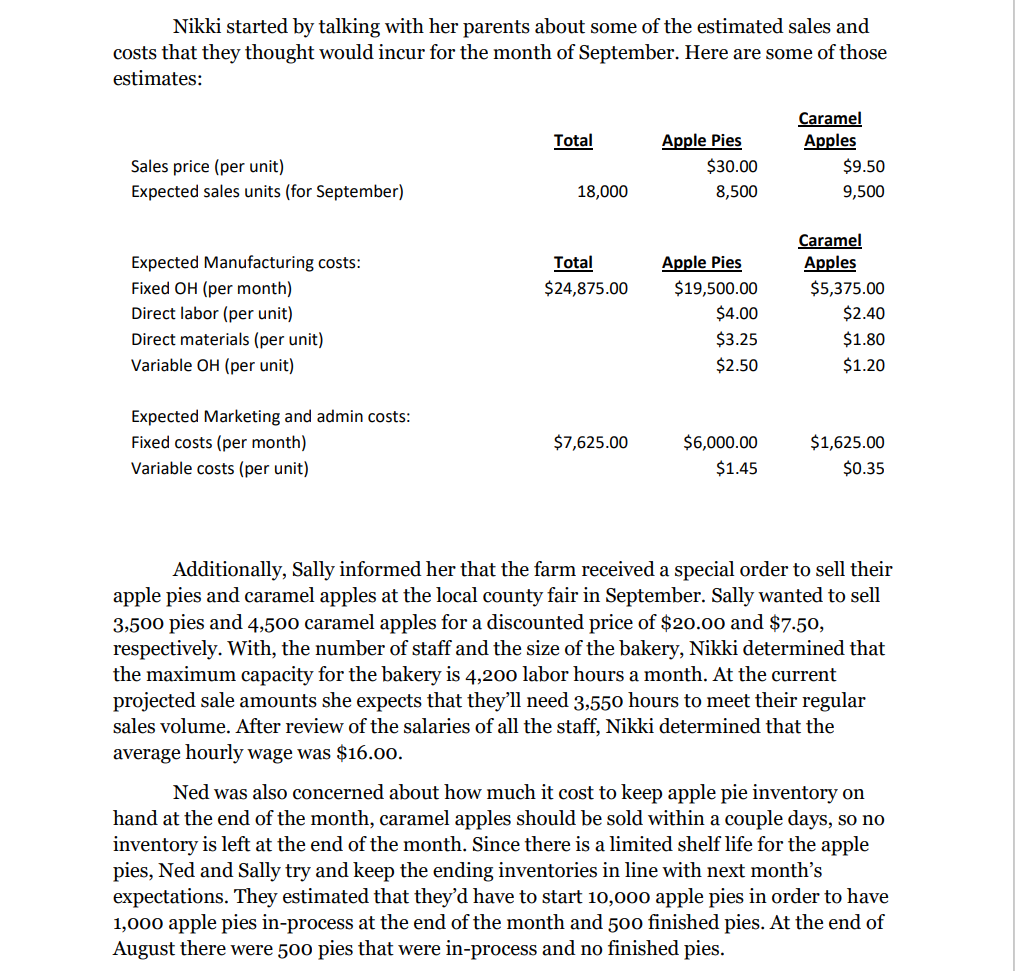

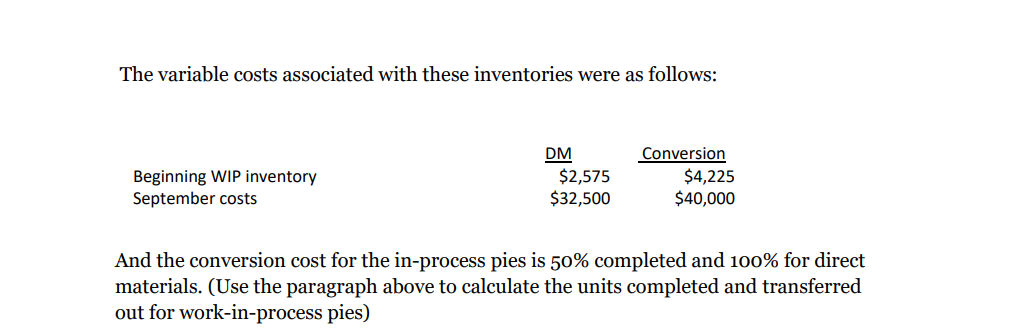

Nikki started by talking with her parents about some of the estimated sales and costs that they thought would incur for the month of September. Here are some of those estimates: Additionally, Sally informed her that the farm received a special order to sell their apple pies and caramel apples at the local county fair in September. Sally wanted to sell 3,500 pies and 4,500 caramel apples for a discounted price of $20.00 and $7.50, respectively. With, the number of staff and the size of the bakery, Nikki determined that the maximum capacity for the bakery is 4,200 labor hours a month. At the current projected sale amounts she expects that they'll need 3,550 hours to meet their regular sales volume. After review of the salaries of all the staff, Nikki determined that the average hourly wage was $16.00. Ned was also concerned about how much it cost to keep apple pie inventory on hand at the end of the month, caramel apples should be sold within a couple days, so no inventory is left at the end of the month. Since there is a limited shelf life for the apple pies, Ned and Sally try and keep the ending inventories in line with next month's expectations. They estimated that they'd have to start 10,000 apple pies in order to have 1,000 apple pies in-process at the end of the month and 500 finished pies. At the end of August there were 500 pies that were in-process and no finished pies. The variable costs associated with these inventories were as follows: And the conversion cost for the in-process pies is 50% completed and 100% for direct materials. (Use the paragraph above to calculate the units completed and transferred out for work-in-process pies)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started