Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: For each year of the assets life, compute (showing all your workings): (i) The deferred tax balance that should be reported in the entitys

Required: For each year of the assets life, compute (showing all your workings):

(i) The deferred tax balance that should be reported in the entitys statement of financial position, explaining whether it should be an asset or a liability, and

(ii) The deferred tax that should be reported in the entitys statement of comprehensive income, explaining whether it should be an income or expense.

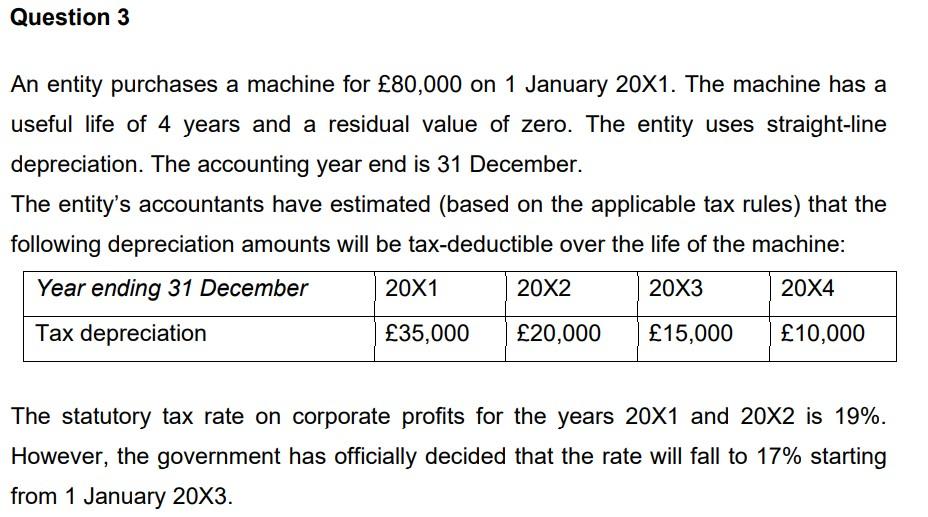

Question 3 An entity purchases a machine for 80,000 on 1 January 20X1. The machine has a useful life of 4 years and a residual value of zero. The entity uses straight-line depreciation. The accounting year end is 31 December. The entity's accountants have estimated (based on the applicable tax rules) that the following depreciation amounts will be tax-deductible over the life of the machine: Year ending 31 December 20X1 20X2 20X3 20X4 Tax depreciation 35,000 20,000 15,000 10,000 The statutory tax rate on corporate profits for the years 20X1 and 20X2 is 19%. However, the government has officially decided that the rate will fall to 17% starting from 1 January 20X3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started