Answered step by step

Verified Expert Solution

Question

1 Approved Answer

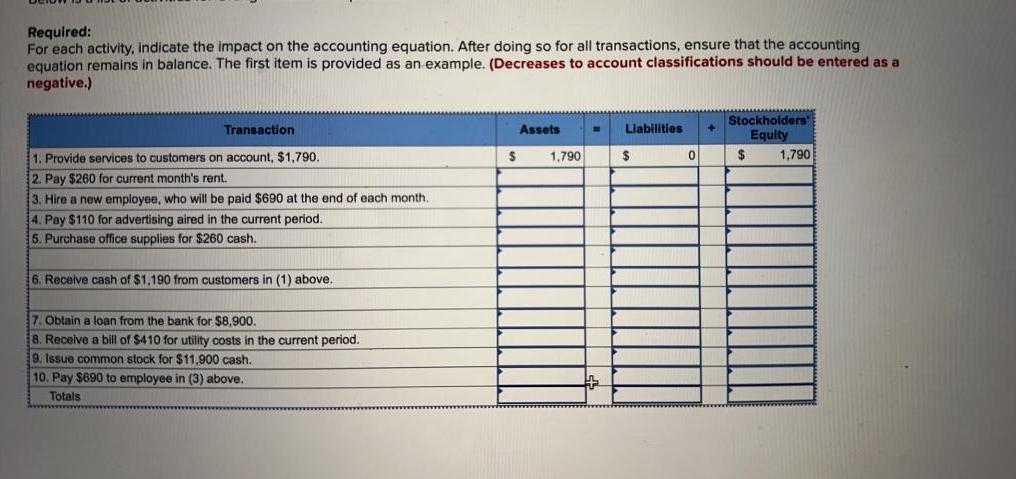

Required: For each activity, indicate the impact on the accounting equation. After doing so for all transactions, ensure that the accounting equation remains in

Required: For each activity, indicate the impact on the accounting equation. After doing so for all transactions, ensure that the accounting equation remains in balance. The first item is provided as an example. (Decreases to account classifications should be entered as a negative.) Transaction 1. Provide services to customers on account, $1,790. 2. Pay $260 for current month's rent. 3. Hire a new employee, who will be paid $690 at the end of each month. 4. Pay $110 for advertising aired in the current period. 5. Purchase office supplies for $260 cash. 6. Receive cash of $1,190 from customers in (1) above. 7. Obtain a loan from the bank for $8,900. 8. Receive a bill of $410 for utility costs in the current period. 9. Issue common stock for $11,900 cash. 10. Pay $690 to employee in (3) above. Totals $ Assets 1,790 # Liabilities + $ 0 Stockholders' Equity $ 1,790

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 Provide services to customers on account 1790 Assets 1790 Liabilities 0 Stockholders Equity 1790 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started